Berkshire Hathaway 2005 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. The Gotrocks, now supporting three classes of expensive Helpers, find that their results get worse,

and they sink into despair. But just as hope seems lost, a fourth group – we’ ll call them the hyper-Helpers

– appears. These friendly folk explain to the Gotrocks that their unsatisfactory results are occurring

because the existing Helpers – brokers, managers, consultants – are not sufficiently motivated and are

simply going through the motions. “What,” the new Helpers ask, “can you expect from such a bunch of

zombies?”

The new arrivals offer a breathtakingly simple solution: Pay more money. Brimming with self-

confidence, the hyper-Helpers assert that huge contingent payments – in addition to stiff fixed fees – are

what each family member must fork over in order to really outmaneuver his relatives.

The more observant members of the family see that some of the hyper-Helpers are really just

manager-Helpers wearing new uniforms, bearing sewn-on sexy names like HEDGE FUND or PRIVATE

EQUITY. The new Helpers, however, assure the Gotrocks that this change of clothing is all-important,

bestowing on its wearers magical powers similar to those acquired by mild-mannered Clark Kent when he

changed into his Superman costume. Calmed by this explanation, the family decides to pay up.

And that’ s where we are today: A record portion of the earnings that would go in their entirety to

owners – if they all just stayed in their rocking chairs – is now going to a swelling army of Helpers.

Particularly expensive is the recent pandemic of profit arrangements under which Helpers receive large

portions of the winnings when they are smart or lucky, and leave family members with all of the losses –

and large fixed fees to boot – when the Helpers are dumb or unlucky (or occasionally crooked).

A sufficient number of arrangements like this – heads, the Helper takes much of the winnings;

tails, the Gotrocks lose and pay dearly for the privilege of doing so – may make it more accurate to call the

family the Hadrocks. Today, in fact, the family’ s frictional costs of all sorts may well amount to 20% of

the earnings of American business. In other words, the burden of paying Helpers may cause American

equity investors, overall, to earn only 80% or so of what they would earn if they just sat still and listened to

no one.

Long ago, Sir Isaac Newton gave us three laws of motion, which were the work of genius. But Sir

Isaac’ s talents didn’ t extend to investing: He lost a bundle in the South Sea Bubble, explaining later, “I can

calculate the movement of the stars, but not the madness of men.” If he had not been traumatized by this

loss, Sir Isaac might well have gone on to discover the Fourth Law of Motion: For investors as a whole,

returns decrease as motion increases.

* * * * * * * * * * * *

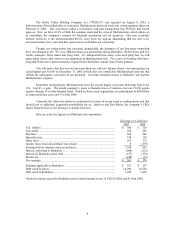

Here’ s the answer to the question posed at the beginning of this section: To get very specific, the

Dow increased from 65.73 to 11,497.12 in the 20th century, and that amounts to a gain of 5.3%

compounded annually. (Investors would also have received dividends, of course.) To achieve an equal rate

of gain in the 21st century, the Dow will have to rise by December 31, 2099 to – brace yourself – precisely

2,011,011.23. But I’ m willing to settle for 2,000,000; six years into this century, the Dow has gained not at

all.

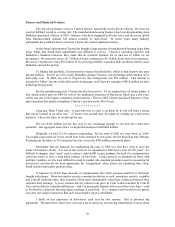

Debt and Risk

As we consolidate MidAmerican, our new balance sheet may suggest that Berkshire has expanded

its tolerance for borrowing. But that’ s not so. Except for token amounts, we shun debt, turning to it for

only three purposes:

1) We occasionally use repos as a part of certain short-term investing strategies that incorporate

ownership of U.S. government (or agency) securities. Purchases of this kind are highly

opportunistic and involve only the most liquid of securities. A few years ago, we entered into

several interesting transactions that have since been unwound or are running off. The offsetting

debt has likewise been cut substantially and before long may be gone.

19