BP 2012 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

84

Oil and gas disclosures for the group

Resource progression

BP manages its hydrocarbon resources in three major categories:

prospect inventory, contingent resources and proved reserves. When a

discovery is made, volumes usually transfer from the prospect inventory

to the contingent resources category. The contingent resources move

through various sub-categories as their technical and commercial maturity

increases through appraisal activity.

At the point of final investment decision, most proved reserves will be

categorized as proved undeveloped (PUD). Volumes will subsequently be

recategorized from PUD to proved developed (PD) as a consequence of

development activity. When part of a well’s proved reserves depends on a

later phase of activity, only that portion of proved reserves associated with

existing, available facilities and infrastructure moves to PD. The first PD

bookings will typically occur at the point of first oil or gas production.

Major development projects typically take one to five years from the time

of initial booking of proved reserves to the start of production. Changes

to proved reserves bookings may be made due to analysis of new or

existing data concerning production, reservoir performance, commercial

factors and additional reservoir development activity.

Volumes can also be added or removed from our portfolio through

acquisition or divestment of properties and projects. When we dispose

of an interest in a property or project, the volumes associated with our

adopted plan of development for which we have a final investment

decision will be removed from our proved reserves upon completion.

When we acquire an interest in a property or project, the volumes

associated with the existing development and any committed projects

will be added to our proved reserves if BP has made a final investment

decision and they satisfy the SEC’s criteria for attribution of proved status.

Following the acquisition, additional volumes may be progressed to

proved reserves from contingent.

Contingent resources in a field will only be recategorized as proved

reserves when all the criteria for attribution of proved status have been

met and the proved reserves are included in the business plan and

scheduled for development, typically within five years. BP will only book

proved reserves where development is scheduled to commence after

more than five years, if these proved reserves satisfy the SEC’s criteria for

attribution of proved status and BP management has reasonable certainty

that these proved reserves will be produced.

At the end of 2012, BP had material volumes of proved undeveloped

reserves held for more than five years in Trinidad, as well as non-material

volumes in Angola, Australia, Azerbaijan, Russia, the UK and the US, that

are part of ongoing development activities for which BP has a historical

track record of completing comparable projects in these countries.

The volumes are being progressed as part of an adopted development

plan where there are physical limits to the development timing such as

infrastructure limitations, contractual limits including gas delivery

commitments, late life compression and the complex nature of working

in remote locations.

Over the past five years, BP has annually progressed on average about

20% of our proved undeveloped reserves (excluding disposals) to proved

developed reserves. This equates to a turnover time of about five years.

We expect the turnover time to remain at or below five years and

anticipate the volume of proved undeveloped reserves held for more than

five years to remain about the same.

In 2012 we progressed 1,279mmboe of proved undeveloped reserves

(780mmboe for our subsidiaries alone) to proved developed reserves

through ongoing investment in our upstream development activities. Total

development expenditure in Upstream, excluding midstream activities,

was $15,247 million in 2012 ($11,964 million for subsidiaries and

$3,283 million for equity-accounted entities). The major areas with

progressed volumes in 2012 were Angola, Azerbaijan, Iraq, Norway,

Russia, Trinidad and the US. Revisions of previous estimates for proved

undeveloped reserves are due to the impact of year-end price (net

reduction of 33%) and changes relating to field performance or well

results (67%). The following tables describe the changes to our proved

undeveloped reserves position through the year for our subsidiaries and

equity-accounted assets and for our subsidiaries alone.

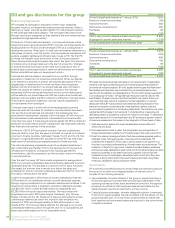

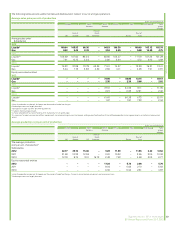

Subsidiaries and equity-accounted assets volumes in mmboe

Proved undeveloped reserves at 1 January 2012 7,919

Revisions of previous estimates (95)

Improved recovery 586

Discoveries and extensions 462

Purchases 49

Sales (116)

Total in year proved undeveloped reserves changes 8,805

Progressed to proved developed reserves (1,279)

Proved undeveloped reserves at 31 December 2012 7,526

Subsidiaries only volumes in mmboe

Proved undeveloped reserves at 1 January 2012 5,378

Revisions of previous estimates (700)

Improved recovery 496

Discoveries and extensions 169

Purchases 49

Sales (108)

Total in year proved undeveloped reserves changes 5,284

Progressed to proved developed reserves (780)

Proved undeveloped reserves at 31 December 2012 4,504

BP bases its proved reserves estimates on the requirement of reasonable

certainty with rigorous technical and commercial assessments based on

conventional industry practice. BP only applies technologies that have been

field tested and have been demonstrated to provide reasonably certain

results with consistency and repeatability in the formation being evaluated or

in an analogous formation. BP applies high-resolution seismic data for the

identification of reservoir extent and fluid contacts only where there is an

overwhelming track record of success in its local application. In certain

deepwater fields BP has booked proved reserves before production flow

tests are conducted, in part because of the significant safety, cost and

environmental implications of conducting these tests. The industry has made

substantial technological improvements in understanding, measuring and

delineating reservoir properties without the need for flow tests. To determine

reasonable certainty of commercial recovery, BP employs a general method

of reserves assessment that relies on the integration of three types of data:

1. Well data used to assess the local characteristics and conditions of

reservoirs and fluids.

2. Field scale seismic data to allow the interpolation and extrapolation of

these characteristics outside the immediate area of the local well control.

3. Data from relevant analogous fields. Well data includes appraisal wells or

sidetrack holes, full logging suites, core data and fluid samples. BP

considers the integration of this data in certain cases to be superior to a

flow test in providing understanding of overall reservoir performance. The

collection of data from logs, cores, wireline formation testers, pressures

and fluid samples calibrated to each other and to the seismic data can allow

reservoir properties to be determined over a greater volume than the

localized volume of investigation associated with a short-term flow test.

There is a strong track record of proved reserves recorded using these

methods, validated by actual production levels.

Governance

BP’s centrally controlled process for proved reserves estimation approval

forms part of a holistic and integrated system of internal control. It

consists of the following elements:

t Accountabilities of certain officers of the group to ensure that there is

review and approval of proved reserves bookings independent of the

operating business and that there are effective controls in the approval

process and verification that the proved reserves estimates and the

related financial impacts are reported in a timely manner.

t Capital allocation processes, whereby delegated authority is exercised

to commit to capital projects that are consistent with the delivery of the

group’s business plan. A formal review process exists to ensure that

both technical and commercial criteria are met prior to the commitment

of capital to projects.