Berkshire Hathaway 2005 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

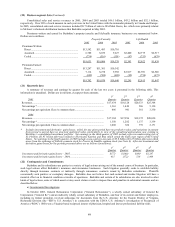

51

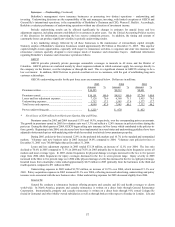

(22) Contingencies and Commitments (Continued)

Various state insurance departments have issued subpoenas or otherwise requested that General Reinsurance, NICO and their

affiliates provide documents and information relating to non-traditional products. The Office of the Connecticut Attorney General has

also issued a subpoena to General Reinsurance for information relating to non-traditional products. General Reinsurance, NICO and

their affiliates have been cooperating fully with these subpoenas and requests.

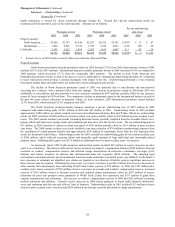

On April 14, 2005, the Australian Prudential Regulation Authority (“APRA”) announced an investigation involving financial

or finite reinsurance transactions by General Reinsurance Australia Limited (“GRA”), a subsidiary of General Reinsurance. An

inspector appointed by APRA under section 52 of the Insurance Act 1973 has been conducting an investigation including a request

for the production of documents of GRA’ s financial or finite reinsurance business. GRA has been cooperating fully with this

investigation.

In December 2004, the Financial Services Authority (“FSA”) advised General Reinsurance’ s affiliate Faraday Group

(“Faraday”) that it was investigating Milan Vukelic, the then Chief Executive Officer of Faraday with respect to transactions entered

into between GRA and companies affiliated with FAI Insurance Limited in 1998. Mr. Vukelic previously served as the head of

General Re’ s international finite business unit. In April 2005, the FSA advised General Reinsurance that it was investigating Mr.

Vukelic and a former officer of CRD with respect to certain finite risk reinsurance transactions, including transactions between CRD

and several other insurers. In addition, the FSA has requested that General Reinsurance affiliates based in the United Kingdom

provide information relating to the transactions involved in their investigations, including transactions with AIG. General

Reinsurance and its affiliates are cooperating fully with the FSA in these matters. In May 2005, Mr. Vukelic was placed on

administrative leave and in July 2005 his employment was terminated.

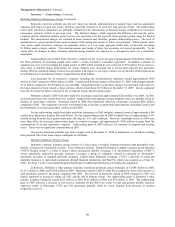

CRD is also providing information to and cooperating fully with the Irish Financial Services Regulatory Authority in its

inquiries regarding the activities of CRD. The Office of the Director of Corporate Enforcement in Ireland is conducting a preliminary

evaluation in relation to CRD concerning, in particular, transactions between CRD and AIG. CRD is cooperating fully with this

preliminary evaluation.

General Reinsurance’ s subsidiary, Kolnische Ruckversicherungs-Gesellschaft AG (“Cologne Re”), is also cooperating fully

with requests for information from the German Federal Financial Supervisory Authority regarding the activities of Cologne Re

relating to “finite reinsurance” and regarding transactions between Cologne Re or its subsidiaries, including CRD, and AIG. General

Reinsurance is also providing information to and cooperating fully with the Office of the Superintendent of Financial Institutions

Canada in its inquiries regarding the activities of General Re and its affiliates relating to “finite reinsurance.”

Berkshire cannot at this time predict the outcome of these matters, is unable to estimate a range of possible loss and cannot

predict whether or not the outcomes will have a material adverse effect on Berkshire’ s business or results of operations for at least the

quarterly period when these matters are completed or otherwise resolved.

b) Civil Litigation

Litigation Related to ROA

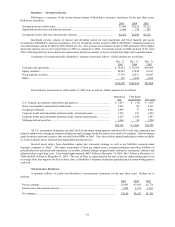

General Reinsurance and four of its current and former employees, along with numerous other defendants, have been sued in a

number of civil actions related to ROA. Plaintiffs assert various claims in these civil actions, including breach of contract, unjust

enrichment, fraud and conspiracy, against General Reinsurance and others, arising from various reinsurance coverages General

Reinsurance provided to ROA and related entities.

Eight putative class actions were initiated by doctors, hospitals and lawyers that purchased insurance through ROA or certain

of its Tennessee-based risk retention groups. These complaints seek compensatory, treble, and punitive damages in an amount

plaintiffs contend is just and reasonable. General Reinsurance is also subject to actions brought by the Virginia Commissioner of

Insurance, as Deputy Receiver of ROA, the Tennessee Commissioner of Insurance, as Liquidator for three Tennessee risk retention

groups, a federal lawsuit filed by a Missouri-based hospital group and a state lawsuit filed by an Alabama doctor that was removed to

federal court. The first of these actions was filed in March 2003 and additional actions were filed in April 2003 through December

2005. In the action filed by the Virginia Commissioner of Insurance, the Commissioner asserts in several of its claims that the

alleged damages being sought exceed $200 million in the aggregate as against all defendants. Eleven of these cases are collectively

assigned to the U.S. District Court for the Western District of Tennessee for pretrial proceedings. General Reinsurance has filed

motions to dismiss all of the claims against it in ten of these cases and the court has not yet ruled on these motions. The other federal

case has been filed in the U.S. District Court for the Northern District of Mississippi and is currently awaiting issuance of a

conditional transfer order to the U.S. District Court for the Western District of Tennessee. No discovery has been initiated in any of

these cases.

General Reinsurance is also a defendant in two lawsuits filed in Alabama state courts. The first suit was filed in the Circuit

Court of Montgomery County by a group of Alabama hospitals that are former members of the Alabama Hospital Association Trust

(“AHAT”). This suit (the “AHA Action”) alleged violations of the Alabama Securities Act, conspiracy, fraud, suppression, unjust

enrichment and breach of contract against General Reinsurance and virtually all of the defendants in the federal suits based on an

alleged business combination between AHAT and ROA in 2001 and subsequent capital contributions to ROA in 2002 by the

Alabama hospitals. The allegations of the AHA Action are largely identical to those set forth in the complaint filed by the Virginia

receiver for ROA. General Reinsurance previously filed a motion to dismiss all of the claims in the AHA Action. The motion was

granted in part by an order in March 2005, which dismissed the Alabama Securities Act claim against General Reinsurance and

ordered plaintiffs to amend their allegations of fraud and suppression. Plaintiffs in the AHA Action filed their Amended and Restated

Complaint in April 2005, alleging claims of conspiracy, fraud, suppression and aiding and abetting breach of fiduciary duty against

General Reinsurance. General Reinsurance filed a motion to dismiss all counts of the Amended and Restated Complaint in May