Berkshire Hathaway 2005 Annual Report Download

Download and view the complete annual report

Please find the complete 2005 Berkshire Hathaway annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.BERKSHIRE HATHAWAY INC.

2005 ANNUAL REPORT

TABLE OF CONTENTS

Business Activities.................................................... Inside Front Cover

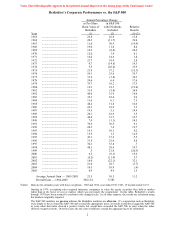

Corporate Performance vs. the S&P 500 ................................................ 2

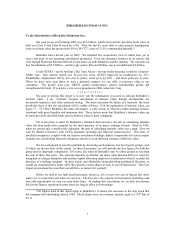

Chairman’ s Letter* ................................................................................. 3

“The Security I Like Best” – An Article About GEICO from 1951....... 24

Acquisition Criteria ................................................................................25

Report of Independent Registered Public Accounting Firm................... 25

Consolidated Financial Statements.........................................................26

Management’ s Report on Internal Control

Over Financial Reporting ................................................................... 54

Selected Financial Data For The

Past Five Years .................................................................................. 55

Management’ s Discussion ...................................................................... 56

Owner’ s Manual .....................................................................................74

Common Stock Data and Corporate Governance Matters......................79

Operating Companies ............................................................................. 80

Directors and Officers of the Company.........................Inside Back Cover

*Copyright © 2006 By Warren E. Buffett

All Rights Reserved

Table of contents

-

Page 1

... Corporate Performance vs. the S&P 500 ...2 Chairman' s Letter* ...3 "The Security I Like Best" - An Article About GEICO from 1951...24 Acquisition Criteria ...25 Report of Independent Registered Public Accounting Firm...25 Consolidated Financial Statements ...26 Management' s Report on Internal... -

Page 2

... products businesses primarily engage in proprietary investing strategies (BH Finance), commercial and consumer lending (Berkshire Hathaway Credit Corporation and Clayton Homes) and transportation equipment and furniture leasing (XTRA and CORT). In addition, Berkshire' s other non-insurance business... -

Page 3

...30; 1967, 15 months ended 12/31. Starting in 1979, accounting rules required insurance companies to value the equity securities they hold at market rather than at the lower of cost or market, which was previously the requirement. In this table, Berkshire' s results through 1978 have been restated to... -

Page 4

... the per-share book value of both our Class A and Class B stock by 6.4%. Over the last 41 years (that is, since present management took over) book value has grown from $19 to $59,377, a rate of 21.5% compounded annually.* Berkshire had a decent year in 2005. We initiated five acquisitions (two of... -

Page 5

... the issuance of Berkshire shares. That' s a crucial, but often ignored, point: When a management proudly acquires another company for stock, the shareholders of the acquirer are concurrently selling part of their interest in everything they own. I' ve made this kind of deal a few times myself - and... -

Page 6

... home for their life' s work, is an example of what can happen when a good idea, a talented individual and hard work converge. • In December we agreed to buy 81% of Applied Underwriters, a company that offers a combination of payroll services and workers' compensation insurance to small businesses... -

Page 7

... and start with insurance, our core business. What counts here is the amount of "float" and its cost over time. For new readers, let me explain. "Float" is money that doesn' t belong to us but that we temporarily hold. Most of our float arises because (1) premiums are paid upfront though the service... -

Page 8

... its market share of U.S. private passenger auto business from about 5.6% to about 6.1%. Auto insurance is a big business: Each sharepoint equates to $1.6 billion in sales. While our brand strength is not quantifiable, I believe it also grew significantly. When Berkshire acquired control of GEICO in... -

Page 9

... at an underwriting profit. And our other primary companies, in aggregate, had an underwriting profit of $324 million on $1,270 million of volume. This is an extraordinary result, and our thanks go to Rod Eldred of Berkshire Hathaway Homestate Companies, John Kizer of Central States Indemnity, Tom... -

Page 10

... a gem. The parent company' s name is HomeServices of America, but our 19,200 agents operate through 18 locally-branded firms. Aided by three small acquisitions, we participated in $64 billion of transactions last year, up 6.5% from 2004. Currently, the white-hot market in residential real estate of... -

Page 11

... value. Small wonder that traders promote them. A business in which huge amounts of compensation flow from assumed numbers is obviously fraught with danger. When two traders execute a transaction that has several, sometimes esoteric, variables and a far-off settlement date, their respective firms... -

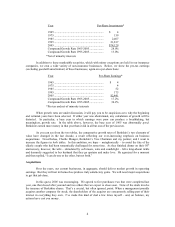

Page 12

... ran away with my best friend, and I sure miss him a lot Below are the results of our various finance and financial products activities: Trading - ordinary income ...Gen Re Securities (loss) ...Life and annuity operation ...Value Capital (loss) ...Leasing operations ...Manufactured-housing finance... -

Page 13

... or units. Pre-Tax Earnings (in $ millions) 2004 2005 $ 751 $ 643 485 466 348 325 257 215 120 191 217 228 413 445 $2,623 $2,481 Building Products ...Shaw Industries ...Apparel & Footwear ...Retailing of Jewelry, Home Furnishings and Candy ...Flight Services...McLane...Other businesses ... 12 -

Page 14

...many more R. C. Willey stores in the years to come. • • In flight services, earnings improved at FlightSafety as corporate aviation continued its rebound. To support growth, we invest heavily in new simulators. Our most recent expansion, bringing us to 42 training centers, is a major facility... -

Page 15

... includes See' s Candies, a company we bought early in 1972 (a date making it our oldest non-insurance business). At that time, Charlie and I immediately decided to put Chuck Huggins, then 46, in charge. Though we were new at the game of selecting managers, Charlie and I hit a home run with this... -

Page 16

... Company ...Wal-Mart Stores, Inc...The Washington Post Company ...Wells Fargo & Company...White Mountains Insurance...Others ...Total Common Stocks ... 12.2 12.1 5.6 8.4 6.0 16.2 1.3 3.0 0.5 18.0 5.7 16.0 *This is our actual purchase price and also our tax basis; GAAP "cost" differs in a few cases... -

Page 17

...every dime paid out in dividends reduces the value of all outstanding options. I' ve never, however, seen this manager-owner conflict referenced in proxy materials that request approval of a fixed-priced option plan. Though CEOs invariably preach internally that capital comes at a cost, they somehow... -

Page 18

... insider. Though I have served as a director of twenty public companies, only one CEO has put me on his comp committee. Hmmmm My views on America' s long-term problem in respect to trade imbalances, which I have laid out in previous reports, remain unchanged. My conviction, however, cost Berkshire... -

Page 19

... is clever or lucky, investor A may take more than his share of the pie at the expense of investor B. And, yes, all investors feel richer when stocks soar. But an owner can exit only by having someone take his place. If one investor sells high, another must buy high. For owners as a whole, there is... -

Page 20

...annually. (Investors would also have received dividends, of course.) To achieve an equal rate...we consolidate MidAmerican, our new balance sheet may suggest that Berkshire has ...investing strategies that incorporate ownership of U.S. government (or agency) securities. Purchases of this kind are highly... -

Page 21

... than any other insurer, we write high-limit policies that are tied to single catastrophic events. We also own a large investment portfolio whose market value could fall dramatically and quickly under certain conditions (as happened on October 19, 1987). Whatever occurs, though, Berkshire will have... -

Page 22

... business arena or in investments. That problem will be solved by having another person in the organization handle marketable securities. That' s an interesting job at Berkshire, and the new CEO will have no problem in hiring a talented individual to do it. Indeed, that' s what we have done at GEICO... -

Page 23

...the Clayton homes on the exhibition floor will be RVs from Forest River. GEICO will have a booth staffed by a number of its top counselors from around the country, all of them ready to supply you with auto insurance quotes. In most cases, GEICO will be able to give you a special shareholder discount... -

Page 24

.... Borsheim' s operates on a gross margin that, even before the shareholders' discount, is fully twenty percentage points below that of its major rivals. Last year, our shareholder-period business increased 9% from 2004, which came on top of a 73% gain the year before. The store sold 5,000 Berkshire... -

Page 25

-

Page 26

... spaniels. A line from a country song expresses our feeling about new ventures, turnarounds, or auction-like sales: "When the phone don' t ring, you' ll know it' s me." _____ REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM To the Board of Directors and Shareholders of Berkshire Hathaway Inc... -

Page 27

... charges reinsurance assumed ...Other...Utilities and Energy: Cash and cash equivalents...Property, plant and equipment...Receivables ...Goodwill...Other...Investments in MidAmerican Energy Holdings Company...Finance and Financial Products: Cash and cash equivalents...Investments in fixed maturity... -

Page 28

... of MidAmerican Energy Holdings Company ("MidAmerican") non-voting cumulative convertible preferred stock into MidAmerican voting common stock as if such conversion had occurred on December 31, 2005. See Note 2 to the Consolidated Financial Statements for additional information. See accompanying... -

Page 29

BERKSHIRE HATHAWAY INC. and Subsidiaries CONSOLIDATED STATEMENTS OF EARNINGS (dollars in millions except per share amounts) Year Ended December 31, 2005 2004 2003 Revenues: Insurance and Other: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ... -

Page 30

... cash flows: Investment gains ...Depreciation...Changes in operating assets and liabilities before business acquisitions: Losses and loss adjustment expenses...Deferred charges reinsurance assumed ...Unearned premiums ...Receivables and originated loans...Derivative contract assets and liabilities... -

Page 31

... December 31, 2005 2004 2003 Class A & B Common Stock Balance at beginning and end of year ...$ 8 $ 8 $ 8 Capital in Excess of Par Value Balance at beginning of year ...Exercise of stock options issued in connection with business acquisitions and SQUARZ warrant premiums...Balance at end of year... -

Page 32

... Berkshire Hathaway Inc. ("Berkshire" or "Company") is a holding company owning subsidiaries engaged in a number of diverse business activities. The most important of these are property and casualty insurance businesses conducted on both a primary and reinsurance basis. Further information... -

Page 33

... its claim on the investee' s book value. Loans and finance receivables Loans and finance receivables consist of commercial and consumer loans originated or purchased by Berkshire' s finance and financial products businesses. Loans and finance receivables are stated at amortized cost less allowances... -

Page 34

... reinsurance contracts written during the period where reports from ceding companies for the period are not contractually due until after the balance sheet date. For policies containing experience rating provisions, premiums are based upon estimated loss experience under the contract. Sales revenues... -

Page 35

...(2) Investments in MidAmerican Energy Holdings Company Berkshire' s investment in MidAmerican Energy Holdings Company ("MidAmerican") as of December 31, 2005 and 2004, which was accounted for pursuant to the equity method, is summarized below. Dollar amounts are in millions. Cost Common stock...$ 32... -

Page 36

... stock, although generally non-voting, was substantially an identical subordinate interest to a share of common stock and economically equivalent to common stock. Therefore, during this period, Berkshire accounted for its investments in MidAmerican pursuant to the equity method. The Energy Policy... -

Page 37

..., Berkshire acquired Medical Protective Company ("Med Pro") from GE Insurance Solutions. Med Pro is one of the nation' s premier professional liability insurers for physicians, dentists and other primary health care providers. On August 31, 2005, Berkshire acquired Forest River, Inc., ("Forest River... -

Page 38

... Amortized Cost Unrealized Gains Unrealized Losses * Fair Value December 31, 2005 Insurance and other: Obligations of U.S. Treasury, U.S. government corporations and agencies ...Obligations of states, municipalities and political subdivisions ...Obligations of foreign governments ...Corporate bonds... -

Page 39

...Gross gains from sales and other disposals ...Gross losses from sales...Losses from other-than-temporary impairments ...Life settlement contracts...Other investments...Net gains are reflected in the Consolidated Statements of Earnings as follows. Insurance and other ...Finance and financial products... -

Page 40

... of partially managing corporate-wide adverse risk from the decline in the value of the U.S. Dollar. Berkshire has also written equity index options and credit default swap contracts during the last two years. Since January 2002, the operations of General Re Securities ("GRS") have been in run-off... -

Page 41

.... This delay in claim reporting is exacerbated in reinsurance of liability or casualty claims as claim reporting by ceding companies is further delayed by contract terms. Supplemental data with respect to unpaid losses and loss adjustment expenses of property/casualty insurance subsidiaries is as... -

Page 42

... latent injury claims under these contracts is, likewise, limited. Berkshire monitors evolving case law and its effect on environmental and latent injury claims. Changing government regulations, newly identified toxins, newly reported claims, new theories of liability, new contract interpretations... -

Page 43

... 31, 2005. Upon distribution as dividends or otherwise, such amounts would be subject to taxation in the United States as well as foreign countries. However, U.S. tax liabilities could be offset, in whole or in part, by tax credits allowable from taxes paid to foreign jurisdictions. Determination of... -

Page 44

... reinsurance assumed, deferred policy acquisition costs, unrealized gains and losses on investments in securities with fixed maturities and related deferred income taxes are recognized under GAAP but not for statutory reporting purposes. In addition, statutory accounting for goodwill of acquired... -

Page 45

... Class A common stock. Class A and Class B common shares vote together as a single class. (18) Pension plans Several Berkshire subsidiaries individually sponsor defined benefit pension plans covering certain employees. Benefits under the plans are generally based on years of service and compensation... -

Page 46

...-term rate of return on plan assets...Rate of compensation increase ...2005 5.7 6.4 4.4 2004 5.9 6.5 4.4 Many Berkshire subsidiaries sponsor defined contribution retirement plans, such as 401(k) or profit sharing plans. Employee contributions to the plans are subject to regulatory limitations and... -

Page 47

... ("Flight services") McLane Company Nebraska Furniture Mart, R.C. Willey Home Furnishings, Star Furniture Company, Jordan' s Furniture, Borsheim' s, Helzberg Diamond Shops and Ben Bridge Jeweler ("Retail") Shaw Industries Underwriting private passenger automobile insurance mainly by direct response... -

Page 48

... Operating Businesses: Insurance group: Premiums earned: GEICO ...General Re ...Berkshire Hathaway Reinsurance Group ...Berkshire Hathaway Primary Group ...Investment income ...Total insurance group...Apparel...Building products ...Finance and financial products *...Flight services ...McLane Company... -

Page 49

... acquisitions. $1,278 $1,066 Operating Businesses: Insurance group: GEICO...General Re ...Berkshire Hathaway Reinsurance and Primary Groups ...Total insurance group ...Apparel ...Building products...Finance and financial products ...Flight services...McLane Company ...Retail...Shaw Industries... -

Page 50

... sales and service revenues included $8.7 billion of sales to Wal-Mart Stores, Inc. which were primarily related to McLane' s wholesale distribution business that Berkshire acquired in May 2003. Premiums written and earned by Berkshire' s property/casualty and life/health insurance businesses... -

Page 51

... the EDVA U.S. Attorney have interviewed a number of current and former officers and employees of General Re and General Reinsurance as well as Berkshire' s Chairman and CEO, Warren E. Buffett, and have indicated they plan to interview additional individuals. The government is reviewing the role of... -

Page 52

... state insurance departments have issued subpoenas or otherwise requested that General Reinsurance, NICO and their affiliates provide documents and information relating to non-traditional products. The Office of the Connecticut Attorney General has also issued a subpoena to General Reinsurance... -

Page 53

..., 2005, General Reinsurance received a Summons and a Verified and Amended Shareholder Derivative Complaint in In re American International Group, Inc. Derivative Litigation, Case No. 04-CV-08406, United States District Court, Southern District of New York, naming "Gen Re Corporation" as a defendant... -

Page 54

... (Continued) purchasers through bid-rigging and contingent commission arrangements. Berkshire, General Re and General Reinsurance were not parties to the original, transferred cases. On August 1, 2005, the named plaintiffs-fourteen businesses, two municipalities, and three individuals-filed their... -

Page 55

... Public Accounting Firm To the Board of Directors and Shareholders of Berkshire Hathaway Inc. We have audited management' s assessment, included in the accompanying Management' s Report on Internal Control Over Financial Reporting, that Berkshire Hathaway Inc. and subsidiaries (the "Company... -

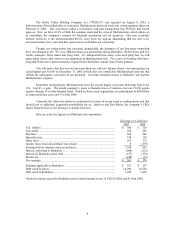

Page 56

BERKSHIRE HATHAWAY INC. and Subsidiaries Selected Financial Data for the Past Five Years (dollars in millions except per share data) 2005 Revenues: Insurance premiums earned ...Sales and service revenues ...Interest, dividend and other investment income ...Interest and other revenues of finance and ... -

Page 57

... or integrated business functions (such as sales, marketing, purchasing, legal or human resources) and there is minimal involvement by Berkshire' s corporate headquarters in the day-to-day business activities of the operating businesses. Berkshire' s corporate office management participates in... -

Page 58

...in 49 states and the District of Columbia. GEICO policies are marketed mainly by direct response methods in which customers apply for coverage directly to the company via the Internet, over the telephone or through the mail. This is a significant element in GEICO' s strategy to be a low cost insurer... -

Page 59

...in 2004 from 2003 was attributable to cancellations and non-renewals over new contracts (estimated at $697 million), partially offset by rate increases across all lines (estimated at $158 million). The comparative decline in premiums earned in the International business in each of the past two years... -

Page 60

... business in run-off. Berkshire Hathaway Reinsurance Group The Berkshire Hathaway Reinsurance Group ("BHRG") underwrites excess-of-loss reinsurance and quota-share coverages for insurers and reinsurers world-wide. BHRG' s business includes catastrophe excess-of-loss reinsurance and excess direct... -

Page 61

... motor vehicle and general liability coverages; U.S. Investment Corporation ("USIC"), whose subsidiaries underwrite specialty insurance coverages; a group of companies referred to internally as "Homestate" operations, providers of standard multi-line insurance; Central States Indemnity Company ("CSI... -

Page 62

... stocks, investment grade...Corporate bonds and redeemable preferred stocks, non-investment grade...Mortgage-backed securities... Fair value $ 7,618 4,333 6,961 3,422 3,547 1,504 $27,385 All U.S. government obligations are rated AAA by the major rating agencies and about 95% of all state, municipal... -

Page 63

... 2003 for the non-insurance businesses follows. Dollars are in millions. Revenues Pre-tax earnings 2005 2004 2003 2005 2004 2003 Apparel...Building products ...Finance and financial products...Flight services * ...McLane Company...Retail ...Shaw Industries ...Other businesses...$ 2,286 4,806 4,559... -

Page 64

... 2004 are primarily derived from interest income from other loans and fixed income investments and the operations of General Re Securities ("GRS") which is being run-off. In 2003, other finance revenues included life insurance annuity premiums of $700 million arising from a few sizable transactions... -

Page 65

...Approximately 33% of McLane' s annual revenues currently derive from sales to Wal-Mart. Loss or curtailment of purchasing by Wal-Mart could have a material adverse impact on revenues and pre-tax earnings of McLane. Retail Berkshire' s retail operations consist of several home furnishings and jewelry... -

Page 66

... value at the date of purchase is recognized as a loss immediately and periodic maintenance costs, such as premiums necessary to keep the underlying policies in force, are charged to earnings immediately. The pre-tax loss in 2004 included $73 million with respect to life settlement contracts... -

Page 67

... insurance businesses. On June 30, 2005, Berkshire acquired Med Pro from an affiliate of General Electric Company. Med Pro is a primary medical malpractice insurer. On August 31, 2005, Berkshire acquired Forest River, Inc., a manufacturer of recreational vehicles sold in the United States and Canada... -

Page 68

...$101,387 Includes interest Principally relates to NetJets' aircraft purchases Principally annuity reserves, employee benefits and derivative contract liabilities Critical Accounting Policies Certain accounting policies require management to make estimates and judgments concerning transactions that... -

Page 69

... per claim and the number of new claims opened. The average severity per claim amount is developed by projecting the ultimate severity for each accident quarter and weighting with both reported claims and unreported claims. Claim adjusters generally establish individual liability claim case loss... -

Page 70

... the insurance and reinsurance contracts. For reinsurance claims, claim examiners receive notices from client companies in a manner that reflects the terms of the reinsurance contracts. Contract terms governing claim reporting are generally based on the client' s view of the case loss (e.g., claims... -

Page 71

...difficult to select an expected loss emergence pattern as has been experienced from the recent wave of corporate scandals that have caused an increase in reported losses. Overall industry-wide loss experience data and informed judgment are used when internal loss data is of limited reliability, such... -

Page 72

... risk. When unable to do so, management may alternatively invest in bonds, loans or other interest rate sensitive instruments. Berkshire' s strategy is to acquire securities that are attractively priced in relation to the perceived credit risk. Management recognizes and accepts that losses may occur... -

Page 73

...910 ** Includes securities sold under agreements to repurchase and effects of interest rate swaps. Equity Price Risk Strategically, Berkshire strives to invest in businesses that possess excellent economics, with able and honest management and at sensible prices. Berkshire' s management prefers to... -

Page 74

...losses insured by Berkshire' s insurance subsidiaries, changes in insurance laws or regulations, changes in Federal income tax laws, and changes in general economic and market factors that affect the prices of securities or the industries in which Berkshire and its affiliates do business, especially... -

Page 75

... behave in respect to their Berkshire stock much as Berkshire itself behaves in respect to companies in which it has an investment. As owners of, say, Coca-Cola or American Express shares, we think of Berkshire as being a non-managing partner in two extraordinary businesses, in which we measure our... -

Page 76

... stock market is likely to present us with significant advantages. For one thing, it tends to reduce the prices at which entire companies become available for purchase. Second, a depressed market makes it easier for our insurance companies to buy small pieces of wonderful businesses - including... -

Page 77

... securities as well. We will not sell small portions of your company - and that is what the issuance of shares amounts to - on a basis inconsistent with the value of the entire enterprise. When we sold the Class B shares in 1996, we stated that Berkshire stock was not undervalued - and some... -

Page 78

... regularly report our per-share book value, an easily calculable number, though one of limited use. The limitations do not arise from our holdings of marketable securities, which are carried on our books at their current prices. Rather the inadequacies of book value have to do with the companies we... -

Page 79

..., depends on the date of my death. But I can anticipate what the management structure will be: Essentially my job will be split into two parts, with one executive becoming responsible for investments and another, who will be CEO, for operations. If the acquisition of new businesses is in prospect... -

Page 80

... owners. Price Range of Common Stock Berkshire' s Class A and Class B Common Stock are listed for trading on the New York Stock Exchange, trading symbol: BRK.A and BRK.B. The following table sets forth the high and low sales prices per share, as reported on the New York Stock Exchange Composite List... -

Page 81

... Moore Berkshire Hathaway Homestate Companies Berkshire Hathaway Reinsurance Division Borsheim's Jewelry The Buffalo News CalEnergy (2) Campbell Hausfeld (1) Carefree of Colorado (1) Central States Indemnity Co. Clayton Homes, Inc. Cleveland Wood Products (1) CORT Business Services CTB International... -

Page 82

..., an academic medical center. DONALD R. KEOUGH, Chairman of Allen and Company Incorporated, an investment banking firm. REBECCA K. AMICK, Director of Internal Auditing MARK D. MILLARD, Director of Financial Assets THOMAS S. MURPHY, Former Chairman of the Board and CEO of Capital Cities/ABC. JO...