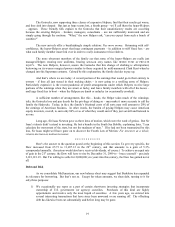

Berkshire Hathaway 2005 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

26

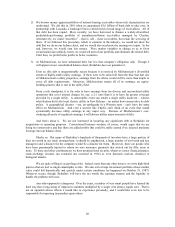

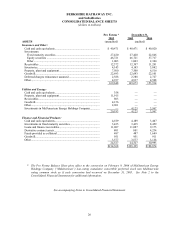

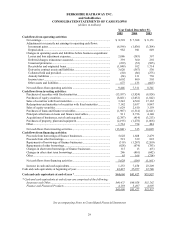

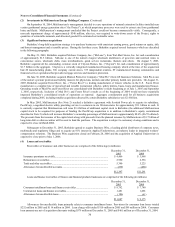

BERKSHIRE HATHAWAY INC.

and Subsidiaries

CONSOLIDATED BALANCE SHEETS

(dollars in millions)

Pro Forma * December 31,

2005 2005 2004

ASSETS (unaudited) (audited)

Insurance and Other:

Cash and cash e

q

uivalents.............................................................. $ 40,471 $ 40,471 $ 40,020

Invest

m

ents:

Fixed maturit

y

securities............................................................. 27,420 27,420 22,846

E

q

uit

y

securities ......................................................................... 46,721 46,721 37,717

Othe

r

........................................................................................... 1,003 1,003 2,346

Receivables .................................................................................... 12,372 12,397 11,291

Inventories...................................................................................... 4,143 4,143 3,842

Pro

p

ert

y

,

p

lant and e

q

ui

p

men

t

........................................................ 7,500 7,500 6,516

Goodwill......................................................................................... 22,693 22,693 22,101

Deferred char

g

es reinsurance assumed .......................................... 2,388 2,388 2,727

Othe

r

............................................................................................... 4,937 4,937 4,508

169,648 169,673 153,914

Utilities and Ener

gy

:

Cash and cash e

q

uivalents.............................................................. 358

—

—

Pro

p

ert

y

,

p

lant and e

q

ui

p

men

t

........................................................ 11,915

—

—

Receivables .................................................................................... 803

—

—

Goodwill......................................................................................... 4,156

—

—

Othe

r

............................................................................................... 2,961

—

—

Investments in MidAmerican Ener

gy

Holdin

g

s Com

p

an

y

.............

—

4,125 3,967

20,193 4,125 3,967

F

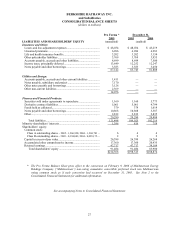

inance and Financial Products:

Cash and cash e

q

uivalents.............................................................. 4,189 4,189 3,407

Investments in fixed maturit

y

securities......................................... 3,435 3,435 8,459

Loans and finance receivables........................................................ 11,087 11,087 9,175

Derivative contract assets............................................................... 801 801 4,234

Funds

p

rovided as collateral........................................................... 487 487 1,649

Goodwill......................................................................................... 951 951 911

Othe

r

............................................................................................... 3,577 3,577 3,158

24,527 24,527 30,993

$214,368 $198,325 $188,874

* The Pro Forma Balance Sheet gives effect to the conversion on February 9, 2006 of MidAmerican Energy

Holdings Company (“MidAmerican”) non-voting cumulative convertible preferred stock into MidAmerican

voting common stock as if such conversion had occurred on December 31, 2005. See Note 2 to the

Consolidated Financial Statements for additional information.

See accompanying Notes to Consolidated Financial Statements