BP 2012 Annual Report Download - page 240

Download and view the complete annual report

Please find page 240 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

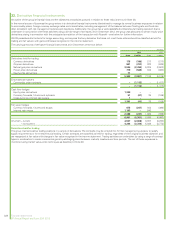

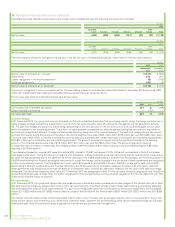

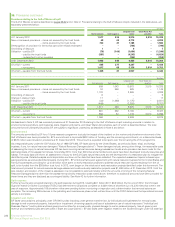

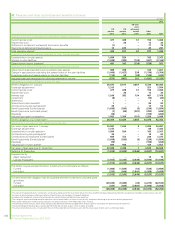

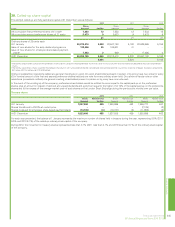

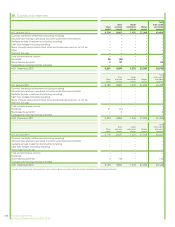

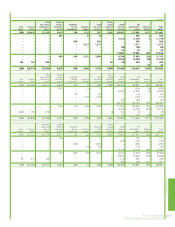

36. Provisions continued

Significant uncertainties exist in relation to the amount of claims that are to be paid and will become payable through the claims process. There is

significant uncertainty in relation to the amounts that ultimately will be paid in relation to current claims, and the number, type and amounts payablefor

claims not yet reported. In addition, there is further uncertainty in relation to interpretations of the claims administrator regarding the protocols under the

settlement agreement and judicial interpretation of these protocols, and the outcomes of any further litigation including in relation to potential opt-outs

from the settlement or otherwise. The PSC settlement is uncapped except for economic loss claims related to the Gulf seafood industry.

While BP has determined its current best estimate of the cost of those aspects of the settlement with the PSC that can be measured reliably, it is

possible that the actual cost of those items could be significantly higher than this estimate due to the uncertainties noted above. In addition, the

provision will be re-established for remaining business economic loss claims as more information becomes available, the interpretation of the protocols

is clarified and the claims process matures, enabling BP to estimate reliably the cost of these claims. BP will continue to analyse claims data and re-

evaluate the assumptions underlying the provision.

The provision recognized for litigation and claims includes an estimate for State and Local government claims. Although the provision recognized is BP’s

current reliable best estimate of the amount required to settle these obligations, significant uncertainty exists in relation to the outcome of any litigation

proceedings and the amount of claims that will become payable by BP. In January 2013, the States of Alabama, Mississippi and Florida formally

presented their claims to BP under OPA 90 for alleged losses including economic and property damage as a result of the Gulf of Mexico oil spill (see

Note 43 for further information).

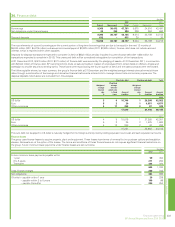

BP reached an agreement in November 2012 with the US government, subject to court approval, to resolve all criminal claims arising from the incident

under which BP will pay $4 billion in instalments over a period of five years. A provision of $3.85 billion has been recognized, representing the discounted

cost of the agreement. This settlement was approved by the court in January 2013 and is not covered by the Trust. In addition, BP reached a settlement

with the US Securities and Exchange Commission (SEC), which was approved by the court in December 2012, resolving all of the US government’s

securities claims against the company, under which BP has agreed to a civil penalty of $525 million, payable in three instalments over a period of three years.

On 10 December 2012, a federal judge issued a final judgment regarding the SEC’s claims and the terms of the settlement. During 2012, a provision was

recognized in the amount of $525 million in respect of the cost of the SEC settlement. The remaining obligation of $350 million for the SEC settlement at

31 December 2012, which is not covered by the trust fund, has been reclassified to other payables.

BP also faces other litigation for which no reliable estimate of the cost can currently be made. Therefore no amounts have been provided for these

items. See Note 43 for further information.

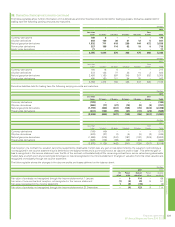

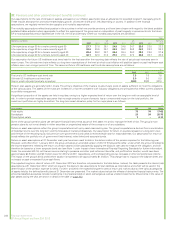

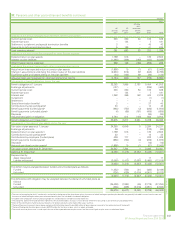

Clean Water Act penalties

A provision has been made for the estimated penalties for strict liability under Section 311 of the Clean Water Act. Such penalties are subject to a

statutory maximum calculated as the product of a per-barrel maximum penalty rate and the number of barrels of oil spilled. Uncertainties currently exist

in relation to both the penalty rate that will ultimately be imposed and the volume of oil spilled.

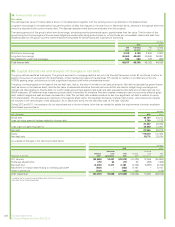

A charge for potential Clean Water Act Section 311 penalties was first included in BP’s second-quarter 2010 interim financial statements. At the time

that charge was taken, the latest estimate from the intra-agency Flow Rate Technical Group created by the National Incident Commander in charge of

the spill response was between 35,000 and 60,000 barrels per day. The mid-point of that range, 47,500 barrels per day, was used for the purposes of

calculating the charge. For the purposes of calculating the amount of the oil flow that was discharged into the Gulf of Mexico, the amount of oil that had

been or was projected to be captured in vessels on the surface was subtracted from the total estimated flow up until when the well was capped on

15 July 2010. The result of this calculation was an estimate that approximately 3.2 million barrels of oil had been discharged into the Gulf. This estimate

of 3.2 million barrels was calculated using a total flow of 47,500 barrels per day multiplied by the 85 days from 22 April 2010 through 15 July 2010 less

an estimate of the amount captured on the surface (approximately 850,000 barrels).

This estimated discharge volume was then multiplied by $1,100 per barrel – the maximum amount the statute allows in the absence of gross negligence or

wilful misconduct – for the purposes of estimating a potential penalty. This resulted in a provision of $3,510 million for potential penalties under Section 311.

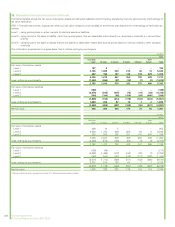

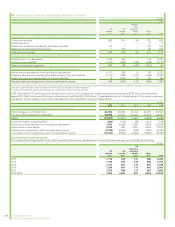

The actual penalty a court may impose could be lower than $1,100 per barrel if it were determined that such a lower penalty was appropriate based on

the factors a court is directed to consider in assessing a penalty. In particular, in determining the amount of a civil penalty, Section 311 directs a court to

consider a number of enumerated factors, including “the seriousness of the violation or violations, the economic benefit to the violator, if any, resulting

from the violation, the degree of culpability involved, any other penalty for the same incident, any history of prior violations, the nature, extent, and

degree of success of any efforts of the violator to minimize or mitigate the effects of the discharge, the economic impact of the penalty on the violator,

and any other matters as justice may require.” Civil penalties above $1,100 per barrel up to a statutory maximum of $4,300 per barrel of oil discharged

would only be imposed if alleged gross negligence or wilful misconduct were proven. BP intends to argue for a penalty lower than $1,100 per barrel

based on several of these factors. However, the $1,100 per-barrel rate has been utilized for the purposes of calculating the provision after considering

and weighing all possible outcomes and in light of: (i) the company’s conclusion that it did not act with gross negligence or engage in wilful misconduct;

and (ii) the uncertainty as to whether a court would assess a penalty below the $1,100 statutory maximum.

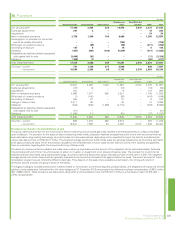

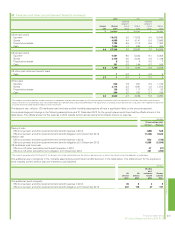

On 2 August 2010, the United States Department of Energy and the Flow Rate Technical Group had issued an estimate that 4.9 million barrels of oil had

flowed from the Macondo well, and 4.05 million barrels had been discharged into the Gulf (the difference being the amount of oil captured by vessels on

the surface as part of BP’s well containment efforts).

It was and remains BP’s view, based on the analysis of available data by its experts, that the 2 August 2010 Government estimate is not reliable. BP

believes that the 2 August 2010 discharge estimate is overstated by at least 20%. If the flow rate were 20% lower than the 2 August 2010 estimate,

then the amount of oil that flowed from the Macondo well would be approximately 3.9 million barrels and the amount discharged into the Gulf would be

approximately 3.1 million barrels (using a current estimate of barrels captured by vessels on the surface of 810,000 in line with the stipulation entered

with the US government – see Legal Proceedings on pages 162-171), which is not materially different from the amount we used for our original

estimate at the end of the second quarter 2010.

For the purposes of calculating a provision for fines and penalties under Section 311 of the Clean Water Act, BP has continued to use an estimate of

3.2 million barrels of oil discharged to the Gulf of Mexico and a penalty of $1,100 per barrel, as its current best estimate, as defined in paragraphs 36-40

of IAS 37 ‘Provisions, Contingent Liabilities and Contingent Assets’, of the amounts which may be used in calculating the penalty under Section 311 of

the Clean Water Act and as a result, the provision at the end of the year was $3,510 million.

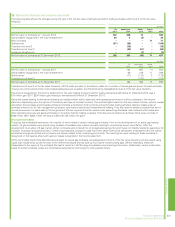

The amount and timing of the amount to be paid ultimately will depend upon what is determined by the court in the federal multi-district litigation

proceedings in New Orleans (MDL 2179) to be the volume of oil spilled and the penalty rate that is imposed or upon any settlement, if one were to be

reached. It is not currently practicable to estimate the timing of expending these costs and the provision has been included within non-current liabilities

on the balance sheet. Save in relation to the amounts described in this note, and in Note 2, no other amounts have been provided as at 31 December

2012 in relation to other potential fines and penalties because it is not possible to measure the obligation reliably. Fines and penalties are not covered by

the trust fund.

238 Financial statements

BP Annual Report and Form 20-F 2012