Berkshire Hathaway 2005 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.31

BERKSHIRE HATHAWAY INC.

and Subsidiaries

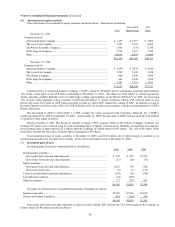

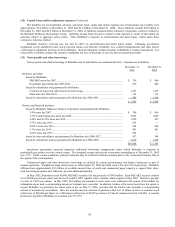

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

December 31, 2005

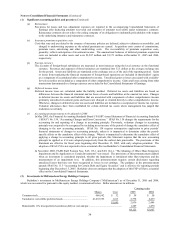

(1) Significant accounting policies and practices

(a) Nature of operations and basis of consolidation

Berkshire Hathaway Inc. (“Berkshire” or “Company”) is a holding company owning subsidiaries engaged in a number

of diverse business activities. The most important of these are property and casualty insurance businesses conducted

on both a primary and reinsurance basis. Further information regarding these businesses and Berkshire’ s other

reportable business segments is contained in Note 20. Berkshire consummated a number of business acquisitions

over the past three years which are discussed in Note 3.

The accompanying Consolidated Financial Statements include the accounts of Berkshire consolidated with the accounts

of all of its subsidiaries and affiliates in which Berkshire holds a controlling financial interest as of the financial

statement date. Normally a controlling financial interest reflects ownership of a majority of the voting interests.

Other factors considered in determining whether a controlling financial interest is held include whether Berkshire

possesses the authority to purchase or sell assets or make other operating decisions that significantly affect the

entity’ s results of operations and whether Berkshire bears a majority of the financial risks of the entity.

Intercompany accounts and transactions have been eliminated. Certain amounts in 2004 and 2003 have been reclassified

to conform with the current year presentation.

(b) Use of estimates in preparation of financial statements

The preparation of the Consolidated Financial Statements in conformity with generally accepted accounting principles

(“GAAP”) requires management to make estimates and assumptions that affect the reported amount of assets and

liabilities at the date of the financial statements and the reported amount of revenues and expenses during the period.

In particular, estimates of unpaid losses and loss adjustment expenses and related recoverables under reinsurance for

property and casualty insurance are subject to considerable estimation error due to the inherent uncertainty in

projecting ultimate claim amounts that can be reported and settled over a period of many years. In addition,

estimates and assumptions associated with the amortization of deferred charges reinsurance assumed, the

determination of fair value of certain invested assets and related impairments, and the determination of goodwill

impairments require considerable judgment by management. Actual results may differ from the estimates used in

preparing the Consolidated Financial Statements.

(c) Cash equivalents

Cash equivalents consist of funds invested in U.S. Treasury Bills, money market accounts, and in other investments

with a maturity of three months or less when purchased. Cash and cash equivalents exclude amounts where

availability is restricted by loan agreements or other contractual provisions. Restricted amounts are included in

other assets.

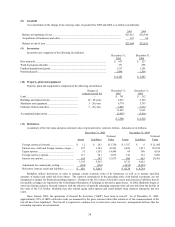

(d) Investments

Berkshire’ s management determines the appropriate classifications of investments in fixed maturity securities and

equity securities at the acquisition date and re-evaluates the classifications at each balance sheet date. Berkshire’ s

investments in fixed maturity and equity securities are primarily classified as available-for-sale, except for certain

securities held by finance businesses which are classified as held-to-maturity.

Held-to-maturity investments are carried at amortized cost, reflecting Berkshire’ s intent and ability to hold the securities

to maturity. Available-for-sale securities are stated at fair value with net unrealized gains or losses reported as a

component of accumulated other comprehensive income.

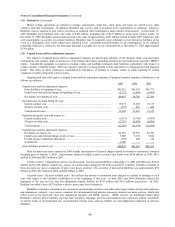

Investment gains and losses arise when investments are sold (as determined on a specific identification basis) or are

other-than-temporarily impaired. If in management’ s judgment a decline in the value of an investment below cost is

other than temporary, the cost of the investment is written down to fair value with a corresponding charge to

earnings. Factors considered in judging whether an impairment is other than temporary include: the financial

condition, business prospects and creditworthiness of the issuer, the length of time that fair value has been less than

cost, the relative amount of the decline, and Berkshire’ s ability and intent to hold the investment until the fair value

recovers.

Berkshire utilizes the equity method of accounting with respect to investments where it exercises significant influence,

but not control, over the operating and financial policies of the investee. A voting interest of at least 20% and no

greater than 50% is normally a prerequisite for utilizing the equity method. However, Berkshire may apply the

equity method with less than 20% voting interests based upon the facts and circumstances including representation

on the investee’ s Board of Directors, contractual veto or approval rights, participation in policy making processes

and the existence or absence of other significant owners. Berkshire applies the equity method to investments in

common stock and other investments when such other investments possess substantially identical subordinated

interests to common stock.