BP 2012 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271 -

272

272 -

273

273 -

274

274 -

275

275 -

276

276 -

277

277 -

278

278 -

279

279 -

280

280 -

281

281 -

282

282 -

283

283 -

284

284 -

285

285 -

286

286 -

287

287 -

288

288 -

289

289 -

290

290 -

291

291 -

292

292 -

293

293 -

294

294 -

295

295 -

296

296 -

297

297 -

298

298 -

299

299 -

300

300 -

301

301 -

302

302 -

303

303

|

|

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

86

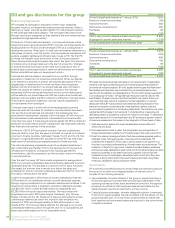

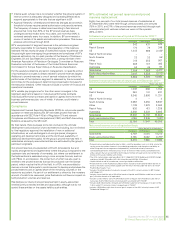

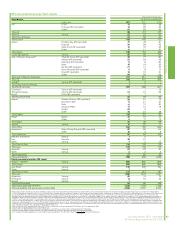

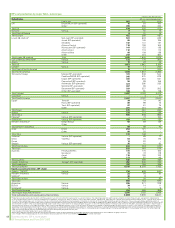

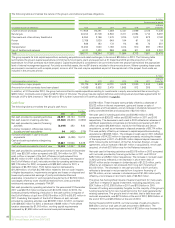

Proved reserves replacement

Total hydrocarbon proved reserves, on an oil equivalent basis including

equity-accounted entities, comprised 17,000mmboe (10,213mmboe

for subsidiaries and 6,787mmboe for equity-accounted entities) at

31 December 2012, a decrease of 4% (decrease of 11% for subsidiaries

and increase of 7% for equity-accounted entities) compared with the

31 December 2011 reserves of 17,748mmboe (11,426mmboe for

subsidiaries and 6,322mmboe for equity-accounted entities). Natural gas

represented about 41% (56% for subsidiaries and 18% for equity-accounted

entities) of these reserves. The change includes a net decrease from

acquisitions and disposals of 455mmboe (440mmboe net decrease for

subsidiaries and 15mmboe net decrease for equity-accounted entities).

Additions from acquisitions occurred principally in the US following a 2011

acquisition. Divestments occurred in Norway, Russia, Trinidad, the UK and

the US.

Proved reserves contain volumes in assets held for sale of 39 million

barrels of liquids and 590 billion cubic feet of natural gas (140 million

barrels of oil equivalent) in our subsidiaries and 4,540 million barrels of

liquids and 4,492 billion cubic feet of natural gas (5,315 million barrels of

oil equivalent) associated with TNK-BP.

The proved reserves replacement ratio is the extent to which production is

replaced by proved reserves additions. This ratio is expressed in oil

equivalent terms and includes changes resulting from revisions to

previous estimates, improved recovery, and extensions and discoveries.

For 2012, the proved reserves replacement ratio excluding acquisitions

and disposals was 77% (103% in 2011 and 106% in 2010) for subsidiaries

and equity-accounted entities, -5% for subsidiaries alone and 195% for

equity-accounted entities alone.

In 2012, net additions to the group’s proved reserves (excluding

production and sales and purchases of reserves-in-place) amounted to

953mmboe (-35mmboe for subsidiaries and 988mmboe for equity-

accounted entities), through revisions to previous estimates, improved

recovery from, and extensions to, existing fields and discoveries of new

fields. The subsidiary additions through improved recovery from, and

extensions to, existing fields and discoveries of new fields were in existing

developments where they represented a mixture of proved developed and

proved undeveloped reserves. Volumes added in 2012 principally resulted

from the application of conventional technologies. The principal proved

reserves additions in our subsidiaries were in Angola, Azerbaijan, India and

Trinidad. We had material proved reserves reductions in Norway and the

US due to price changes, changes in activity and performance updates.

The principal reserves additions in our equity-accounted entities were in

Angola, Argentina and Russia.

Twelve per cent of our proved reserves are associated with PSAs. The

countries in which we operated under PSAs in 2012 were Algeria, Angola,

Azerbaijan, Egypt, India, Indonesia, Oman, Vietnam and a non-material

volume in Trinidad. In addition, the technical service contract (TSC)

governing our investment in the Rumaila field in Iraq functions as a PSA.

The Abu Dhabi onshore concession expires in January 2014 with a

consequent reduction in production of approximately 140mb/d. The group

holds no other licences due to expire within the next three years that

would have a significant impact on BP’s reserves or production.

For further information on our reserves see page 263.