Berkshire Hathaway 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

59

Insurance — Underwriting (Continued)

General Re

Property/casualty (Continued)

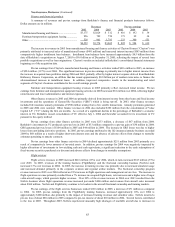

The International property/casualty businesses produced pre-tax underwriting losses of $138 million in 2005 and $93

million in 2004 compared with a gain of $20 million in 2003. Underwriting results included catastrophe losses from U.S.

hurricanes of $205 million in 2005 and $110 million in 2004. Additionally, results in 2005 included $29 million in losses from

Windstorm Erwin. Losses from catastrophes and large individual property losses were minimal in 2003. Underwriting results for

each of the last three years benefited from favorable results of the aviation business and relatively small non-catastrophe property

losses. The International property and casualty underwriting results included gains from prior years’ loss occurrences of $108

million in 2005, compared with losses of $102 million in 2004 and $104 million in 2003. Prior years’ losses in 2004 and 2003

were primarily in motor excess, workers’ compensation and other casualty lines and also reflect reserve increases for operations

placed in run-off.

Although loss reserve levels are now believed to be adequate, there are no guarantees. A relatively small change in the

estimate of net reserves can produce large changes in annual underwriting results. In addition, the timing and magnitude of

catastrophe and large individual property losses are expected to continue to contribute to volatile periodic underwriting results in

the future.

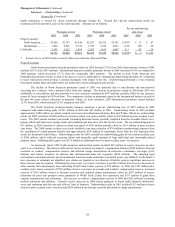

Life and health

Premiums earned in 2005 increased 13.9% over 2004, which increased 9.1% over 2003. Adjusting for the effects of

foreign currency exchange rates, premiums earned increased 14.2% in 2005 and 3.7% in 2004. The increase in 2005 premiums

earned reflected increases in both North American and European life business. In 2004, the increase was attributable, in part, to

the strengthening of foreign currencies and an increase in European life business.

Underwriting results for the global life/health operations produced pre-tax underwriting gains of $111 million in 2005,

$85 million in 2004 and $58 million in 2003. Both the U.S. and International life/health operations were profitable in each of the

past three years primarily due to favorable mortality; however, most of the gains were earned in the International life business.

Additionally, included in the 2005 and 2004 results were $66 million and $46 million, respectively, of net losses attributable to

reserve increases on certain U.S. health business in run-off.

Berkshire Hathaway Reinsurance Group

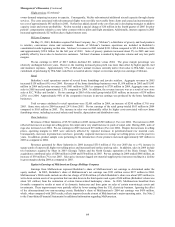

The Berkshire Hathaway Reinsurance Group (“BHRG”) underwrites excess-of-loss reinsurance and quota-share

coverages for insurers and reinsurers world-wide. BHRG’ s business includes catastrophe excess-of-loss reinsurance and excess

direct and facultative reinsurance for large or otherwise unusual discrete property risks referred to as individual risk. Retroactive

reinsurance policies provide indemnification of losses and loss adjustment expenses with respect to past loss events. Other multi-

line refers to other business written on both a quota-share and excess basis, and includes participations in and contracts with

Lloyd’ s syndicates. In addition, during the past twelve months BHRG has written increased amounts of aviation business and

workers’ compensation insurance. Amounts are in millions.

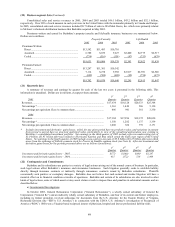

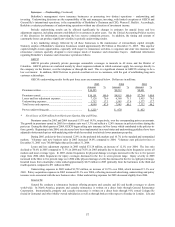

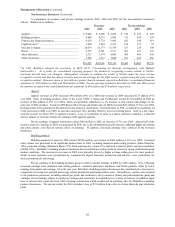

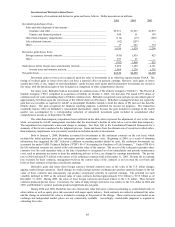

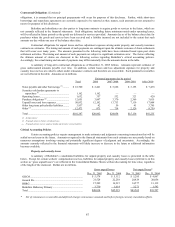

Premiums earned Pre-tax underwriting gain (loss)

2005 2004 2003 2005 2004 2003

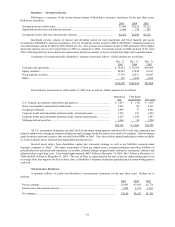

Catastrophe and individual risk.............................. $1,663 $1,462 $1,330 $(1,178) $ 385 $1,108

Retroactive reinsurance .......................................... 10 188 526 (214) (412) (387)

Other multi-line...................................................... 2,290 2,064 2,574 323 444 326

$3,963 $3,714 $4,430 $(1,069)* $ 417 $1,047

* Includes losses of $2.5 billion from Hurricanes Katrina, Rita and Wilma.

Catastrophe and individual risk contracts may provide exceptionally large limits of indemnification, often several

hundred million dollars and occasionally in excess of $1 billion, and cover catastrophe risks (such as hurricanes, earthquakes or

other natural disasters) or other property risks (such as aviation and aerospace, commercial multi-peril or terrorism). Catastrophe

and individual risk premiums written totaled approximately $1.8 billion in 2005, $1.5 billion in 2004 and $1.2 billion in 2003.

The level of business written in future periods will vary, perhaps materially, based upon market conditions and management’ s

assessment of the adequacy of premium rates, which is affected by industry capacity for catastrophe coverages.

Underwriting results from catastrophe and individual risk business in 2005 included estimated losses of approximately

$2.4 billion from Hurricanes Katrina, Rita and Wilma. In 2004, underwriting results from catastrophe and individual risk

business included estimated catastrophe losses of $790 million from four hurricanes that struck the U.S. and Caribbean during

the third quarter. The catastrophe and individual risk business produced substantial underwriting gains in 2003 due to the lack of

catastrophic or otherwise large loss events. The timing and magnitude of losses may produce extraordinary volatility in periodic

underwriting results of BHRG’ s catastrophe and individual risk business. Management accepts such volatility, however,

provided that the long-term prospect of achieving underwriting profits is reasonable. BHRG generally does not cede catastrophe

and individual risks to other reinsurers.