Berkshire Hathaway 2005 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

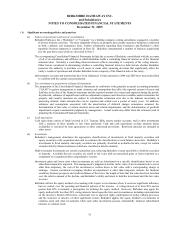

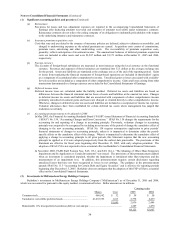

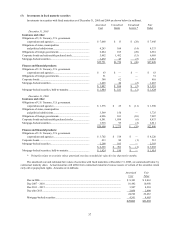

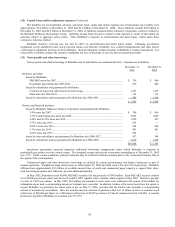

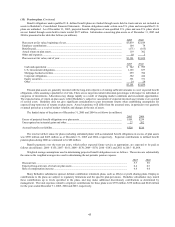

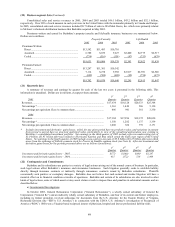

(8) Goodwill

A reconciliation of the change in the carrying value of goodwill for 2005 and 2004 is as follows (in millions).

2005 2004

Balance at beginning of year ......................................................................................................... $23,012 $22,948

Acquisitions of businesses and other............................................................................................. 632 64

Balance at end of year ................................................................................................................... $23,644 $23,012

(9) Inventories

Inventories are comprised of the following (in millions):

December 31, December 31,

2005 2004

Raw materials................................................................................................................... $ 657 $ 527

Work in progress and other.............................................................................................. 271 256

Finished manufactured goods .......................................................................................... 1,217 1,201

Purchased goods............................................................................................................... 1,998 1,858

$ 4,143 $ 3,842

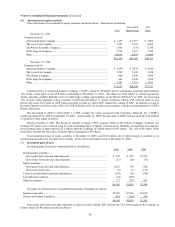

(10) Property, plant and equipment

Property, plant and equipment is comprised of the following (in millions):

Ranges of December 31, December 31,

estimated useful life 2005 2004

Land..................................................................................... — $ 361 $ 312

Buildings and improvements .............................................. 10 – 40 years 2,623 2,525

Machinery and equipment................................................... 3 – 20 years 6,774 5,763

Furniture, fixtures and other................................................ 3 – 20 years 1,649 1,332

11,407 9,932

Accumulated depreciation .................................................. (3,907) (3,416)

$ 7,500 $ 6,516

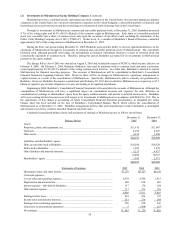

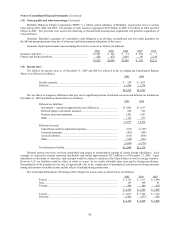

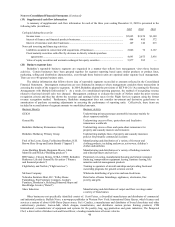

(11) Derivatives

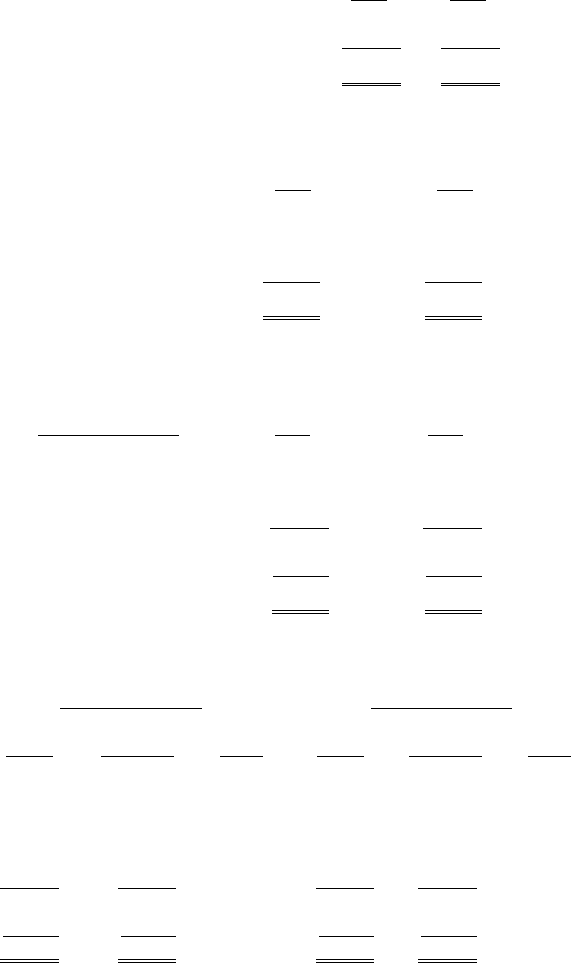

A summary of the fair value and gross notional value of open derivative contracts follows. Amounts are in millions.

December 31, 2005 December 31, 2004

Notional Notional

Assets Liabilities Value Assets Liabilities Value

Foreign currency forwards ...................................

.

$ 12 $ 243 $13,760 $ 1,767 $ 6 $ 21,445

Interest rate, credit and foreign currency swaps ...

.

977 3,142 43,941 6,043 7,651 153,185

Equity options ......................................................

.

35 1,592 14,488 69 380 4,626

Foreign currency options......................................

.

117 241 2,072 343 352 6,083

Interest rate options..............................................

.

164 347 12,033 500 893 28,961

1,305 5,565 8,722 9,282

Adjustment for counterparty netting ....................

.

(504) (504) (4,488) (4,488)

Derivative contract assets and liabilities ..............

.

$ 801 $ 5,061 $ 4,234 $ 4,794

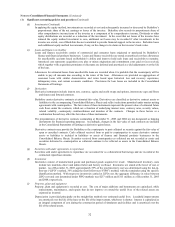

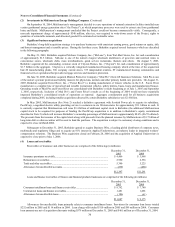

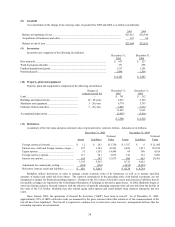

Berkshire utilizes derivatives in order to manage certain economic risks of its businesses as well as to assume specified

amounts of market and credit risk from others. The contracts summarized in the preceding table, with limited exceptions, are not

designated as hedges for financial reporting purposes. Changes in the fair values of derivative assets and derivative liabilities that do

not qualify as hedges are reported in the Consolidated Statements of Earnings as derivative gains/losses. In 2002, Berkshire began to

enter into foreign currency forward contracts with the objective of partially managing corporate-wide adverse risk from the decline in

the value of the U.S. Dollar. Berkshire has also written equity index options and credit default swap contracts during the last two

years.

Since January 2002, the operations of General Re Securities (“GRS”) have been in run-off. As of December 31, 2005,

approximately 95% of GRS’ s derivative risks (as measured by the gross notional value) that existed as of the commencement of the

run-off have been liquidated. The run-off is expected to continue over several more years, however, management believes that the

remaining exposures are not material.