Berkshire Hathaway 2005 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

69

Property and casualty losses (Continued)

GEICO (Continued)

For unreported claims, IBNR reserve estimates are calculated by first projecting the ultimate number of claims

expected (reported and unreported) for each significant coverage by using historical quarterly and monthly claim counts, to

develop age-to-age projections of the ultimate counts by accident quarter. Reported claims are subtracted from the ultimate

claim projections to produce an estimate of the number of unreported claims. The number of unreported claims is multiplied by

an estimate of the average cost per unreported claim to produce the IBNR reserve amount. Actuarial techniques are difficult to

apply reliably in certain situations, such as to new legal precedents, class action suits or recent catastrophes. Consequently,

supplemental IBNR reserves for these types of events may be established.

For each of its major coverages, GEICO tests the adequacy of the total loss reserves using one or more actuarial

projections based on claim closure models, paid loss triangles and incurred loss triangles. Each type of projection analyzes loss

occurrence data for claims occurring in a given period and projects the ultimate cost.

GEICO’ s exposure to highly uncertain losses is believed to be limited to certain commercial excess umbrella policies

written during a period from 1981 to 1984. Remaining reserves associated with such exposure is currently a relatively

insignificant component of GEICO’ s total reserves (3%) and there is little, if any, apparent asbestos or environmental liability

exposure. Related claim activity over the past year was insignificant.

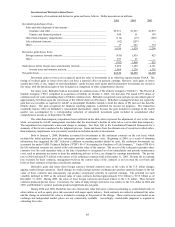

General Re

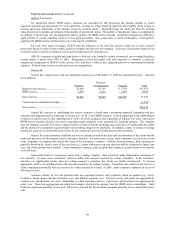

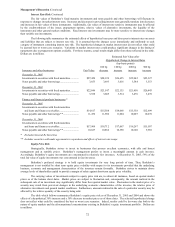

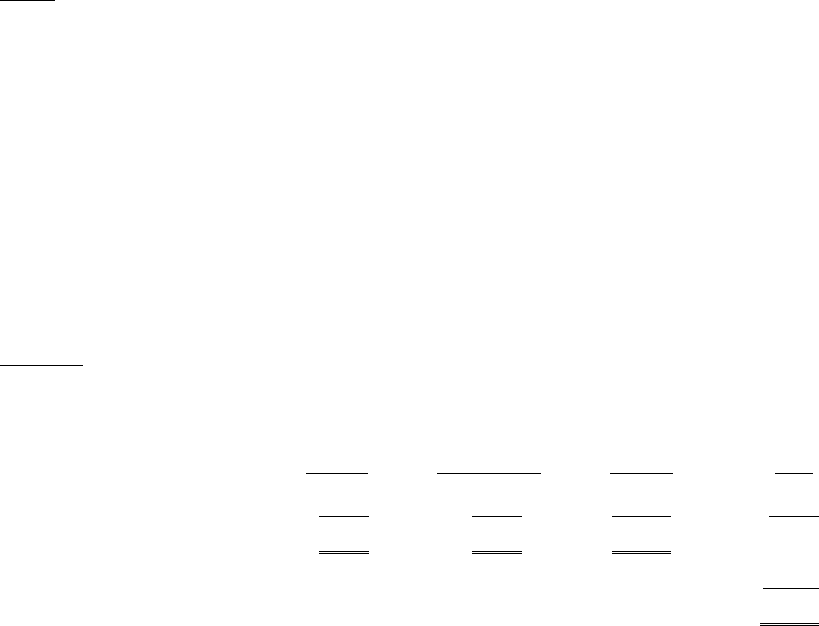

General Re’ s unpaid losses and loss adjustment expenses as of December 31, 2005 are summarized below. Amounts

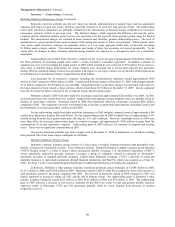

are in millions.

Workers’

Property Compensation Casualty Total

Reported case reserves ............................... $1,968 $2,199 $ 7,768 $11,935

IBNR reserves ............................................ 1,479 1,019 7,091 9,589

Gross reserves ............................................ $3,447 $3,218 $14,859 21,524

Ceded reserves and deferred charges.......... (1,095)

Net reserves................................................ $20,429

General Re’ s process of establishing loss reserve estimates is based upon a ground-up approach, beginning with case

estimates and supplemented by additional case reserves (“ACR’ s”) and IBNR reserves. Critical judgments in the establishment

of these loss reserves involve the establishment of ACR’ s by claim examiners, the expectation of ultimate loss ratios which drive

IBNR reserve amounts and the case reserve reporting trends compared to the expected loss reporting patterns. The company

does not routinely calculate loss reserve ranges because it believes that the techniques necessary have not sufficiently developed

and the myriad of assumptions required render such resulting ranges to be unreliable. In addition, counts of claims or average

amount per claim are not utilized because clients do not consistently provide reliable data in sufficient detail.

General Re claim examiners establish case reserve estimates based on the facts and circumstances of the claims and the

terms and provisions of the insurance and reinsurance contracts. For reinsurance claims, claim examiners receive notices from

client companies in a manner that reflects the terms of the reinsurance contracts. Contract terms governing claim reporting are

generally based on the client’ s view of the case loss (e.g., claims with reserves greater than one-half the retention) or injury type

(e.g., any claim arising from a fatality). Some reinsurance contracts, such as quota-share contracts, permit claims to be reported

on a bulk basis.

Upon notification of a reinsurance claim from a ceding company, claim examiners make independent evaluations of

loss amounts. In some cases, examiners’ estimates differ from amounts reported by ceding companies. If the examiners’

estimates are significantly greater than the ceding company’ s estimates, the claims are further investigated. If deemed

appropriate, ACR’ s are established above the amount reported by the ceding company. Examiners also conduct claim reviews at

client companies periodically and case reserves are often increased as a result. In 2005, claim examiners conducted in excess of

400 claim reviews.

Actuaries classify all loss and premium data into segments (reserve cells) primarily based on product (e.g., treaty,

facultative, and program) and line of business (e.g., auto liability, property, etc.). For each reserve cell, losses are aggregated by

accident year and analyzed over time. Depending on client reporting practices, some losses and premiums are aggregated by

policy year. These loss aggregations are called loss triangles, which are the primary basis for IBNR reserve calculations. North

American operations presently review over 300 reserve cells and the International operations presently review about 900 reserve

cells.