BP 2012 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

36

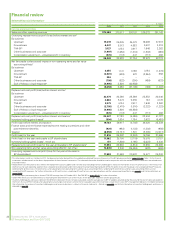

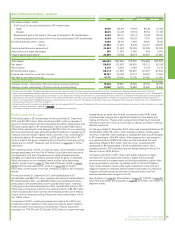

Finance costs and net finance expense relating to

pensions and other post-retirement benefits

Finance costs comprise interest payable less amounts capitalized, and

interest accretion on provisions and long-term other payables. Finance

costs in 2012 were $1,125 million compared with $1,246 million in 2011

and $1,170 million in 2010.

Net finance income relating to pensions and other post-retirement

benefits in 2012 was $201 million compared with $263 million in 2011 and

$47 million in 2010. In 2012, compared with 2011, the reduced net income

largely reflected lower expected returns on pension assets following

reductions in the yield assumptions, mainly for bonds, being applied in

2012 compared to 2011.

In 2013, when we adopt the revised version of IAS 19 ‘Employee

Benefits’, we will be required to apply the same expected rate of return

on plan assets as we use to discount our pension liabilities. We expect

this accounting change to adversely impact our annual earnings by

approximately $1 billion on a pre-tax basis, with no impact on cash flow.

Taxation

The charge for corporate taxes in 2012 was $6,993 million, compared

with a charge of $12,737 million in 2011 and a credit of $1,501 million in

2010. The effective tax rate was 37% in 2012, 33% in 2011 and 31% in

2010. The group earns income in many countries and, on average, pays

taxes at rates higher than the UK statutory rate of 24%. The increase in

the effective tax rate in 2012 compared with 2011 primarily reflects the

impact of the provision for the settlement with the US government,

which is not tax deductible. The increase in the effective tax rate in 2011

compared with 2010 primarily reflected a higher level of income earned

in jurisdictions with a higher tax rate.

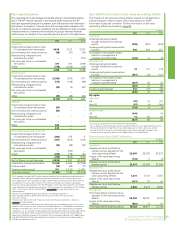

Acquisitions and disposals

In 2012 there were no significant acquisitions.

Total disposal proceeds received during 2012 were $11.4 billion.

In Upstream, total disposal proceeds of $10.7 billion included $5.55 billion

for the disposal of BP’s interests in the Marlin hub, Horn Mountain,

Holstein, Ram Powell and Diana Hoover fields in the Gulf of Mexico.

Proceeds of $1.5 billion were received for the sale of the Canadian natural

gas liquids (NGL) business to Plains Midstream Canada ULC, a wholly

owned subsidiary of Plains All American Pipeline, L.P. and

$1.2 billion for the Hugoton basin assets (including the Jayhawk NGL

processing plant and associated producing gas fields in Kansas) to an

affiliate of LINN Energy, LLC. The sale of BP’s interest in the Jonah and

Pinedale upstream operations in Wyoming, also to LINN Energy, LLC

generated disposal proceeds of $1.025 billion.

In Downstream, disposal proceeds totalled $0.5 billion, including the sale

of our interests in purified terephthalic acid production in Malaysia.

There were no significant disposals during 2012 in Other businesses and

corporate.

Prior years’ transactions

In 2011, BP acquired from Reliance Industries Limited (Reliance) a 30%

interest in each of 21 oil and gas production-sharing agreements operated

by Reliance in India for $7.0 billion. We completed the purchase, for

$3.6 billion, of 10 exploration and production blocks in Brazil, which was

the final part of a $7-billion transaction with Devon Energy that had been

announced in March 2010, and our Alternative Energy business acquired

the Brazilian sugar and ethanol producer Companhia Nacional de Açúcar e

Álcool (CNAA) for $0.7 billion. See Financial statements – Note 3 on

page 198 for further details of business combinations.

Total disposal proceeds received during 2011, after the repayment of the

disposal deposit relating to Pan American Energy LLC (PAE) (see below),

were $2.7 billion.

In Upstream, disposal proceeds included $0.6 billion from the sale of our

upstream assets in Pakistan to United Energy Pakistan Limited, a

subsidiary of United Energy Group (UEG); $0.5 billion from the sale of half

of the 3.29% interest in the Azeri-Chirag-Gunashli (ACG) development in

the Caspian Sea, which we had acquired from Devon Energy in 2010, to

Azerbaijan (ACG) Limited; and $0.5 billion from the sale of our interests in

the Wytch Farm, Wareham, Beacon and Kimmeridge fields to Perenco

UK Ltd. In addition, further payments of $1.1 billion were received on

completion of the sales of our upstream and certain midstream interests

in Venezuela and Vietnam and our oil and gas exploration, production and

transportation business in Colombia, for which we had received

$2.3 billion in 2010 as deposits. In November 2011, BP received from

Bridas Corporation (Bridas) a notice of termination of the agreement for

their purchase of BP’s 60% interest in PAE. As a result, the deposit of

$3.5 billion relating to the sale of PAE, which had been received by BP in

2010, was repaid to Bridas.

In Downstream we made disposals totalling $0.7 billion, which included

completion of the divestment of non-strategic pipelines and terminals in

the US, announced in 2009, for $0.3 billion and the disposal of our fuels

marketing businesses in several African countries for $0.2 billion.

Within Other businesses and corporate, we completed the sale of BP’s

wholly-owned subsidiary, ARCO Aluminum Inc., to a consortium of

Japanese companies for $0.7 billion.

In 2010, BP acquired a major portfolio of deepwater exploration acreage

and prospects in the US Gulf of Mexico and an additional interest in the

BP-operated ACG developments in the Caspian Sea, Azerbaijan, for

$2.9 billion, as part of a $7-billion transaction with Devon Energy. Total

disposal proceeds during 2010 were $17 billion, which included $7 billion

from the sale of US Permian Basin, Western Canadian gas assets, and

Western Desert exploration concessions in Egypt to Apache Corporation

(and an existing partner that exercised pre-emption rights), and $6.2 billion

of deposits received in advance of disposal transactions expected to

complete in 2011. Of these deposits received, $3.5 billion was for the sale

of our interest in PAE to Bridas; however, this was subsequently repaid to

Bridas at the end of 2011 following the termination of the sale agreement.

The deposits received also included $1 billion for the sale of our

upstream and midstream interests in Venezuela and Vietnam to TNK-BP,

and $1.3 billion for the sale of our oil and gas exploration, production and

transportation business in Colombia to a consortium of Ecopetrol and

Talisman.

In Downstream we made disposals totalling $1.8 billion in 2010, which

included our French retail fuels and convenience business to Delek

Europe; the fuels marketing business in Botswana to Puma Energy;

certain non-strategic pipelines and terminals in the US, our interests in

ethylene and polyethylene production in Malaysia to Petronas; and our

interest in a futures exchange.