Berkshire Hathaway 2005 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

44

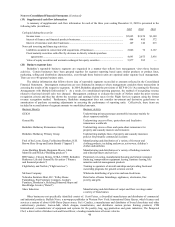

Notes to Consolidated Financial Statements (Continued)

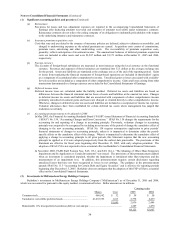

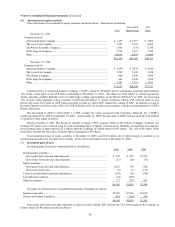

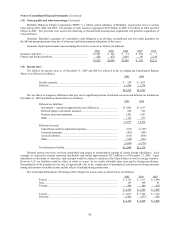

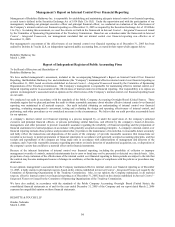

(17) Common stock

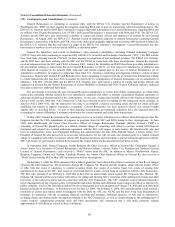

Changes in issued and outstanding Berkshire common stock during the three years ended December 31, 2005 are shown in the

table below.

Class A Common, $5 Par Value Class B Common, $0.1667 Par Value

(1,650,000 shares authorized) (55,000,000 shares authorized)

Shares Issued and Shares Issued and

Outstanding Outstanding

Balance December 31, 2002.............................................. 1,311,186 6,704,117

Conversions of Class A common stock

to Class B common stock and other............................... (28,207) 905,426

Balance December 31, 2003.............................................. 1,282,979 7,609,543

Conversions of Class A common stock

to Class B common stock and other............................... (14,196) 489,632

Balance December 31, 2004.............................................. 1,268,783 8,099,175

Conversions of Class A common stock

to Class B common stock and other............................... (7,863) 294,908

Balance December 31, 2005.............................................. 1,260,920 8,394,083

Each share of Class B common stock has dividend and distribution rights equal to one-thirtieth (1/30) of such rights of a Class

A share. Accordingly, on an equivalent Class A common stock basis there are 1,540,723 shares outstanding as of December 31, 2005

and 1,538,756 shares as of December 31, 2004.

Each share of Class A common stock is convertible, at the option of the holder, into thirty shares of Class B common stock.

Class B common stock is not convertible into Class A common stock. Each share of Class B common stock possesses voting rights

equivalent to one-two-hundredth (1/200) of the voting rights of a share of Class A common stock. Class A and Class B common

shares vote together as a single class.

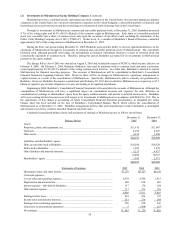

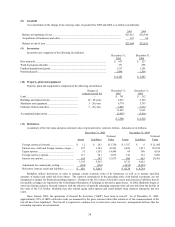

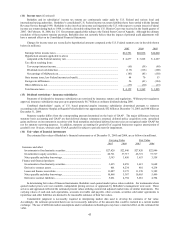

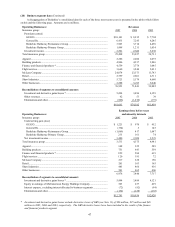

(18) Pension plans

Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under

the plans are generally based on years of service and compensation, although benefits under certain plans are based on years of

service and fixed benefit rates. The companies generally contribute to the plans amounts required to meet regulatory requirements

plus additional amounts determined by management based on actuarial valuations. The measurement date for the pension plans is

predominantly December 31.

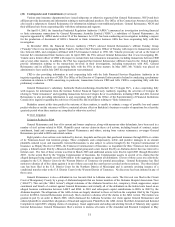

The components of net periodic pension expense for each of the three years ending December 31, 2005 are as follows (in

millions).

2005 2004 2003

Service cost ..................................................................................................................................... $ 113 $ 109 $ 105

Interest cost ..................................................................................................................................... 190 189 181

Expected return on plan assets......................................................................................................... (186) (171) (159)

Curtailment gain.............................................................................................................................. — (70) —

Net amortization, deferral and other................................................................................................ 9 13 7

Net pension expense........................................................................................................................ $ 126 $ 70 $ 134

During the third quarter of 2004 a Berkshire subsidiary amended its defined benefit plan to freeze benefits as of the end of

2005. Such an event is considered a curtailment and the curtailment gain included in the table above represents the elimination of

projected plan benefits beyond the end of 2005 and the recognition of unamortized prior service costs and actuarial losses as of the

amendment date.

The increase (decrease) in minimum liabilities included in other comprehensive income was $63 million in 2005, $41 million in

2004, and $(3) million in 2003. Such amounts include Berkshire’ s share of changes in minimum liabilities of MidAmerican.

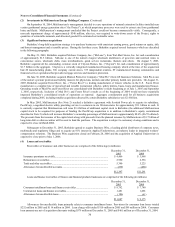

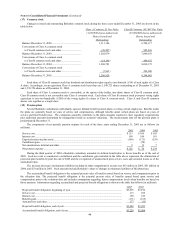

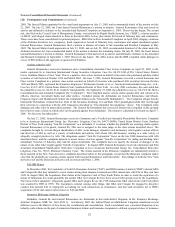

The accumulated benefit obligation is the actuarial present value of benefits earned based on service and compensation prior to

the valuation date. The projected benefit obligation is the actuarial present value of benefits earned based upon service and

compensation prior to the valuation date and includes assumptions regarding future compensation levels when benefits are based on

those amounts. Information regarding accumulated and projected benefit obligations is shown in the table that follows (in millions).

2005 2004

Projected benefit obligation, beginning of year............................................................................... $3,293 $3,192

Service cost ..................................................................................................................................... 113 109

Interest cost ..................................................................................................................................... 190 189

Benefits paid.................................................................................................................................... (171) (165)

Actuarial loss and other................................................................................................................... 177 (32)

Projected benefit obligation, end of year......................................................................................... $3,602 $3,293

Accumulated benefit obligation, end of year................................................................................... $3,228 $2,908