Berkshire Hathaway 2005 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

36

Notes to Consolidated Financial Statements (Continued)

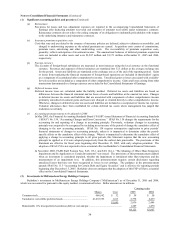

(2) Investments in MidAmerican Energy Holdings Company (Continued)

On September 10, 2004, MidAmerican’ s management decided to cease operations of mineral extraction facilities installed near

certain geothermal energy generation sites (“the Project”), at which proprietary processes were used to extract zinc from geothermal

brine and fluids. MidAmerican’ s management concluded that the Project could not become commercially viable. Consequently, a

non-cash impairment charge of approximately $340 million, after tax, was required to write-down assets of the Project, rights to

quantities of extractable minerals, and allocated goodwill to estimated net realizable value.

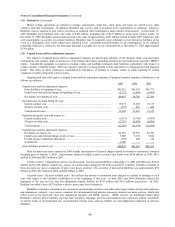

(3) Significant business acquisitions

Berkshire’ s long-held acquisition strategy is to purchase businesses with consistent earning power, good returns on equity, able

and honest management and at sensible prices. During the last three years, Berkshire acquired several businesses which are described

in the following paragraphs.

On May 23, 2003, Berkshire acquired McLane Company, Inc. (“McLane”), from Wal-Mart Stores, Inc. for cash consideration

of approximately $1.5 billion. McLane is one of the nation’ s largest wholesale distributors of groceries and nonfood items to

convenience stores, wholesale clubs, mass merchandisers, quick service restaurants, theaters and others. On August 7, 2003,

Berkshire acquired all the outstanding common stock of Clayton Homes, Inc. (“Clayton”) for cash consideration of approximately

$1.7 billion in the aggregate. Clayton is a vertically integrated manufactured housing company which at the time of the acquisition

had 20 manufacturing plants, 306 company owned stores, 535 independent retailers, 89 manufactured housing communities and

financial services operations that provide mortgage services and insurance protection.

On June 30, 2005, Berkshire acquired Medical Protective Company (“Med Pro”) from GE Insurance Solutions. Med Pro is one

of the nation’ s premier professional liability insurers for physicians, dentists and other primary health care providers. On August 31,

2005, Berkshire acquired Forest River, Inc., (“Forest River”) a leading manufacturer of leisure vehicles in the U.S. Forest River

manufactures a complete line of motorized and towable recreational vehicles, utility trailers, buses, boats and manufactured houses.

Operating results of Med Pro and Forest River are consolidated with Berkshire’ s results beginning as of July 1, 2005 and September

1, 2005, respectively. Inclusion of Med Pro’ s and Forest River’ s results as of the beginning of 2004 would not have materially

impacted Berkshire’ s consolidated results of operations as reported. Aggregate consideration paid for all business acquisitions

completed during 2005, including smaller acquisitions directed by certain Berkshire subsidiaries was $2.4 billion.

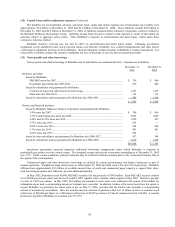

In May 2005, MidAmerican (See Note 2) reached a definitive agreement with Scottish Power plc to acquire its subsidiary,

PacifiCorp, a regulated electric utility providing service to customers in six Western states for approximately $5.1 billion in cash. It

is currently expected that MidAmerican will issue $3.4 billion of additional capital stock to Berkshire (the additional MidAmerican

capital stock to be acquired for purposes of funding the PacifiCorp acquisition is in addition to Berkshire’ s equity commitment

described in Note 2) which will increase Berkshire’ s ownership percentage of MidAmerican to approximately 88.6% (86.5% diluted).

The proceeds from the issuance of the capital stock along with proceeds from the planned issuance by MidAmerican of $1.7 billion of

long-term debt or other securities will be used to fund the purchase. The acquisition is subject to customary closing conditions and is

expected to close in March 2006.

Subsequent to December 31, 2005, Berkshire agreed to acquire Business Wire, a leading global distributor of corporate news,

multimedia and regulatory filings and to acquire an 81% interest in Applied Underwriters, an industry leader in integrated workers’

compensation solutions. The Business Wire acquisition closed on February 28, 2006 and the acquisition of Applied Underwriters is

expected to close prior to May 1, 2006.

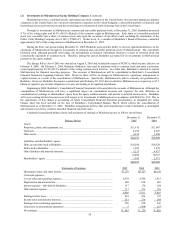

(4) Loans and receivables

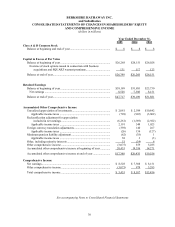

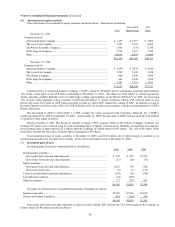

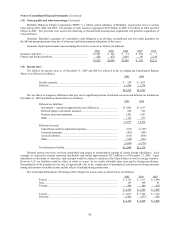

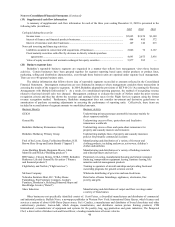

Receivables of insurance and other businesses are comprised of the following (in millions).

December 31, December 31,

2005 2004

Insurance premiums receivable...................................................................................... $ 4,406 $ 3,968

Reinsurance recoverables............................................................................................... 2,990 2,556

Trade and other receivables ........................................................................................... 5,340 5,225

Allowances for uncollectible accounts .......................................................................... (339) (458)

$12,397 $11,291

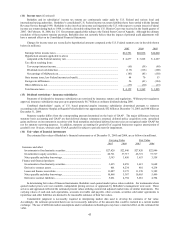

Loans and finance receivables of finance and financial products businesses are comprised of the following (in millions).

December 31, December 31,

2005 2004

Consumer installment loans and finance receivables .................................................... $ 9,792 $ 7,740

Commercial loans and finance receivables.................................................................... 1,481 1,496

Allowances for uncollectible loans................................................................................ (186) (61)

$11,087 $ 9,175

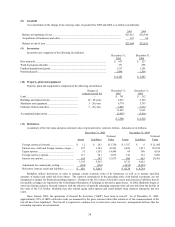

Allowances for uncollectible loans primarily relate to consumer installment loans. Provisions for consumer loan losses totaled

$232 million in 2005 and $116 million in 2004. Loan charge-offs totaled $110 million in 2005 and $99 million in 2004. Consumer

loan amounts are net of acquisition discounts totaling $579 million at December 31, 2005 and $461 million as of December 31, 2004.