Berkshire Hathaway 2005 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report. Huge severance payments, lavish perks and outsized payments for ho-hum performance often

occur because comp committees have become slaves to comparative data. The drill is simple: Three or so

directors – not chosen by chance – are bombarded for a few hours before a board meeting with pay

statistics that perpetually ratchet upwards. Additionally, the committee is told about new perks that other

managers are receiving. In this manner, outlandish “goodies” are showered upon CEOs simply because of

a corporate version of the argument we all used when children: “But, Mom, all the other kids have one.”

When comp committees follow this “logic,” yesterday’ s most egregious excess becomes today’ s baseline.

Comp committees should adopt the attitude of Hank Greenberg, the Detroit slugger and a boyhood

hero of mine. Hank’s son, Steve, at one time was a player’ s agent. Representing an outfielder in

negotiations with a major league club, Steve sounded out his dad about the size of the signing bonus he

should ask for. Hank, a true pay-for-performance guy, got straight to the point, “What did he hit last year?”

When Steve answered “.246,” Hank’ s comeback was immediate: “Ask for a uniform.”

(Let me pause for a brief confession: In criticizing comp committee behavior, I don’ t speak as a

true insider. Though I have served as a director of twenty public companies, only one CEO has put me on

his comp committee. Hmmmm . . .)

* * * * * * * * * * * *

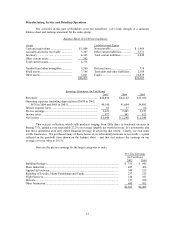

My views on America’ s long-term problem in respect to trade imbalances, which I have laid out in

previous reports, remain unchanged. My conviction, however, cost Berkshire $955 million pre-tax in 2005.

That amount is included in our earnings statement, a fact that illustrates the differing ways in which GAAP

treats gains and losses. When we have a long-term position in stocks or bonds, year-to-year changes in

value are reflected in our balance sheet but, as long as the asset is not sold, are rarely reflected in earnings.

For example, our Coca-Cola holdings went from $1 billion in value early on to $13.4 billion at yearend

1998 and have since declined to $8.1 billion – with none of these moves affecting our earnings statement.

Long-term currency positions, however, are daily marked to market and therefore have an effect on

earnings in every reporting period. From the date we first entered into currency contracts, we are $2.0

billion in the black.

We reduced our direct position in currencies somewhat during 2005. We partially offset this

change, however, by purchasing equities whose prices are denominated in a variety of foreign currencies

and that earn a large part of their profits internationally. Charlie and I prefer this method of acquiring non-

dollar exposure. That’ s largely because of changes in interest rates: As U.S. rates have risen relative to

those of the rest of the world, holding most foreign currencies now involves a significant negative “carry.”

The carry aspect of our direct currency position indeed cost us money in 2005 and is likely to do so again in

2006. In contrast, the ownership of foreign equities is likely, over time, to create a positive carry – perhaps

a substantial one.

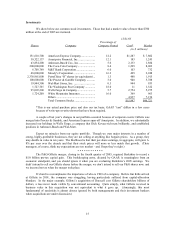

The underlying factors affecting the U.S. current account deficit continue to worsen, and no letup

is in sight. Not only did our trade deficit – the largest and most familiar item in the current account – hit an

all-time high in 2005, but we also can expect a second item – the balance of investment income – to soon

turn negative. As foreigners increase their ownership of U.S. assets (or of claims against us) relative to

U.S. investments abroad, these investors will begin earning more on their holdings than we do on ours.

Finally, the third component of the current account, unilateral transfers, is always negative.

The U.S., it should be emphasized, is extraordinarily rich and will get richer. As a result, the huge

imbalances in its current account may continue for a long time without their having noticeable deleterious

effects on the U.S. economy or on markets. I doubt, however, that the situation will forever remain benign.

Either Americans address the problem soon in a way we select, or at some point the problem will likely

address us in an unpleasant way of its own.

17