Berkshire Hathaway 2005 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

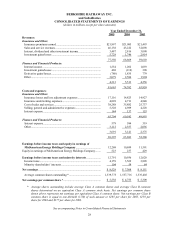

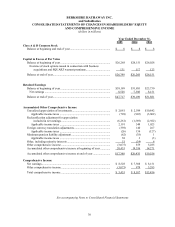

BERKSHIRE HATHAWAY INC.

and Subsidiaries

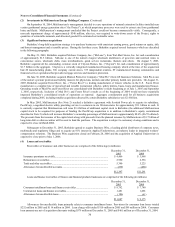

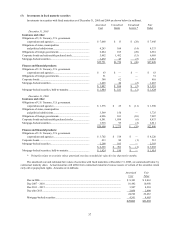

CONSOLIDATED STATEMENTS OF CHANGES IN SHAREHOLDERS’ EQUITY

AND COMPREHENSIVE INCOME

(dollars in millions)

Year Ended December 31,

2005 2004 2003

Class A & B Common Stock

Balance at beginning and end of year........................................................ $ 8 $ 8 $ 8

Capital in Excess of Par Value

Balance at beginning of year ..................................................................... $26,268 $26,151 $26,028

Exercise of stock options issued in connection with business

acquisitions and SQUARZ warrant premiums.................................. 131 117 123

Balance at end of year................................................................................ $26,399 $26,268 $26,151

Retained Earnings

Balance at beginning of year ..................................................................... $39,189 $31,881 $23,730

Net earnings ........................................................................................... 8,528 7,308 8,151

Balance at end of year................................................................................ $47,717 $39,189 $31,881

Accumulated Other Comprehensive Income

Unrealized appreciation of investments..................................................... $ 2,081 $ 2,599 $10,842

Applicable income taxes ...................................................................... (728) (905) (3,802)

Reclassification adjustment for appreciation

included in net earnings .................................................................... (6,261) (1,569) (2,922)

Applicable income taxes ...................................................................... 2,191 549 1,023

Foreign currency translation adjustments .................................................. (359) 140 267

Applicable income taxes ...................................................................... (26) 134 (127)

Minimum pension liability adjustment ...................................................... (62) (38) 1

Applicable income taxes ...................................................................... 38 3 (3)

Other, including minority interests ............................................................ 51 (34) 6

Other comprehensive income .................................................................... (3,075) 879 5,285

Accumulated other comprehensive income at beginning of year .............. 20,435 19,556 14,271

Accumulated other comprehensive income at end of year ........................ $17,360 $20,435 $19,556

Comprehensive Income

Net earnings............................................................................................... $ 8,528 $ 7,308 $ 8,151

Other comprehensive income .................................................................... (3,075) 879 5,285

Total comprehensive income..................................................................... $ 5,453 $ 8,187 $13,436

See accompanying Notes to Consolidated Financial Statements