BP 2012 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

78

long-term competitive advantage. In line with this strategy, in the second

quarter of 2012, we completed the acquisition of Shell and Cosan Industria

e Commercio’s interests in significant aviation fuels assets at seven

Brazilian airports, which is an important growth market.

LPG

We are in the process of exiting our global LPG marketing business, which

sells bulk and bottled LPG products, in order to simplify our marketing

operations. We will retain focus on LPG where it is deeply integrated into

our wholesale and autogas sectors in order to optimize refinery and retail

operations. As at 31 December 2012, the sales of the LPG business in

three countries out of nine had been completed and a further three

announced and the integration of the wholesale and autogas sectors into

the FVCs is complete.

Lubricants

Our lubricants business manufactures and markets lubricants and related

products and services to the automotive, industrial, marine, aviation and

energy markets across the world. Distinctive brands, cutting-edge

technology and sustaining customer relationships are the cornerstone

of our approach. Our key brands are Castrol, BP and Aral. Castrol is a

recognized brand worldwide and we believe it provides us with a

significant competitive advantage. In technology, we apply our expertise

to create quality lubricants and high performance fluids for customers in

on-road, off-road, air, sea and industrial applications globally.

We divide our lubricants business up into five customer sectors:

automotive, marine, industrial, aviation and energy:

t The automotive sector, which accounts for more than two-thirds of our

lubricants sales, serves the needs of land-based vehicles including cars,

trucks, motorcycles, buses, tractors, earth movers and other vehicles.

We supply lubricants and other related products and services to

intermediate customers such as retailers and workshops. These, in

turn, serve end consumers such as car, truck and motorcycle owners.

t The marine sector serves users of river and sea-going vessels. BP’s

marine lubricants business is one of the largest global suppliers of

lubricants to the marine industry, with a global presence in over

800 ports.

t Our industrial sector serves customers who run or maintain plant and

equipment and it is a leading supplier to those sectors of the market

involved in the manufacturing of automobiles, trucks, machinery

components and steel.

t Our aviation sector serves aircraft operators and maintenance

industries. In the aviation industry, we estimate that we are the

lubricants supplier for around 40% of the jet engines of the world’s

commercial airlines.

t Our energy sector serves the oil and gas and power industries. In the

oil and gas industry we supply some of world’s largest production and

drilling companies.

We look to market and sell our products across the world. We sell

products direct to our customers in around 45 countries and use approved

local distributors for other geographies. Approximately 40% of our

employees are located in non-OECD markets and around 20% are located

in China and India alone. We are particularly strong in Europe and key Asia

Pacific markets including India. In 2012 approximately 50% of the

lubricants business replacement cost profit before interest and tax was

generated from non-OECD markets.

We have chosen not to participate at scale in base oil or additives

manufacturing. We are, however, one of the largest purchasers of base

oil in the market.

We participate in blending in locations where scale and competitive

advantage can be sustained, or where customer service or security of

supply are of critical importance and otherwise difficult to secure. We

have a network of 25 wholly owned and operated blending plants

worldwide and joint ownership in five others operated by third parties.

Our participation in the value chain is focused on areas of competitive

differentiation and strength. These fall into three main areas: the

development of formulations and the application of cutting-edge

technology; developing product brands and communicating the benefits

that our products provide to our customers; and building and extending

our relationships with customers so that our products and services are

delivered in a manner that best meets their needs.

In lubricants technology we apply our expertise to create quality lubricants

and high performance fluids for on-road, off-road, air, sea and industrial

applications globally. We continue to support our partners and customers

in delivering high-performance lubricants that deliver greater energy

efficiency and reduced CO2 emissions in both established and emerging

markets.

During 2012 we launched a Performance Biolubes product line, adding a

range of bio-based metalworking fluids and lubricants for use in cutting,

grinding, forming and maintenance lubrication. This new technology

underpins the Castrol brand’s commitment to developing environmentally

responsible product offers. In addition, we introduced ‘80BN’ (the BN

refers to the base number), a new product for the marine market that uses

advanced technology to optimize the performance of lubricants in

slow-steaming marine engines and further strengthens our credentials in

technology leadership. In 2012 we also introduced a co-branded product

with Ford to support their new range of environmentally friendly engines.

Our focus is on developing premium products, and we often work

alongside original equipment manufacturers in doing this. The new Castrol

EDGE professional range was launched to the franchised workshop

market in Europe and Africa in 2012.

Our lubricants businesses continued to grow the proportion of total sales

resulting from premium product sales; in 2012 the percentage of premium

sales was 39% compared with 37% in 2011 and 34% in 2010.

Petrochemicals

Our global petrochemicals business has operations in the US, Europe

and Asia. The business buys a range of feedstocks for input into our

manufacturing units, the majority of which have been built and operate

utilizing our proprietary technology. We manufacture and market four

main product lines:

t Purified terephthalic acid (PTA).

t Paraxylene (PX).

t Acetic acid.

t Olefins and derivatives (O&D).

We also produce a number of other speciality petrochemicals products.

Our strategy is to leverage our industry-leading technology in the markets

in which we choose to participate, to grow the business and to deliver

industry-leading returns. New investments are targeted principally in the

higher-growth Asian markets. We both own and operate assets, and have

also invested in a number of joint ventures in Asia, where our partners are

leading companies within their domestic market.

PTA is a raw material used in the manufacture of polyesters used in fibres,

textiles and film, and polyethylene terephthalate (PET) bottles. PTA

production requires PX as a feedstock, which we produce in the US and

Europe and buy in Asia. PTA is then reacted with glycol to produce

polyester chips or fibres, which are in turn used to produce PET bottles,

polyester fibres and various speciality products, including protective

screens for computers and TVs. PX production is primarily from the mixed

xylene stream produced in a reformer within a refinery.

Acetic acid is a versatile intermediate chemical used in a variety of

products such as paints, adhesives and solvents, as well as in the

production of PTA. In producing acetic acid, we purchase methanol and

either make or buy carbon monoxide (CO). CO can be produced from a

variety of hydrocarbon feedstocks, including natural gas, naphtha, fuel oil

and coal.

Our O&D business is based in China and is focused on serving the

Chinese market. The SECCO joint venture is between BP, Sinopec and

its subsidiary, Shanghai Petrochemical Company. BP also co-owns one

other naphtha cracker site outside Asia, which is integrated with our

Gelsenkirchen refinery in Germany and this has an associated solvents

plant at Mülheim, Germany.

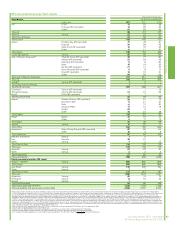

At 31 December 2012, the petrochemicals business ran 15 manufacturing

sites including our joint ventures (as shown in the following table), and we

have two petrochemicals plants (Gelsenkirchen and Mülheim), which are

managed by the fuels business as they utilize feedstock from our