Berkshire Hathaway 2005 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

Notes to Consolidated Financial Statements (Continued)

(22) Contingencies and Commitments (Continued)

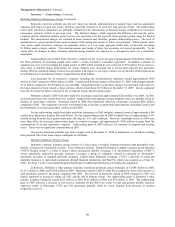

General Reinsurance is continuing to cooperate fully with the EDVA U.S. Attorney and the Department of Justice in

Washington (the “DOJ”) in their ongoing investigation regarding ROA and, in part, its transactions with General Reinsurance. The

EDVA U.S. Attorney and the DOJ have continued to request additional information from General Reinsurance regarding ROA and

its affiliate, First Virginia Reinsurance, Ltd. (“FVR”) and General Reinsurance’ s transactions with ROA and FVR. The EDVA U.S.

Attorney and the DOJ have also interviewed a number of current and former officers and employees of General Re and General

Reinsurance. In August 2005, the EDVA U.S. Attorney issued an additional subpoena to General Reinsurance regarding General

Reinsurance’ s transactions with ROA and FVR. One of the individuals originally subpoenaed in October 2003 has been informed by

the EDVA U.S. Attorney that this individual is a target of the EDVA U.S. Attorney’ s investigation. General Reinsurance has also

been sued in a number of civil actions related to ROA, as described below.

General Re, Berkshire, and certain of Berkshire’ s other insurance subsidiaries, including National Indemnity Company

(“NICO”) have also been continuing to cooperate fully with the U.S. Securities and Exchange Commission (“SEC”), the DOJ and the

New York State Attorney General (“NYAG”) in their ongoing investigations of non-traditional products. The EDVA U.S. Attorney

and the DOJ have also been working with the SEC and the NYAG in connection with these investigations. General Re originally

received subpoenas from the SEC and NYAG in January 2005. General Re, Berkshire and NICO have been providing information to

the government relating to transactions between General Reinsurance or NICO (or their respective subsidiaries or affiliates) and

other insurers in response to the January 2005 subpoenas and related requests and, in the case of General Reinsurance (or its

subsidiaries or affiliates), in response to subpoenas from other U.S. Attorneys conducting investigations relating to certain of these

transactions. In particular, General Re and Berkshire have been responding to requests from the government for information relating

to certain transactions that may have been accounted for incorrectly by counterparties of General Reinsurance (or its subsidiaries or

affiliates). The SEC, NYAG, DOJ and the EDVA U.S. Attorney have interviewed a number of current and former officers and

employees of General Re and General Reinsurance as well as Berkshire’ s Chairman and CEO, Warren E. Buffett, and have indicated

they plan to interview additional individuals.

The government is reviewing the role of General Re and its subsidiaries, as well as that of their counterparties, in certain finite

transactions, including whether General Re or its subsidiaries conspired with others to misstate counterparty financial statements or

aided and abetted such misstatements by the counterparties. In one case, a transaction initially effected with American International

Group (“AIG”) in late 2000 (the “AIG Transaction”), AIG has corrected its prior accounting for the transaction on the grounds, as

stated in AIG’ s 2004 10-K, that the transaction was done to accomplish a desired accounting result and did not entail sufficient

qualifying risk transfer to support reinsurance accounting. General Reinsurance has been named in related civil actions brought

against AIG, as described below. As part of their ongoing investigations, governmental authorities have also inquired about the

accounting by certain of Berkshire’ s insurance subsidiaries for certain assumed and ceded finite transactions.

In May 2005, General Re terminated the consulting services of its former Chief Executive Officer, Ronald Ferguson, after Mr.

Ferguson invoked the Fifth Amendment in response to questions from the SEC and DOJ relating to their investigations. In June

2005, John Houldsworth, the former Chief Executive Officer of Cologne Reinsurance Company (Dublin) Limited (“CRD”), a

subsidiary of General Re, pleaded guilty to a federal criminal charge of conspiring with others to misstate certain AIG financial

statements and entered into a partial settlement agreement with the SEC with respect to such matters. Mr. Houldsworth, who had

been on administrative leave, was terminated following this announcement. In June 2005, Richard Napier, a former Senior Vice

President of General Re who had served as an account representative for the AIG account, also pleaded guilty to a federal criminal

charge of conspiring with others to misstate certain AIG financial statements and entered into a partial settlement agreement with the

SEC with respect to such matters. General Re terminated Mr. Napier following the announcement of these actions.

In September 2005, Ronald Ferguson, Joseph Brandon, the Chief Executive Officer of General Re, Christopher Garand, a

former Senior Vice President of General Reinsurance, and Robert Graham, a former Senior Vice President and Assistant General

Counsel of General Reinsurance, each received a “Wells” notice from the SEC. In addition to Messrs. Houldsworth, Napier,

Brandon, Ferguson, Garand and Graham, Elizabeth Monrad, the former Chief Financial Officer of General Re, also received a

“Wells” notice from the SEC in May 2005 in connection with its investigation.

On February 2, 2006, the DOJ announced that a federal grand jury had indicted three former executives of Gen Re on charges

related to the AIG Transaction. The indictment charges Mr. Ferguson, Ms. Monrad and Mr. Graham, along with one former officer

of AIG, with one count of conspiracy to commit securities fraud, four counts of securities fraud, two counts of causing false

statements to be made to the SEC, four counts of wire fraud and two counts of mail fraud in connection with the AIG Transaction.

The SEC also announced on February 2, 2006 that it had filed an enforcement action against Mr. Ferguson, Ms. Monrad, Mr.

Graham, Mr. Garand and the same former AIG officer, for aiding and abetting AIG’ s violations of the antifraud provisions and other

provisions of the federal securities laws in connection with the AIG Transaction. The SEC complaint seeks permanent injunctive

relief, disgorgement of any ill-gotten gains, civil penalties and orders barring each defendant from acting as an officer or director of a

public company. Each of the individuals indicted by the federal grand jury was arraigned on February 16, 2006 and each individual

pleaded not guilty to all charges. A trial date was set for May 22, 2006. On February 9, 2006, AIG announced that it had reached a

resolution of claims and matters under investigation with the DOJ, the SEC, the NYAG and the New York State Department of

Insurance in connection with the accounting, financial reporting and insurance brokerage practices of AIG and its subsidiaries,

including claims and matters under investigation relating to the AIG Transaction, as well as claims relating to the underpayment of

certain workers’ compensation premium taxes and other assessments. AIG announced that it will make payments totaling

approximately $1.64 billion as a result of these settlements.