Berkshire Hathaway 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

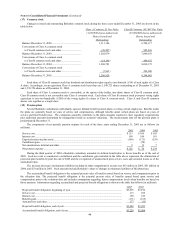

(14) Income taxes (Continued)

Berkshire and its subsidiaries’ income tax returns are continuously under audit by U.S. Federal and various local and

international taxing authorities. Berkshire’ s consolidated U.S. Federal income tax return liabilities have been settled with the Internal

Revenue Service through 1998. Berkshire is also involved in income tax litigation in the U.S. with respect to certain issues in Federal

income tax returns dating back to 1988, in which a favorable ruling from the U.S. District Court was received in the fourth quarter of

2005. On February 16, 2006, the U.S. Government appealed this ruling to the United States Court of Appeals. Although the ultimate

resolution of these matters remains uncertain, Berkshire does not currently believe that the impact of potential audit adjustments will

have a material effect on its Consolidated Financial Statements.

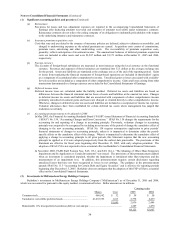

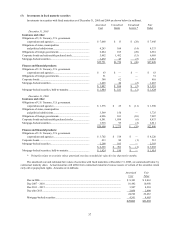

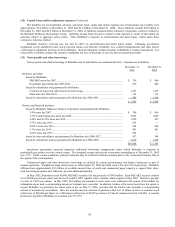

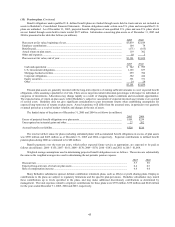

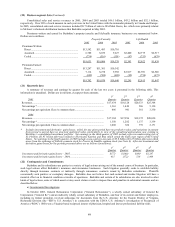

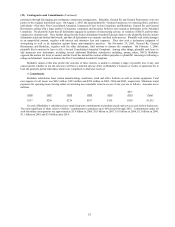

Charges for income taxes are reconciled to hypothetical amounts computed at the U.S. Federal statutory rate in the table shown

below (in millions).

2005 2004 2003

Earnings before income taxes................................................................................................ $12,791 $10,936 $12,020

Hypothetical amounts applicable to above

computed at the Federal statutory rate ............................................................................... $ 4,477 $ 3,828 $ 4,207

Tax effects resulting from:

Tax-exempt interest income............................................................................................... (65) (59) (88)

Dividends received deduction ............................................................................................ (133) (116) (100)

Net earnings of MidAmerican............................................................................................ (183) (83) (150)

State income taxes, less Federal income tax benefit.............................................................. 84 70 53

Foreign rate differences......................................................................................................... 56 (41) (104)

Other differences, net ............................................................................................................ (77) (30) (13)

Total income taxes ................................................................................................................ $ 4,159 $ 3,569 $ 3,805

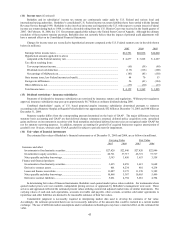

(15) Dividend restrictions – Insurance subsidiaries

Payments of dividends by insurance subsidiaries are restricted by insurance statutes and regulations. Without prior regulatory

approval, insurance subsidiaries may pay up to approximately $6.7 billion as ordinary dividends during 2006.

Combined shareholders’ equity of U.S. based property/casualty insurance subsidiaries determined pursuant to statutory

accounting rules (Statutory Surplus as Regards Policyholders) was approximately $52 billion at December 31, 2005 and $48 billion at

December 31, 2004.

Statutory surplus differs from the corresponding amount determined on the basis of GAAP. The major differences between

statutory basis accounting and GAAP are that deferred charges reinsurance assumed, deferred policy acquisition costs, unrealized

gains and losses on investments in securities with fixed maturities and related deferred income taxes are recognized under GAAP but

not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired businesses requires amortization of

goodwill over 10 years, whereas under GAAP, goodwill is subject to periodic tests for impairment.

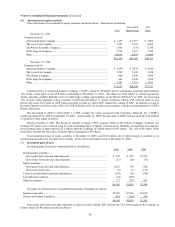

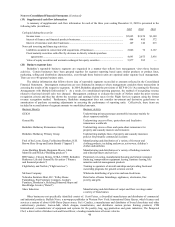

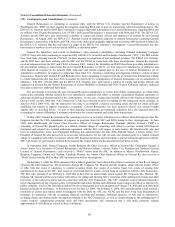

(16) Fair values of financial instruments

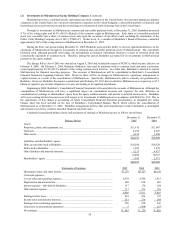

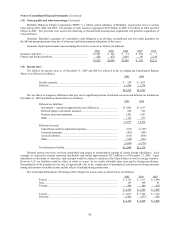

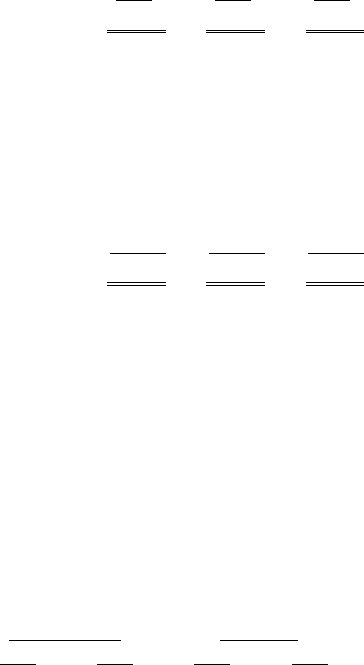

The estimated fair values of Berkshire’ s financial instruments as of December 31, 2005 and 2004, are as follows (in millions).

Carrying Value Fair Value

2005 2004 2005 2004

Insurance and other:

Investments in fixed maturity securities....................................................... $27,420 $22,846 $27,420 $22,846

Investments in equity securities ................................................................... 46,721 37,717 46,721 37,717

Notes payable and other borrowings............................................................ 3,583 3,450 3,653 3,558

Finance and financial products:

Investments in fixed maturity securities....................................................... 3,435 8,459 3,615 8,648

Derivative contract assets ............................................................................ 801 4,234 801 4,234

Loans and finance receivables ..................................................................... 11,087 9,175 11,370 9,382

Notes payable and other borrowings............................................................ 10,868 5,387 10,865 5,499

Derivative contract liabilities....................................................................... 5,061 4,794 5,061 4,794

In determining fair value of financial instruments, Berkshire used quoted market prices when available. For instruments where

quoted market prices were not available, independent pricing services or appraisals by Berkshire’ s management were used. Those

services and appraisals reflected the estimated present values utilizing current risk adjusted market rates of similar instruments. The

carrying values of cash and cash equivalents, accounts receivable and payable, other accruals, securities sold under agreements to

repurchase and other liabilities are deemed to be reasonable estimates of their fair values.

Considerable judgment is necessarily required in interpreting market data used to develop the estimates of fair value.

Accordingly, the estimates presented herein are not necessarily indicative of the amounts that could be realized in a current market

exchange. The use of different market assumptions and/or estimation methodologies may have a material effect on the estimated fair

value.