Berkshire Hathaway 2005 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

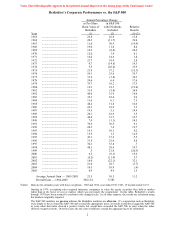

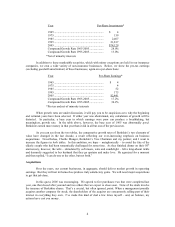

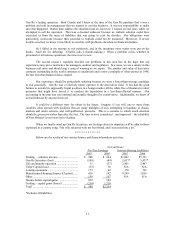

Year

Per-Share Investments*

1965 ..................................................................... $ 4

1975 ..................................................................... 159

1985 ..................................................................... 2,407

1995 ..................................................................... 21,817

2005 ..................................................................... $74,129

Compound Growth Rate 1965-2005.................... 28.0%

Compound Growth Rate 1995-2005.................... 13.0%

*Net of minority interests

In addition to these marketable securities, which with minor exceptions are held in our insurance

companies, we own a wide variety of non-insurance businesses. Below, we show the pre-tax earnings

(excluding goodwill amortization) of these businesses, again on a per-share basis:

Year

Per-Share Earnings*

1965 ..................................................................... $ 4

1975 ..................................................................... 4

1985 ..................................................................... 52

1995 ..................................................................... 175

2005 ..................................................................... $2,441

Compound Growth Rate 1965-2005.................... 17.2%

Compound Growth Rate 1995-2005.................... 30.2%

*Pre-tax and net of minority interests

When growth rates are under discussion, it will pay you to be suspicious as to why the beginning

and terminal years have been selected. If either year was aberrational, any calculation of growth will be

distorted. In particular, a base year in which earnings were poor can produce a breathtaking, but

meaningless, growth rate. In the table above, however, the base year of 1965 was abnormally good;

Berkshire earned more money in that year than it did in all but one of the previous ten.

As you can see from the two tables, the comparative growth rates of Berkshire’ s two elements of

value have changed in the last decade, a result reflecting our ever-increasing emphasis on business

acquisitions. Nevertheless, Charlie Munger, Berkshire’ s Vice Chairman and my partner, and I want to

increase the figures in both tables. In this ambition, we hope – metaphorically – to avoid the fate of the

elderly couple who had been romantically challenged for some time. As they finished dinner on their 50th

anniversary, however, the wife – stimulated by soft music, wine and candlelight – felt a long-absent tickle

and demurely suggested to her husband that they go upstairs and make love. He agonized for a moment

and then replied, “I can do one or the other, but not both.”

Acquisitions

Over the years, our current businesses, in aggregate, should deliver modest growth in operating

earnings. But they will not in themselves produce truly satisfactory gains. We will need major acquisitions

to get that job done.

In this quest, 2005 was encouraging. We agreed to five purchases: two that were completed last

year, one that closed after yearend and two others that we expect to close soon. None of the deals involve

the issuance of Berkshire shares. That’ s a crucial, but often ignored, point: When a management proudly

acquires another company for stock, the shareholders of the acquirer are concurrently selling part of their

interest in everything they own. I’ ve made this kind of deal a few times myself – and, on balance, my

actions have cost you money.

4