BP 2012 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

Our strategy

In 2011 we put forward a 10-point plan that

outlined what could be expected from BP over

the next three years. During 2012 we worked

towards the milestones we had set out for

2014. We refined our plans and communicated

further information on our longer-term

strategic objectives beyond 2014.

Through this work and the actions taken to

strengthen the group, BP enters 2013 a more

focused oil and gas company with promising

opportunities and a clear plan for the future.

BP’s strengthened position, distinctive

capabilities, strong financial framework and

vision for the future provide the foundation

for our long-term strategy. This strategy is

intended to ensure BP is well positioned for

the world we see ahead.

Our financial framework

We expect our organic capital expenditurea

to be in the range of $24-27 billion per year

through to the end of the decade, with

investment prioritized towards the Upstream

segment. All investments will continue to be

subject to a rigorous capital allocation review

process.

We expect to make around $2-3 billion of

divestments per year in order to constantly

optimize our portfolio. We will target gearingb

in the 10-20% range while uncertainties

remain. Our intention is to increase

shareholder distributions in line with BP’s

improving circumstances.

Our strategic priorities

Our aim is to be an oil and gas company

that grows over the long term. We will seek

to continually enhance safety and risk

management, earn and keep people’s trust,

and create value for shareholders. We will

continue to simplify our organization and fine

tune the portfolio. We will focus on efficient

execution in our operations and our use of

capital. We will build capability through the

pursuit of greater standardization and

increased functional expertise.

BP Energy Outlook 2030 projects that world

demand for energy will continue to grow. In

helping to meet this demand, BP has a large

suite of opportunities – the legacy of years of

success in gaining access to and developing

resources. This allows us to select and invest

in those projects with the potential to provide

the highest returns. We will prioritize value

rather than seek to grow production volume

for its own sake. We will concentrate on

higher quality assets in both our Upstream and

Downstream segments, starting with safety

and the delivery of strong and growing cash

flows to the group.

a Organic capital expenditure excludes acquisitions and asset

exchanges.

b See footnote d on page 21.

Through our strategy we aim to create a distinctive platform

for value growth over the long term.

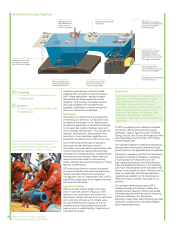

Our seismic technology helps minimize field

appraisal and development risk. The above

model of a hydrocarbon field in the Gulf of

Mexico shows large salt deposits obscuring

a hydrocarbon reservoir.

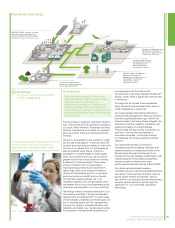

Upstream portfolio simplification

50%

110 20,000 18,000 13

68%

50%

~90%

Operated

installations

Operated

wells

Operated

pipelines (km)

Reserves

(bn boe)

We have divested a significant proportion

of our operated assets while still retaining

virtually all our future major projectsa and

around 90% of our proved reserves.

a See pages 67-71 for information on our major Upstream projects.

b Since April 2010.

DivestedbRetained

Business review: Group overview

BP Annual Report and Form 20-F 2012

20