BP 2012 Annual Report Download - page 221

Download and view the complete annual report

Please find page 221 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

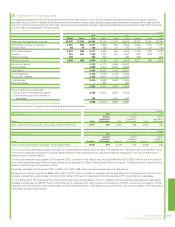

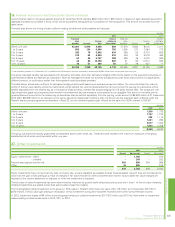

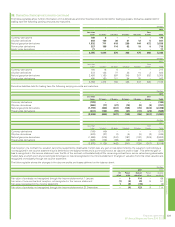

25. Investments in associates

The significant associates of the BP group at 31 December 2012 are shown in Note 45. Summarized financial information for the group’s share of

associates is set out below. Balance sheet information shown below excludes data relating to associates reclassified as assets held for sale as at the

end of the period. Income statement information shown below includes data relating to associates reclassified as assets held for sale for the period up

until their date of reclassification as held for sale.

$ million

2012 2011 2010

TNK-BP Other Total TNK-BP Other Total TNK-BP Other Total

Sales and other operating revenues 24,675 11,965 36,640 30,100 12,145 42,245 22,323 10,031 32,354

Profit before interest and taxation 4,405 906 5,311 5,992 958 6,950 3,866 1,215 5,081

Finance costs 84 16 100 132 13 145 128 22 150

Profit before taxation 4,321 890 5,211 5,860 945 6,805 3,738 1,193 4,931

Taxation 979 201 1,180 1,333 214 1,547 913 228 1,141

Minority interest 356 – 356 342 – 342 208 – 208

Profit for the year 2,986 689 3,675 4,185 731 4,916 2,617 965 3,582

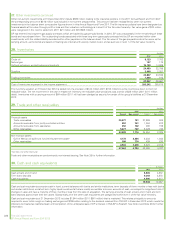

Non-current assets 3,270 16,172 3,865 20,037

Current assets 2,399 4,210 2,273 6,483

Total assets 5,669 20,382 6,138 26,520

Current liabilities 2,126 3,086 2,149 5,235

Non-current liabilities 1,290 6,416 1,744 8,160

Total liabilities 3,416 9,502 3,893 13,395

Minority interest –867 – 867

2,253 10,013 2,245 12,258

Group investment in associates

Group share of net assets (as above) 2,253 10,013 2,245 12,258

Loans made by group companies to

associates 745 – 1,033 1,033

2,998 10,013 3,278 13,291

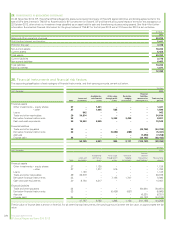

Transactions between the group and its associates are summarized below.

$ million

Sales to associates 2012 2011 2010

Product Sales

Amount

receivable at

31 December Sales

Amount

receivable at

31 December Sales

Amount

receivable at

31 December

LNG, crude oil and oil products, natural gas, employee services 3,771 401 3,855 393 3,561 330

$ million

Purchases from associates 2012 2011 2010

Product Purchases

Amount

payable at

31 December Purchases

Amount

payable at

31 December Purchases

Amount

payable at

31 December

Crude oil and oil products, natural gas, transportation tariff 9,135 915 8,159 815 4,889 633

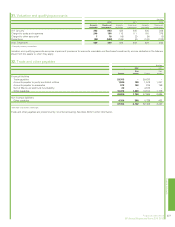

The terms of the outstanding balances receivable from associates are typically 30 to 45 days. The balances are unsecured and will be settled in cash.

There are no significant provisions for doubtful debts relating to these balances and no significant expense recognized in the income statement in

respect of bad or doubtful debts.

The amounts receivable and payable at 31 December 2012, as shown in the table above, exclude $159 million (2011 $220 million) due from and due

to an intermediate associate which provides funding for our associate The Baku-Tbilisi-Ceyhan Pipeline Company. These balances are expected to be

settled in cash throughout the period to 2015.

Dividends receivable at 31 December 2012 of $34 million (2011 $38 million) are also excluded from the table above.

BP has commitments amounting to $595 million (2011 $1,477 million) in relation to contracts with its associates for the purchase of crude oil and oil

products, transportation and storage. See Note 44 for further information on capital commitments relating to BP’s investments in associates.

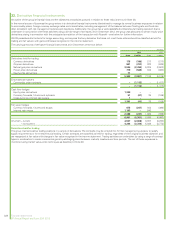

On 18 October 2010, BP announced that it had reached agreement to sell assets in Vietnam, together with its upstream businesses and associated

interests in Venezuela, to TNK-BP. As at 31 December 2010, a deposit of $1 billion had been received from TNK-BP in advance of completion of this

transaction and was reported within finance debt on the group balance sheet. This deposit was not reflected in the amount payable in the table above.

These sales completed during 2011.

Financial statements 219

BP Annual Report and Form 20-F 2012

Financial statements