Berkshire Hathaway 2005 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

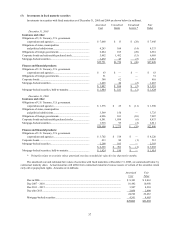

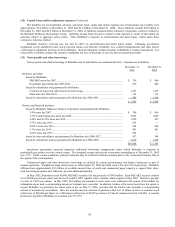

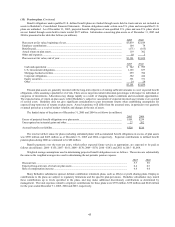

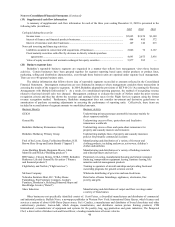

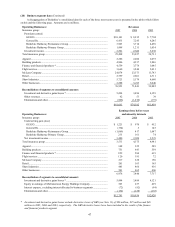

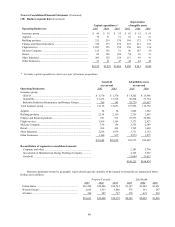

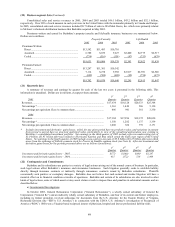

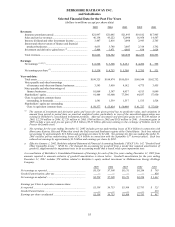

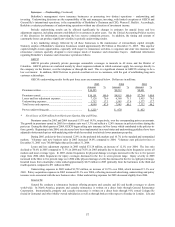

(20) Business segment data (Continued)

A disaggregation of Berkshire’ s consolidated data for each of the three most recent years is presented in the tables which follow

on this and the following page. Amounts are in millions.

Operating Businesses: Revenues

Insurance group: 2005 2004 2003

Premiums earned:

GEICO ................................................................................................................ $10,101 $ 8,915 $ 7,784

General Re .......................................................................................................... 6,435 7,245 8,245

Berkshire Hathaway Reinsurance Group ............................................................ 3,963 3,714 4,430

Berkshire Hathaway Primary Group................................................................... 1,498 1,211 1,034

Investment income ................................................................................................. 3,501 2,842 3,238

Total insurance group................................................................................................ 25,498 23,927 24,731

Apparel...................................................................................................................... 2,286 2,200 2,075

Building products...................................................................................................... 4,806 4,337 3,846

Finance and financial products *............................................................................... 4,559 3,774 3,045

Flight services ........................................................................................................... 3,660 3,244 2,431

McLane Company..................................................................................................... 24,074 23,373 13,743

Retail......................................................................................................................... 2,759 2,601 2,311

Shaw Industries ......................................................................................................... 5,723 5,174 4,660

Other businesses........................................................................................................ 3,588 3,213 3,040

76,953 71,843 59,882

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses * ............................................................... 5,494 3,496 4,129

Other revenues ....................................................................................................... 42 53 39

Eliminations and other ........................................................................................... (826) (1,010) (191)

$81,663 $74,382 $63,859

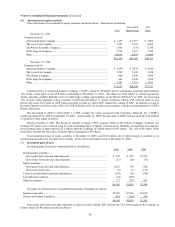

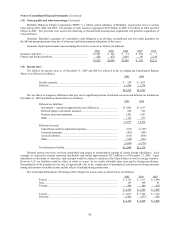

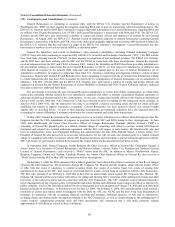

Earnings (loss) before taxes

Operating Businesses: and minority interests

Insurance group: 2005 2004 2003

Underwriting gain (loss):

GEICO ................................................................................................................ $ 1,221 $ 970 $ 452

General Re .......................................................................................................... (334) 3 145

Berkshire Hathaway Reinsurance Group ............................................................ (1,069) 417 1,047

Berkshire Hathaway Primary Group................................................................... 235 161 74

Net investment income........................................................................................... 3,480 2,824 3,223

Total insurance group................................................................................................ 3,533 4,375 4,941

Apparel...................................................................................................................... 348 325 289

Building products...................................................................................................... 751 643 559

Finance and financial products *............................................................................... 822 584 619

Flight services ........................................................................................................... 120 191 72

McLane Company..................................................................................................... 217 228 150

Retail......................................................................................................................... 201 163 165

Shaw Industries ......................................................................................................... 485 466 436

Other businesses........................................................................................................ 501 465 486

6,978 7,440 7,717

Reconciliation of segments to consolidated amount:

Investment and derivative gains/losses * ............................................................... 5,494 3,489 4,121

Equity in earnings of MidAmerican Energy Holdings Company........................... 523 237 429

Interest expense, excluding interest allocated to business segments ...................... (72) (92) (94)

Eliminations and other ........................................................................................... (132) (138) (153)

$12,791 $10,936 $12,020

* Investment and derivative gains/losses exclude derivative losses of GRS (see Note 11) of $86 million, $25 million and $46

million in 2005, 2004 and 2003, respectively. The GRS derivative losses have been included in the results of the finance

and financial products segment.