BP 2012 Annual Report Download - page 87

Download and view the complete annual report

Please find page 87 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

85

t Internal audit, whose role is to consider whether the group’s system of

internal control is adequately designed and operating effectively to

respond appropriately to the risks that are significant to BP.

t Approval hierarchy, whereby proved reserves changes above certain

threshold volumes require central authorization and periodic reviews.

The frequency of review is determined according to field size and

ensures that more than 80% of the BP proved reserves base

undergoes central review every two years, and more than 90% is

reviewed centrally every four years. In addition, BP commenced a

review of certain of its assets and estimation processes. This review

process will continue through 2013.

BP’s vice president of segment reserves is the petroleum engineer

primarily responsible for overseeing the preparation of the reserves

estimate. He has nearly 30 years of diversified industry experience with

the past eight spent managing the governance and compliance of BP’s

reserves estimation. He is a past member of the Society of Petroleum

Engineers Oil and Gas Reserves Committee, a sitting member of the

American Association of Petroleum Geologists Committee on Resource

Evaluation and chair of the bureau of the United Nations Economic

Commission for Europe Expert Group on Resource Classification.

For the executive directors and senior management, no specific portion

of compensation bonuses is directly related to proved reserves targets.

Additions to proved reserves is one of several indicators by which the

performance of the Upstream segment is assessed by the remuneration

committee for the purposes of determining compensation bonuses for

the executive directors. Other indicators include a number of financial and

operational measures.

BP’s variable pay programme for the other senior managers in the

Upstream segment is based on individual performance contracts.

Individual performance contracts are based on agreed items from the

business performance plan, one of which, if chosen, could relate to

proved reserves.

Compliance

International Financial Reporting Standards (IFRS) do not provide specific

guidance on reserves disclosures. BP estimates proved reserves in

accordance with SEC Rule 4-10 (a) of Regulation S-X and relevant

Compliance and Disclosure Interpretations (C&DI) and Staff Accounting

Bulletins as issued by the SEC staff.

By their nature, there is always some risk involved in the ultimate

development and production of proved reserves including, but not limited

to: final regulatory approval; the installation of new or additional

infrastructure, as well as changes in oil and gas prices; changes in

operating and development costs; and the continued availability of

additional development capital. All the group’s proved reserves held in

subsidiaries and equity-accounted entities are estimated by the group’s

petroleum engineers.

Our proved reserves are associated with both concessions (tax and

royalty arrangements) and agreements where the group is exposed to the

upstream risks and rewards of ownership, but where our entitlement to

the hydrocarbons is calculated using a more complex formula, such as

with PSAs. In a concession, the consortium of which we are a part is

entitled to the proved reserves that can be produced over the licence

period, which may be the life of the field. In a PSA, we are entitled to

recover volumes that equate to costs incurred to develop and produce the

proved reserves and an agreed share of the remaining volumes or the

economic equivalent. As part of our entitlement is driven by the monetary

amount of costs to be recovered, price fluctuations will have an impact on

both production volumes and reserves.

We disclose our share of proved reserves held in equity-accounted

entities (jointly controlled entities and associates), although we do not

control these entities or the assets held by such entities.

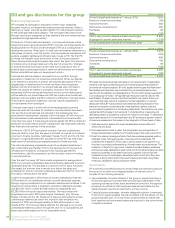

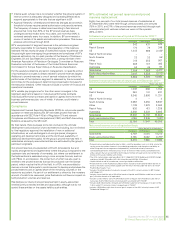

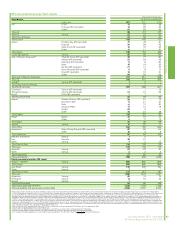

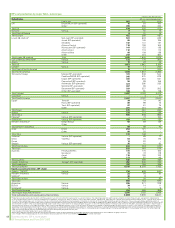

BP’s estimated net proved reserves and proved

reserves replacement

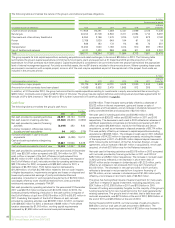

Eighty-two per cent of our total proved reserves of subsidiaries at

31 December 2012 were held through unincorporated joint ventures

(75% in 2011), and 31% of the proved reserves were held through such

unincorporated joint ventures where we were not the operator

(33% in 2011).

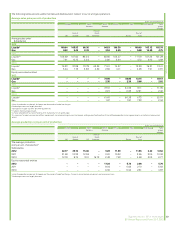

Estimated net proved reserves of liquids at 31 December 2012 a b c

million barrels

Developed Undeveloped Total

UK 242 431 673

Rest of Europe 170 79 249

US 1,443 989 2,432d

Rest of North America ––

–

South America 22 32 54e

Africa 312 255 567

Rest of Asia 268 137 405

Australasia 52 45 97

Subsidiaries 2,509 1,968 4,477f

Equity-accounted entities 3,041 2,532 5,573g h

Total 5,550 4,500 10,050

Estimated net proved reserves of natural gas at 31 December 2012a b

billion cubic feet

Developed Undeveloped Total

UK 1,038 666 1,704

Rest of Europe 340 141 481

US 8,245 2,986 11,231

Rest of North America 4–

4

South America 3,588 6,250 9,838i

Africa 1,139 1,923 3,062

Rest of Asia 926 413 1,339

Australasia 3,282 2,323 5,605

Subsidiaries 18,562 14,702 33,264f

Equity-accounted entities 4,196 2,845 7,041g h

Total 22,758 17,547 40,305

Net proved reserves on an oil equivalent basis

million barrels of oil equivalent

Developed Undeveloped Total

Subsidiaries 5,709 4,504 10,213f

Equity-accounted entities 3,765 3,022 6,787g

Total 9,474 7,526 17,000

a Proved reserves exclude royalties due to others, whether payable in cash or in kind, where the

royalty owner has a direct interest in the underlying production and the option and ability to

make lifting and sales arrangements independently, and include minority interests in

consolidated operations. We disclose our share of reserves held in jointly controlled entities

and associates that are accounted for by the equity method although we do not control these

entities or the assets held by such entities.

b The 2012 marker prices used were Brent $111.13/bbl (2011 $110.96/bbl and 2010 $79.02/bbl)

and Henry Hub $2.75/mmBtu (2011 $4.12/mmBtu and 2010 $4.37/mmBtu).

c Liquids include crude oil, condensate, natural gas liquids and bitumen.

d Proved reserves in the Prudhoe Bay field in Alaska include an estimated 76 million barrels on

which a net profits royalty will be payable over the life of the field under the terms of the BP

Prudhoe Bay Royalty Trust.

e Includes 14 million barrels of crude oil in respect of the 30% minority interest in BP Trinidad

and Tobago LLC.

f Includes assets held for sale of 39 million barrels of liquids and 590 billion cubic feet of natural

gas (140 million barrels of oil equivalent).

g Includes assets held for sale of 4,540 million barrels of liquids and 4,492 billion cubic feet of

natural gas (5,315 million barrels of oil equivalent) associated with TNK-BP.

h Includes 328 million barrels of liquids and 270 billion cubic feet of natural gas in respect of the

7.35% and 6.17% minority interests respectively in TNK-BP.

i Includes 2,890 billion cubic feet of natural gas in respect of the 30% minority interest in BP

Trinidad and Tobago LLC.