BP 2012 Annual Report Download - page 251

Download and view the complete annual report

Please find page 251 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

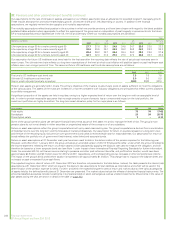

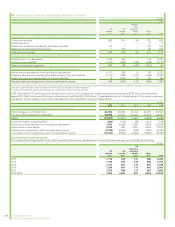

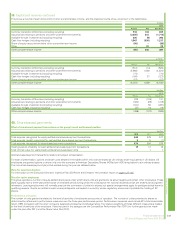

The pre-tax amounts of each component of other comprehensive income, and the related amounts of tax, are shown in the table below.

$ million

2012

Pre-tax Tax Net of tax

Currency translation differences (including recycling) 516 146 662

Actuarial loss relating to pensions and other post-retirement benefits (2,335) 616 (1,719)

Available-for-sale investments (including recycling) 305 (9) 296

Cash flow hedges (including recycling) 1,547 (330) 1,217

Share of equity-accounted entities’ other comprehensive income (98) – (98)

Other –23 23

Other comprehensive income (65) 446 381

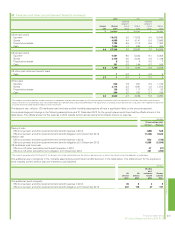

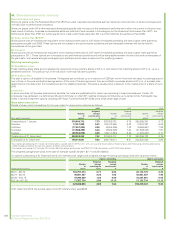

$ million

2011

Pre-tax Tax Netoftax

Currency translation differences (including recycling) (512) (14) (526)

Actuarial loss relating to pensions and other post-retirement benefits (5,960) 1,636 (4,324)

Available-for-sale investments (including recycling) (74) – (74)

Cash flow hedges (including recycling) (164) 37 (127)

Share of equity-accounted entities’ other comprehensive income (57) – (57)

Other comprehensive income (6,767) 1,659 (5,108)

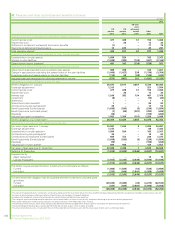

$ million

2010

Pre-tax Tax Netoftax

Currency translation differences (including recycling) 239 (108) 131

Actuarial loss relating to pensions and other post-retirement benefits (320) (98) (418)

Available-for-sale investments (including recycling) (341) 50 (291)

Cash flow hedges (including recycling) (37) 19 (18)

Other comprehensive income (459) (137) (596)

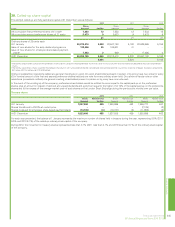

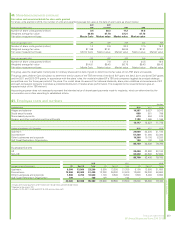

40. Share-based payments

Effect of share-based payment transactions on the group’s result and financial position

$ million

2012 2011 2010

Total expense recognized for equity-settled share-based payment transactions 669 579 577

Total expense (credit) recognized for cash-settled share-based payment transactions 55 (1)

Total expense recognized for share-based payment transactions 674 584 576

Closing balance of liability for cash-settled share-based payment transactions 12 12 16

Total intrinsic value for vested cash-settled share-based payments –11

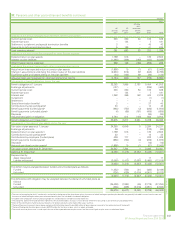

All share-based payment transactions relate to employee compensation.

For ease of presentation, options and share units detailed in the tables within this note are stated as UK ordinary share equivalents in US dollars. US

employees are granted options or share units over the company’s American Depositary Shares (ADSs) (one ADS is equivalent to six ordinary shares).

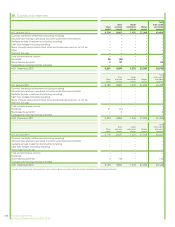

The main share-based payment plans that existed during the year are detailed below.

Plans for executive directors

For information on the Executive Directors’ Incentive Plan (EDIP) see the Directors’ remuneration report on pages 127-145.

Plans for senior employees

The group operates a number of equity-settled share plans under which share units are granted to its senior leaders and certain other employees. These

plans typically have a three-year performance or restricted period during which the units accrue net notional dividends which are treated as having been

reinvested. Leaving employment will normally preclude the conversion of units into shares, but special arrangements apply for participants that leave for

qualifying reasons. Grants are settled in cash where participants are located in a country whose regulatory environment prohibits the holding of BP

shares.

Performance unit plans

The number of units granted is related to the level of seniority of employees and country of operation. The number of units converted to shares is

determined by reference to performance measures over the three-year performance period. Performance measures used include BP’s total shareholder

return (TSR) compared with the other oil majors, balanced scorecard and individual rating. The relative weighting of these different measures is related

to the level of seniority of the employee. Plans included in this category are the Competitive Performance Plan (CPP) (no further grants to be made

under this plan after 2011) and the Share Value Plan (SVP).

Financial statements 249

BP Annual Report and Form 20-F 2012

Financial statements

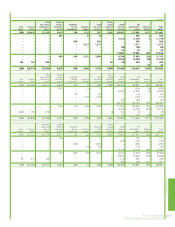

39. Capital and reserves continued