Berkshire Hathaway 2005 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

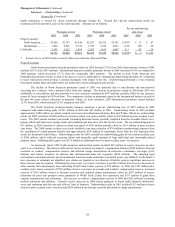

Management’s Discussion (Continued)

Financial Condition

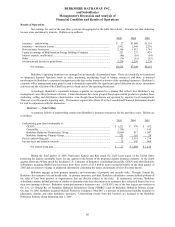

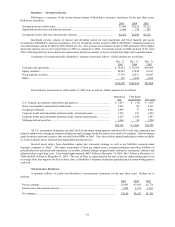

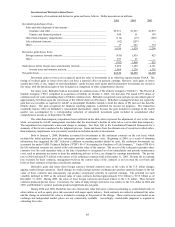

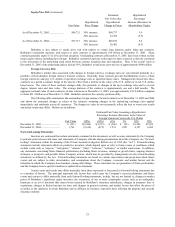

Berkshire’ s balance sheet continues to reflect significant liquidity and a strong capital base. Consolidated

shareholders’ equity at December 31, 2005 totaled $91.5 billion. Consolidated cash and invested assets, excluding assets of

finance and financial products businesses, totaled approximately $115.6 billion at December 31, 2005 (including cash and cash

equivalents of $40.5 billion) and $102.9 billion at December 31, 2004 (including $40.0 billion in cash and cash equivalents).

Berkshire’ s invested assets are held predominantly in its insurance businesses.

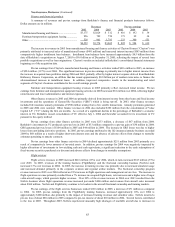

On June 30, 2005, Berkshire acquired Med Pro from an affiliate of General Electric Company. Med Pro is a primary

medical malpractice insurer. On August 31, 2005, Berkshire acquired Forest River, Inc., a manufacturer of recreational vehicles

sold in the United States and Canada. In addition, a few other smaller add on acquisitions were completed by Berkshire

subsidiaries during 2005. Aggregate consideration paid for all acquisitions in 2005 was approximately $2.4 billion.

Berkshire’ s consolidated notes payable and other borrowings, excluding borrowings of finance businesses, totaled $3.6

billion at December 31, 2005 and $3.5 billion at December 31, 2004. During 2005, commercial paper and short-term borrowings

of subsidiaries increased $242 million, due primarily to borrowings of NetJets to acquire additional aircraft. Additionally,

borrowings under investment contracts increased $250 million during 2005 due to a new contract which matures in 2007.

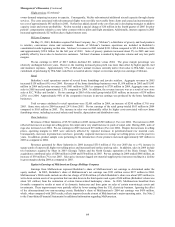

In May 2002, Berkshire issued the SQUARZ securities, which consist of $400 million par amount of senior notes due

in November 2007 together with warrants to purchase 4,464 Class A equivalent shares of Berkshire common stock, which expire

in May 2007. A warrant premium is payable to Berkshire at an annual rate of 3.75% and interest is payable to note holders at a

rate of 3.00%. Each warrant provides the holder the right to purchase either 0.1116 shares of Class A or 3.348 shares of Class B

stock for $10,000. In addition, holders of the senior notes have the option to require Berkshire to repurchase the senior notes at

par on May 15, 2006, provided that the holders also surrender a corresponding amount of warrants for cancellation. To date, no

warrants have been exercised and $64 million par of notes have been redeemed.

On February 9, 2006, Berkshire obtained control of MidAmerican for financial reporting purposes. See Note 2 to the

Consolidated Financial Statements for more information concerning MidAmerican. In addition, MidAmerican expects to

complete its acquisition of PacifiCorp in March 2006 for approximately $5.1 billion, at which time Berkshire will acquire

additional shares of MidAmerican for $3.4 billion thereby increasing its ownership interest to 88.6% (86.5% diluted).

MidAmerican intends to issue additional debt or other securities for the remainder of the purchase price. Berkshire has not

provided and does not intend to guaranty debt issued by MidAmerican or its subsidiaries. However, Berkshire has made a

commitment that allows MidAmerican to request up to $3.5 billion of capital until February 28, 2011 to pay its debt obligations

or to provide funding to its regulated subsidiaries.

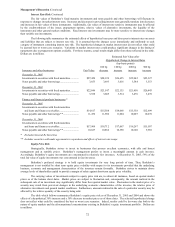

Total assets of the finance and financial products businesses totaled $24.5 billion as of December 31, 2005, and $31.0

billion at December 31, 2004. Liabilities totaled $20.3 billion as of December 31, 2005, and $20.4 billion at December 31, 2004.

During 2005, significant declines in investments in fixed maturity securities ($5.0 billion) resulted from sales and disposals and

were offset by a decline ($4.6 billion) in securities sold under repurchase agreements. A $3.4 billion decline in derivative

contract assets was the result of a large reduction in derivative contracts outstanding, including the ongoing run-off of the

remaining positions of GRS. The asset reductions were partially offset by declines in liabilities to counterparties for funds held

as collateral. Derivative contract liabilities increased slightly in 2005 as declines in liabilities due to the run-off of GRS were

offset by increases in liabilities established with respect to other derivative positions of another Berkshire subsidiary.

Cash and cash equivalents of finance and financial products businesses totaled $4.2 billion as of December 31, 2005

and $3.4 billion as of December 31, 2004. During 2004, manufactured housing loans of Clayton increased approximately $5.0

billion to $7.5 billion as of December 31, 2004 and as of December 31, 2005 further increased to $9.6 billion. The increases

were primarily attributed to loan portfolio acquisitions during 2004 and 2005. Prior to its acquisition by Berkshire in August

2003, Clayton securitized and sold a significant portion of its installment loans through special purpose entities. In early 2003,

Clayton discontinued its loan securitizations and sales.

Notes payable and other borrowings of Berkshire’ s finance and financial products businesses totaled $10.9 billion at

December 31, 2005 and $5.4 billion at December 31, 2004. During 2005, Berkshire Hathaway Finance Corporation (“BHFC”)

issued a total of $5.25 billion par amount of medium term notes. The proceeds of these issues were used to finance originated

and acquired loans of Clayton. Medium term notes issued by BHFC ($8.85 billion in the aggregate) are guaranteed by

Berkshire.

Berkshire believes that it currently maintains sufficient liquidity to cover its existing contractual obligations and

provide for contingent liquidity.

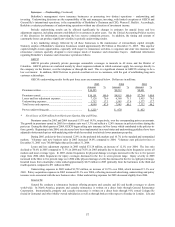

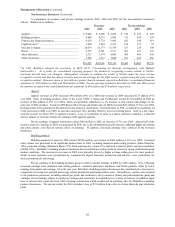

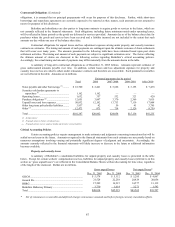

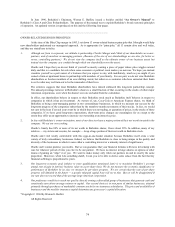

Contractual Obligations

Berkshire and its subsidiaries are parties to contracts associated with ongoing business and financing activities, which

will result in cash payments to counterparties in future periods. Notes payable and securities sold under agreements to

repurchase are reflected in the Consolidated Financial Statements along with accrued but unpaid interest as of the balance sheet

date. In addition, Berkshire will be obligated to pay interest under debt obligations for periods subsequent to the balance sheet

date. Although certain principal balances may be prepaid in advance of the maturity date, thus reducing future interest