Berkshire Hathaway 2005 Annual Report Download - page 66

Download and view the complete annual report

Please find page 66 of the 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

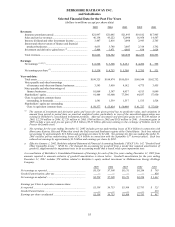

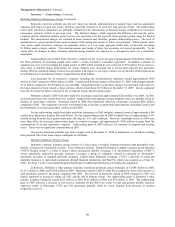

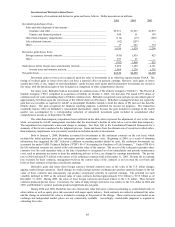

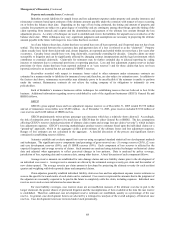

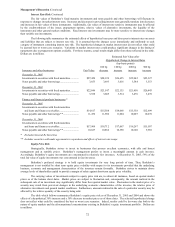

Investment and Derivative Gains/Losses

A summary of investment and derivative gains and losses follows. Dollar amounts are in millions.

2005 2004 2003

Investment gains/losses from -

Sales and other disposals of investments -

Insurance and other...................................................................................... $5,831 $1,527 $2,873

Finance and financial products .................................................................... 544 61 338

Other-than-temporary impairments.................................................................... (114) (19) (289)

Life settlement contracts .................................................................................... (82) (207) —

Other .................................................................................................................. 17 267 374

6,196 1,629 3,296

Derivative gains/losses from -

Foreign currency forward contracts ................................................................... (955) 1,839 825

Other .................................................................................................................. 253 21 —

(702) 1,860 825

Gains/losses before income taxes and minority interests ........................................ 5,494 3,489 4,121

Income taxes and minority interests............................................................. 1,964 1,230 1,392

Net gains/losses....................................................................................................... $3,530 $2,259 $2,729

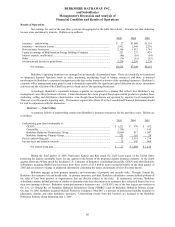

Investment gains or losses are recognized upon the sales of investments or as otherwise required under GAAP. The

timing of realized gains or losses from sales can have a material effect on periodic earnings. However, such gains or losses

usually have little, if any, impact on total shareholders’ equity because most equity and fixed maturity investments are carried at

fair value, with the unrealized gain or loss included as a component of other comprehensive income.

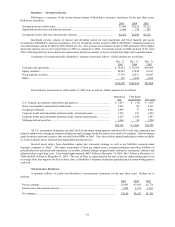

For many years, Berkshire held an investment in common stock of The Gillette Company (“Gillette”). The Procter &

Gamble Company (“PG”) completed its acquisition of Gillette on October 1, 2005. On that date, PG issued 0.975 shares of

common stock for each outstanding share of Gillette common stock. Berkshire recognized a non-cash pre-tax investment gain of

approximately $5 billion upon the conversion of the Gillette shares for PG shares. Berkshire’ s management does not regard the

gain that was recorded, as required by GAAP, as meaningful. Berkshire intends to hold the shares of PG just as it has held the

Gillette shares. The gain recognized for financial reporting purposes is deferred for income tax purposes. The transaction

essentially had no effect on Berkshire’ s consolidated shareholders’ equity because the gain included in earnings in the fourth

quarter was accompanied by a corresponding reduction of unrealized investment gains included in accumulated other

comprehensive income as of September 30, 2005.

The other-than-temporary impairment losses reflected in the table above represent the adjustment of cost to fair value

when, as required by GAAP, management concludes that the investment’ s decline in value below cost is other than temporary.

The impairment loss represents a non-cash charge to earnings. See Note 1(d) to the Consolidated Financial Statements for a

summary of the factors considered in the judgment process. Gains and losses from the ultimate sale of securities in which other-

than-temporary impairments were previously recorded are included in sales of investments.

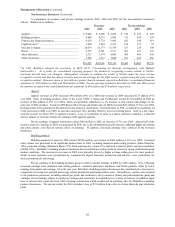

Prior to January 1, 2004, Berkshire accounted for investments in life settlement contracts on the cost basis, which

included the initial purchase price plus subsequent periodic maintenance costs. Beginning in 2004, as a result of obtaining

information that suggested the SEC believed a different accounting method should be used, life settlement investments are

accounted for under FASB Technical Bulletin (“FTB”) 85-4 “Accounting for Purchases of Life Insurance.” Under FTB 85-4,

the life settlement contracts are carried at the cash surrender value of the contract. The excess of the cash paid to purchase these

contracts over the cash surrender value at the date of purchase is recognized as a loss immediately and periodic maintenance

costs, such as premiums necessary to keep the underlying policies in force, are charged to earnings immediately. The pre-tax

loss in 2004 included $73 million with respect to life settlement contracts held at December 31, 2003. Despite the accounting

loss recorded for these contracts, management believes the current value of the contracts is no less than the cost basis and

believes these contracts will produce satisfactory earnings.

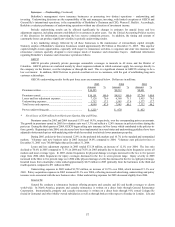

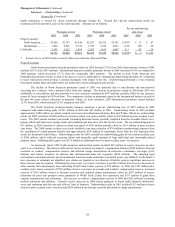

Derivative gains and losses from foreign currency forward contracts arise as the value of the U.S. dollar changes

against certain foreign currencies. Small changes in certain foreign currency exchange rates produce material changes in the fair

value of these contracts and consequently can produce exceptional volatility in reported earnings. The potential for such

volatility declined in 2005 as the notional value of open contracts declined approximately $7.6 billion to $13.8 billion as of

December 31, 2005. During 2005, the value of most foreign currencies decreased relative to the U.S. dollar. Thus, forward

contracts produced pre-tax losses. Conversely, the value of many foreign currencies rose relative to the U.S. dollar in 2004 and

2003, and Berkshire’ s contract positions produced significant pre-tax gains.

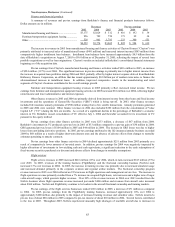

During 2004 and 2005, Berkshire has also entered into other derivative contracts pertaining to credit default risks of

other entities as well as equity price risk associated with major equity indexes. Such contracts are carried at estimated fair value

and the change in estimated fair value is included in earnings in the period of the change. These contracts are not traded on an

exchange and independent market prices are not consistently available. Accordingly, considerable judgment is required in

estimating fair value.