BP 2012 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

90

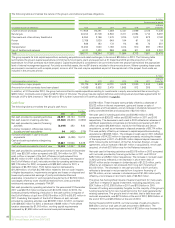

Liquidity and capital resources

Since the Gulf of Mexico oil spill in 2010 and the significant costs relating

to the response activities and the initial uncertainty regarding the ultimate

magnitude of its liabilities and timing of cash outflows, the group’s

situation has continued to stabilize. This has been reflected in the group’s

liquidity and capital resources position, which has continued to be

strengthened as well as put on a stable footing, underpinned by a prudent

financial framework.

The group’s long-term credit ratings are A (positive outlook) from Standard

& Poor’s, strengthened from A (stable outlook) in July 2012, and A2

(stable outlook) from Moody’s Investor Services.

BP renegotiated its committed bank facilities during early 2011, putting in

place $6.8 billion of facilities with 23 international banking counterparties

for a term of three years. In addition the group has continued to

strengthen its access to commercial bank letters of credit (LC) and at the

end of 2012 has in place committed LC facilities of $6.9 billion and

secured LC arrangements of $2.2 billion, to supplement its uncommitted

and unsecured LC lines.

The disposal programme for $38 billion has been essentially completed a

year ahead of schedule, including $15 billion during 2012. Cash receipts of

$11.4 billion were received in 2012, following $2.7 billion of receipts in

2011 and $17.0 billion in 2010.

In addition, we will benefit from further financial flexibility when we

complete the sale of BP’s 50% share in TNK-BP to Rosneft, as announced

early in the fourth quarter of 2012, in return for cash and shares. Having

already received $709 million in December as a dividend from TNK-BP, we

expect to receive a further net $11.6 billion cash on completion, which is

anticipated in the first half of 2013. At that time our shareholding in

Rosneft will increase from 1.25% to 19.75%.

During 2012 BP completed the payments into the Deepwater Horizon Oil

Spill Trust that have totalled $20 billion.

BP accessed US, European and Australian capital markets throughout the

year with bond issuances amounting to $11 billion in 2012.

During 2012 BP repaid the remaining balance of $2.3 billion on the

$4.5 billion of borrowings raised in 2010 that were backed by future crude oil

sales from BP’s interests in specific offshore Angola and Azerbaijan fields.

Financial framework

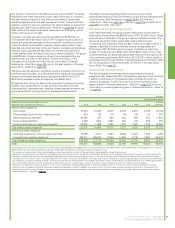

BP continues to refine its financial framework to support the pursuit of

value growth for shareholders, while maintaining a secure financial base.

BP intends to increase operating cash flowa by around 50% in 2014

compared with 2011b, and thereafter maintain focus on growing

sustainable free cash flowsc. The improvement in operating cashflow to

2014 will be delivered partly from the removal of quarterly trust fund

payments of $1.25 billion after completion in 2012, and partly through

high-margin projects coming onstream. The growth in operating cashflow

will be utilized to increase both organic reinvestment and shareholder

distributions.

The financial framework remains prudent and we expect to operate within

a gearingd range of 10-20%, and to be robust to cash break-even levels in

an oil price environment between $80 and $100 per barrel. BP expects to

continue to maintain a significant liquidity buffer while uncertainties

remain.

a

Operating cash flow is net cash provided by (used in) operating activities, as presented in the

group cash flow statement on page 185.

b Adjusted to remove TNK-BP dividends from 2011 and 2014 operating cash flow; 2014 includes

BP’s estimate of Rosneft dividend; 2014 includes the impact of payments in respect of the

settlement of all federal criminal and securities claims with the US government; BP’s

assumption for 2014 is $100/bbl oil, $5/mmBtu Henry Hub gas. The projection does not reflect

any cash flows relating to other liabilities, contingent liabilities, settlements or contingent assets

arising from the Gulf of Mexico oil spill, which may or may not arise at that time. See Financial

statements – Note 43 on page 253 for further information on contingent liabilities.

c

Free cash flow is operating cash flow less net cash used in investing activities, as presented in

the group cash flow statement on page 185.

d Gearing refers to the ratio of the group’s net debt to net debt plus equity and is a non-GAAP

measure. See Financial statements – Note 35 on page 234 for information on gross debt, which

is the nearest equivalent measure to net debt on an IFRS basis.

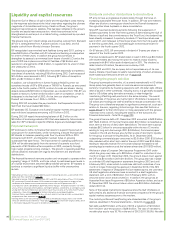

Dividends and other distributions to shareholders

BP aims to have a progressive dividend policy through the focus on

increasing sustainable free cash flows. In addition, BP has committed to

offset any dilution to earnings per share from the Rosneft transaction

through either share buybacks or share consolidation.

Since BP resumed dividend payments following the suspension of

dividend payments for the first three quarters of 2010 relating the Gulf of

Mexico oil spill and the commitments to the Trust Fund, the dividend has

been steadily increased. A quarterly dividend of 7 cents per share was

paid in 2011, and increased to 8 cents per share from the first quarter 2012

to the third quarter 2012, and increased again to 9 cents per share for

payment in the fourth quarter 2012.

On 5 February 2013, BP announced a dividend of 9 cents per share in

respect of the fourth quarter 2012.

The total dividend paid to BP shareholders in cash in 2012 was $5.3 billion

with shareholders also having the option to receive a scrip dividend,

compared with $4.1 billion cash dividend paid in 2011. The dividend is

determined in US dollars, the economic currency of BP.

During 2012 and 2011, the company did not repurchase any of its own

shares. Details of purchases to satisfy requirements of certain employee

share-based payment plans are set out on page 158.

Financing the group’s activities

The group’s principal commodity, oil, is priced internationally in US dollars.

Group policy has generally been to minimize economic exposure to

currency movements by financing operations with US dollar debt. Where

debt is issued in other currencies, including euros, it is generally swapped

back to US dollars using derivative contracts, or else hedged by

maintaining offsetting cash positions in the same currency. The overall

cash balances of the group are mainly held in US dollars or swapped to

US dollars and holdings are well-diversified to reduce concentration risk.

The group is not therefore exposed to significant currency risk, such as in

relation to the euro, regarding its borrowings. Also see Risk factors on

pages 38-44 for further information on risks associated with the general

macroeconomic outlook, including the stability of the eurozone and

Financial statements – Note 26 on page 220.

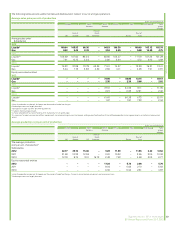

The group’s finance debt at 31 December 2012 amounted to $48.8 billion

(2011 $44.2 billion). Of the total finance debt, $10.0 billion is classified as

short term at the end of 2012 (2011 $9.0 billion). The short-term balance

includes $6.2 billion for amounts repayable within the next 12 months

relating to long-term borrowings (2011 $4.9 billion). Commercial paper

markets in the US and Europe are a further source of short-term liquidity

for the group to provide timing flexibility. At 31 December 2012,

outstanding commercial paper amounted to $3.0 billion (2011 $3.6 billion).

Also included within short-term debt at the end of 2012 was $0.6 billion

relating to deposits received for announced disposal transactions still

pending legal completion post the balance sheet date (2011 $30 million).

We have in place a European Debt Issuance Programme (DIP) under

which the group may raise up to $20 billion of debt for maturities of one

month or longer. At 31 December 2012, the amount drawn down against

the DIP was $14.0 billion (2011 $11.6 billion). The group also had in place

an unlimited US shelf registration statement throughout 2012 and until

5 February 2013, under which it could raise debt with maturities of one

month or longer. Following the approval in December 2012 of the SEC

settlement in respect of Deepwater Horizon-related claims, the unlimited

US shelf registration statement was converted to a shelf registration

statement with a limit of $30 billion from 5 February 2013, with no

amounts drawn down since conversion. In addition, the group has an

Australian Note Issue Programme of $5 billion Australian dollars, and as at

31 December 2012 the amount drawn down was $0.5 billion Australian

dollars (2011 nil).

None of the capital market bond issuances since the Gulf of Mexico oil

spill contains any additional financial covenants compared with the group’s

capital markets issuances prior to the incident.

The maturity profile and fixed/floating rate characteristics of the group’s

debt are described in Financial statements – Note 34 on page 233.

Net debt was $27.5 billion at the end of 2012, a reduction of $1.5 billion

from the 2011 year-end position of $29.0 billion. The ratio of net debt to

net debt plus equity was 18.7% at the end of 2012 (2011 20.5%). Net debt