BP 2012 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

98

Certain definitions

Unless the context indicates otherwise, the following terms have the

meaning shown below:

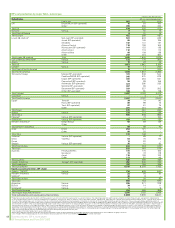

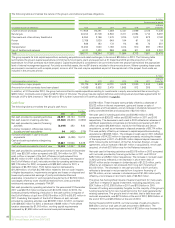

Replacement cost profit

Replacement cost (RC) profit or loss reflects the replacement cost of

supplies and is arrived at by excluding inventory holding gains and losses

from profit or loss. IFRS requires that the measure of profit or loss

disclosed for each operating segment is the measure that is provided

regularly to the chief operating decision maker for the purposes of

performance assessment and resource allocation. For BP, both RC profit

or loss before interest and tax and underlying RC profit or loss before

interest and tax are provided regularly to the chief operating decision

maker. In such cases IFRS requires that the measure of profit disclosed

for each operating segment is the measure that is closest to IFRS, which

for BP is RC profit or loss before interest and tax. RC profit or loss for the

group is not a recognized GAAP measure. The nearest equivalent GAAP

measure is profit or loss for the year attributable to BP shareholders. BP

believes that replacement cost profit before interest and taxation for the

group is a useful measure for investors because it is a profitability

measure used by management. A reconciliation is provided between the

total of the operating segments’ measures of profit or loss and the group

profit or loss before taxation, as required under IFRS. See Financial

statements – Note 6 on page 203.

Inventory holding gains and losses

Inventory holding gains and losses represent the difference between the

cost of sales calculated using the average cost to BP of supplies acquired

during the period and the cost of sales calculated on the first-in first-out

(FIFO) method after adjusting for any changes in provisions where the net

realizable value of the inventory is lower than its cost. Under the FIFO

method, which we use for IFRS reporting, the cost of inventory charged

to the income statement is based on its historic cost of purchase, or

manufacture, rather than its replacement cost. In volatile energy markets,

this can have a significant distorting effect on reported income. The

amounts disclosed represent the difference between the charge (to the

income statement) for inventory on a FIFO basis (after adjusting for any

related movements in net realizable value provisions) and the charge that

would have arisen if an average cost of supplies was used for the period.

For this purpose, the average cost of supplies during the period is

principally calculated on a monthly basis by dividing the total cost of

inventory acquired in the period by the number of barrels acquired. The

amounts disclosed are not separately reflected in the financial statements

as a gain or loss. No adjustment is made in respect of the cost of

inventories held as part of a trading position and certain other temporary

inventory positions.

Management believes this information is useful to illustrate to investors

the fact that crude oil and product prices can vary significantly from period

to period and that the impact on our reported result under IFRS can be

significant. Inventory holding gains and losses vary from period to period

due principally to changes in oil prices as well as changes to underlying

inventory levels. In order for investors to understand the operating

performance of the group excluding the impact of oil price changes on the

replacement of inventories, and to make comparisons of operating

performance between reporting periods, BP’s management believes it is

helpful to disclose this information.

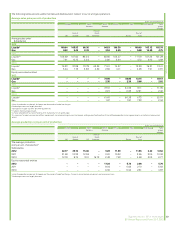

Underlying replacement cost profit

Underlying RC profit or loss is RC profit or loss after adjusting for

non-operating items and fair value accounting effects. Underlying RC

profit or loss and fair value accounting effects are not recognized GAAP

measures. On page 37 we provide additional information on the non-

operating items and fair value accounting effects that are used to arrive at

underlying RC profit or loss in order to enable a full understanding of the

events and their financial impact.

BP believes that underlying RC profit or loss before interest and taxation is

a useful measure for investors because it is a measure closely tracked by

management to evaluate BP’s operating performance and to make

financial, strategic and operating decisions and because it may help

investors to understand and evaluate, in the same manner as

management, the underlying trends in BP’s operational performance on a

comparable basis, year on year, by adjusting for the effects of these

non-operating items and fair value accounting effects. The nearest

equivalent measure on an IFRS basis for the group is profit or loss for the

year attributable to BP shareholders. The nearest equivalent measure on

an IFRS basis for segments is RC profit or loss before interest and taxation.

Non-GAAP information on fair value accounting effects

BP uses derivative instruments to manage the economic exposure

relating to inventories above normal operating requirements of crude oil,

natural gas and petroleum products. Under IFRS, these inventories are

recorded at historic cost. The related derivative instruments, however, are

required to be recorded at fair value with gains and losses recognized in

income because hedge accounting is either not permitted or not followed,

principally due to the impracticality of effectiveness testing requirements.

Therefore, measurement differences in relation to recognition of gains and

losses occur. Gains and losses on these inventories are not recognized

until the commodity is sold in a subsequent accounting period. Gains and

losses on the related derivative commodity contracts are recognized in the

income statement from the time the derivative commodity contract is

entered into on a fair value basis using forward prices consistent with the

contract maturity.

BP enters into commodity contracts to meet certain business

requirements, such as the purchase of crude for a refinery or the sale of

BP’s gas production. Under IFRS these contracts are treated as

derivatives and are required to be fair valued when they are managed as

part of a larger portfolio of similar transactions. Gains and losses arising

are recognized in the income statement from the time the derivative

commodity contract is entered into.

IFRS requires that inventory held for trading be recorded at its fair value

using period end spot prices whereas any related derivative commodity

instruments are required to be recorded at values based on forward prices

consistent with the contract maturity. Depending on market conditions,

these forward prices can be either higher or lower than spot prices

resulting in measurement differences.

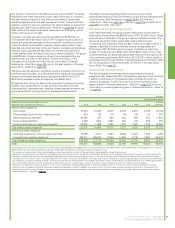

BP enters into contracts for pipelines and storage capacity, oil and gas

processing and liquefied natural gas (LNG) that, under IFRS, are recorded

on an accruals basis. These contracts are risk-managed using a variety of

derivative instruments, which are fair valued under IFRS. This results in

measurement differences in relation to recognition of gains and losses.

The way that BP manages the economic exposures described above, and

measures performance internally, differs from the way these activities are

measured under IFRS. BP calculates this difference for consolidated

entities by comparing the IFRS result with management’s internal

measure of performance. Under management’s internal measure of

performance the inventory, capacity, oil and gas processing and LNG

contracts in question are valued based on fair value using relevant forward

prices prevailing at the end of the period and the commodity contracts for

business requirements are accounted for on an accruals basis. We believe

that disclosing management’s estimate of this difference provides useful

information for investors because it enables investors to see the economic

effect of these activities as a whole. The impacts of fair value accounting

effects, relative to management’s internal measure of performance and a

reconciliation to GAAP information is shown on page 37.

Commodity trading contracts

BP’s Upstream and Downstream segments both participate in regional

and global commodity trading markets in order to manage, transact and

hedge the crude oil, refined products and natural gas that the group either

produces or consumes in its manufacturing operations. These physical

trading activities, together with associated incremental trading

opportunities, are discussed further in Upstream on page 71 and in

Downstream on page 77. The range of contracts the group enters into in

its commodity trading operations is as follows.

Exchange-traded commodity derivatives

These contracts are typically in the form of futures and options traded on

a recognized exchange, such as Nymex, SGX and ICE. Such contracts are

traded in standard specifications for the main marker crude oils, such as

Brent and West Texas Intermediate, the main product grades, such as

gasoline and gasoil, and for natural gas and power. Gains and losses,

otherwise referred to as variation margins, are settled on a daily basis with

the relevant exchange. These contracts are used for the trading and risk