BP 2012 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

with the US government at those premises. We

continue to work with the EPA to resolve

suspension and debarment issues.

Value

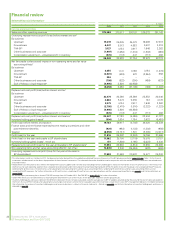

We achieved a profit of $11.6 billion in 2012

compared with $25.7 billion in 2011. Excluding

inventory holding gains, our replacement cost

(RC) profita in 2012 was $12.0 billion compared

with $23.9 billion in 2011. After adjusting for

non-operating items and fair value accounting

effectsb, our underlying RC profitb was $17.6

billion in 2012 compared with $21.7 billion in 2011.

Underlying RC profit is a measure closely tracked

by management to evaluate BP’s operating

performance and to make financial, strategic and

operating decisions.

Our goal is to grow operating cash flowc to

enable us to invest for future growth and

increase distributions to shareholders. This year

we generated operating cash flow of $20.4

billion, compared with $22.2 billion in 2011. The

cash outflow in respect of the Gulf of Mexico oil

spill reduced from $6.8 billion in 2011 to $2.4

billion in 2012. Cash and cash equivalents at the

end of 2012 totalled $19.5 billion. Gross debt at

31 December 2012 was $48.8 billion compared

with $44.2 billion at 31 December 2011. Net

debta was $27.5 billion at 31 December 2012,

leaving our gearing (net debt ratio)d at 18.7%

compared with 20.5% at the end of 2011. We

continue to target gearing in the 10-20% range

while uncertainties remain.

Dividends

Total dividends paid in 2012 were 33 cents per

share, up 18% compared with 2011 on a dollar

basis and 20% in sterling terms. This equated

to a total cash distribution to shareholders of

$5.3 billion during the year. We announced two

increases in the quarterly dividend during 2012

– by 14%, to 8 cents per share, in February and

by a further 12.5%, to 9 cents per share, in

October. These increases reflected our

confidence in the company’s progress against

the 10-point plan and our growing belief in its

longer-term prospects.

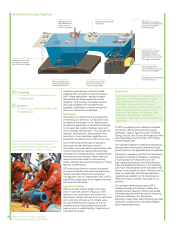

We made good progress on the Whiting refinery

modernization programme (right) in 2012, and the

project is on track to come onstream in the

second half of 2013.

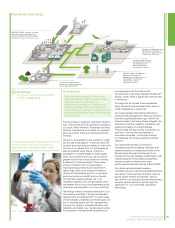

BP is accelerating the commercialization of

advanced biobutanol technology – with partner

Du Pont – at a purpose-built development and

demonstration facility at our Saltend site, near

Hull, UK (above).

$22.5 billion

Our Upstream segment’s replacement cost

profit before interest and tax in 2012.

Upstream

For more on the segment’s financial

performance see page 65 and for

information on segmental changes affecting

Upstream at the beginning of 2012 see

page 64.

a

Replacement cost profit for the group is not a recognized

GAAP measure. The equivalent measure on an IFRS basis is

‘Profit for the year attributable to BP shareholders’. See

footnote b on page 34 and page 98 for further information.

b

Underlying replacement cost profit and fair value accounting

effects are not recognized GAAP measures. See pages 34, 37

and 98 for further information.

c

Operating cash flow is shown in our cash flow statement

as net cash provided by operating activities.

d

Net debt and gearing are non-GAAP measures. See footnote d

on page 21 for further information.

e

See footnote b on page 34.

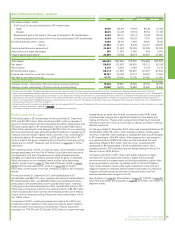

Portfolio reshaped

During the year we strengthened the group’s

financial position, announcing further asset

sales and, by the end of 2012, we had

essentially reached our $38 billion target.

We began the divestment programme in 2010,

increasing the focus of the company’s core

portfolio on BP’s areas of distinctive strength

and capability, while reducing operational

complexity. We have since sold around 50% of

our upstream installations, 32% of our wells and

50% of our pipelines, while only reducing our

proved reserves base by approximately 10%

and our production by about 9%. We have

traded mature assets with declining cash flows

so we can concentrate on assets with greater

potential for growth.

In November 2012 we took a major step

forward in repositioning BP within Russia,

agreeing to sell our 50% shareholding in

TNK-BP to Rosneft – the world’s largest publicly

traded oil company in terms of oil production

and reserves. Our intention is to use part of the

cash proceeds from the agreed transaction to

offset any dilution to BP’s earnings per share.

Upstream

We reported RC profit before interest and tax of

$22.5 billion, compared with $26.4 billion in

2011. After adjusting for non-operating items

and fair value accounting effects, underlying RC

profit before interest and taxe was $19.4 billion

in 2012, compared with $25.2 billion in 2011

reflecting higher costs, lower production and

lower realizations.

Business review: Group overview

BP Annual Report and Form 20-F 2012 25

Business review: Group overview