Berkshire Hathaway 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

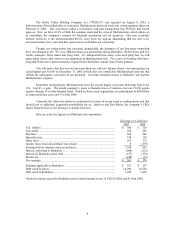

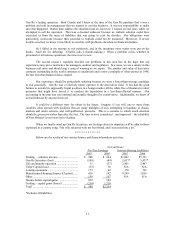

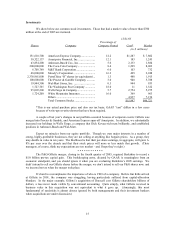

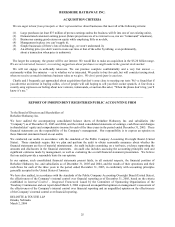

Investments

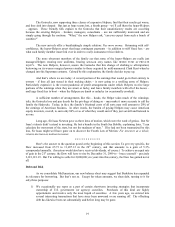

We show below our common stock investments. Those that had a market value of more than $700

million at the end of 2005 are itemized.

12/31/05

Percentage of

Shares Company Company Owned Cost* Market

(in $ millions)

151,610,700 American Express Company ................... 12.2 $1,287 $ 7,802

30,322,137 Ameriprise Financial, Inc..................... 12.1 183 1,243

43,854,200 Anheuser-Busch Cos., Inc.................... 5.6 2,133 1,884

200,000,000 The Coca-Cola Company ........................ 8.4 1,299 8,062

6,708,760 M&T Bank Corporation .......................... 6.0 103 732

48,000,000 Moody’ s Corporation .............................. 16.2 499 2,948

2,338,961,000 PetroChina “H” shares (or equivalents)... 1.3 488 1,915

100,000,000 The Procter & Gamble Company .......... 3.0 940 5,788

19,944,300 Wal-Mart Stores, Inc. ......................... 0.5 944 933

1,727,765 The Washington Post Company .............. 18.0 11 1,322

95,092,200 Wells Fargo & Company......................... 5.7 2,754 5,975

1,724,200 White Mountains Insurance..................... 16.0 369 963

Others ...................................................... 4,937 7,154

Total Common Stocks ............................. $15,947 $46,721

*This is our actual purchase price and also our tax basis; GAAP “cost” differs in a few cases

because of write-ups or write-downs that have been required.

A couple of last year’ s changes in our portfolio occurred because of corporate events: Gillette was

merged into Procter & Gamble, and American Express spun off Ameriprise. In addition, we substantially

increased our holdings in Wells Fargo, a company that Dick Kovacevich runs brilliantly, and established

positions in Anheuser-Busch and Wal-Mart.

Expect no miracles from our equity portfolio. Though we own major interests in a number of

strong, highly-profitable businesses, they are not selling at anything like bargain prices. As a group, they

may double in value in ten years. The likelihood is that their per-share earnings, in aggregate, will grow 6-

8% per year over the decade and that their stock prices will more or less match that growth. (Their

managers, of course, think my expectations are too modest – and I hope they’ re right.)

* * * * * * * * * * * *

The P&G-Gillette merger, closing in the fourth quarter of 2005, required Berkshire to record a

$5.0 billion pre-tax capital gain. This bookkeeping entry, dictated by GAAP, is meaningless from an

economic standpoint, and you should ignore it when you are evaluating Berkshire’ s 2005 earnings. We

didn’ t intend to sell our Gillette shares before the merger; we don’ t intend to sell our P&G shares now; and

we incurred no tax when the merger took place.

It’ s hard to overemphasize the importance of who is CEO of a company. Before Jim Kilts arrived

at Gillette in 2001, the company was struggling, having particularly suffered from capital-allocation

blunders. In the major example, Gillette’ s acquisition of Duracell cost Gillette shareholders billions of

dollars, a loss never made visible by conventional accounting. Quite simply, what Gillette received in

business value in this acquisition was not equivalent to what it gave up. (Amazingly, this most

fundamental of yardsticks is almost always ignored by both managements and their investment bankers

when acquisitions are under discussion.)

15