Berkshire Hathaway 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

Management’s Discussion (Continued)

Insurance — Underwriting (Continued)

General Re

(Continued)

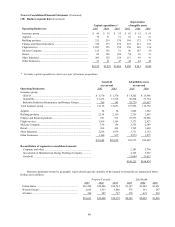

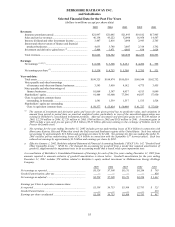

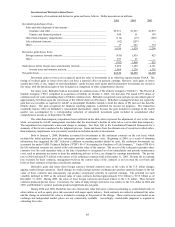

health reinsurance is written for clients worldwide through Cologne Re. General Re’ s pre-tax underwriting results are

summarized for the past three years in the following table. Amounts are in millions.

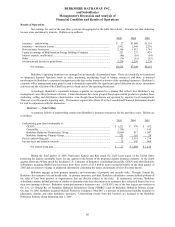

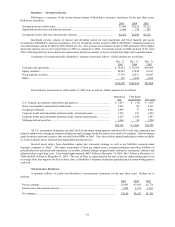

Pre-tax underwriting

Premiums written Premiums earned gain (loss)

2005 2004 2003 2005 2004 2003 2005 2004 2003

Property/casualty:

North American ......... $1,988 $2,747 $3,440 $2,201 $3,012 $3,551 $ (307) $ 11 $ 67

International............... 1,864 2,091 2,742 1,939 2,218 2,847 (138) (93) 20

Life/health ....................... 2,303 2,022 1,839 2,295 2,015 1,847 111 85 58

$6,155 $6,860 $8,021 $6,435 $7,245 $8,245 $ (334)* $ 3 $ 145

* Includes losses of $685 million related to Hurricanes Katrina, Rita and Wilma.

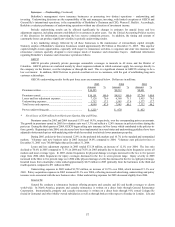

Property/casualty

North American property/casualty premiums written in 2005 declined 27.6% from 2004 and premiums written in 2004

declined 20.1% from 2003 amounts. International property/casualty premiums written in 2005 decreased 10.9% as compared to

2004 amounts, which decreased 23.7% from the comparable 2003 amounts. The decline in both North American and

International premiums written in each of the past two years is attributable to maintaining underwriting discipline by continuing

to reject transactions where pricing is deemed inadequate with respect to the risk. Underwriting performance is not evaluated

based upon market share and underwriters are instructed to reject inadequately priced risks.

The decline in North American premiums earned in 2005 was primarily due to cancellations and non-renewals

exceeding new contracts, with a minimal effect from rate changes. The decline in premiums earned in 2004 from 2003 was

attributable to cancellations and non-renewals over new contracts (estimated at $697 million), partially offset by rate increases

across all lines (estimated at $158 million). The comparative decline in premiums earned in the International business in each of

the past two years reflects reductions in premium volume. In local currencies, 2005 International premiums earned declined

12.3% from 2004, which declined 29.1% compared with 2003.

The North American property/casualty business produced a pre-tax underwriting loss of $307 million in 2005

compared with underwriting gains of $11 million in 2004 and $67 million in 2003. Underwriting losses in 2005 included

approximately $480 million in current accident year losses from Hurricanes Katrina, Rita and Wilma. Otherwise, underwriting

results for 2005 consisted of $220 million in current accident year gains partially offset by $47 million in prior accident years’

losses. The 2005 current accident year results (excluding hurricane losses) generally benefited from the favorable effects of re-

pricing efforts and improved coverage terms and conditions put into place over the last few years. The net underwriting gain of

$11 million in 2004 consisted of current accident year gains of $166 million partially offset by $155 million in prior accident

year losses. The 2004 current accident year results included a one-time reduction of $70 million in underwriting expenses from

the curtailment of certain pension benefits and approximately $120 million of catastrophe losses from the four hurricanes that

struck the Southeast United States. Underwriting results for 2003 included net underwriting gains for the current accident year

of $200 million, which reflected re-pricing efforts and unusually small amounts of large individual and catastrophe-related

property losses. Offsetting these gains were $133 million in additional losses for prior accident years’ occurrences.

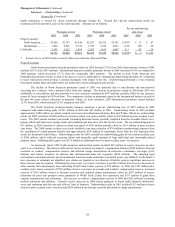

As previously stated, 2005 North American underwriting results included $47 million in reserve increases on prior

years’ loss occurrences. The increase reflected net reserve increases on workers’ compensation business ($228 million); discount

accretion on workers’ compensation reserves and deferred charge amortization on retroactive reinsurance coverages ($136

million); and reserve increases on asbestos and environmental mass tort exposures ($102 million). The changing legal

environment concerning asbestos and environmental losses has made estimation of potential losses very difficult. In the future if

new exposures or claimants are identified, new claims are reported or new theories of liability emerge, significant increases to

these reserves may be required. Offsetting the prior years’ loss reserve increases were $419 million in net reserve decreases in

other casualty lines and property lines, including World Trade Center reserves of $72 million. In 2004, the $155 million prior

accident years’ losses consisted of $729 million of reserve increases on casualty and workers’ compensation reserves, increased

reserves of $110 million related to discount accretion and deferred charge amortization, offset by $307 million of reserve

reductions for prior year property losses (primarily in World Trade Center loss exposures) and $377 million of gains from

contract commutations and settlements. The increase in workers’ compensation reserves in 2004 and 2005 reflected escalating

medical utilization and inflation. Casualty reserve increases in 2004 related primarily to losses under financial institutions’

errors and omissions and directors and officers’ lines of business. Underwriting results in 2003 included $133 million in losses

related to prior accident years, which included $99 million from discount accretion and deferred charge amortization.