BP 2012 Annual Report Download - page 78

Download and view the complete annual report

Please find page 78 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

76

distribution through pipeline and terminal infrastructure; and marketing

and sales to our customers on a regional basis. This integration, together

with a focus on excellent execution and cost management as well as a

strong brand, market presence and customer base, are key to our financial

performance.

The FVC strategy focuses on large-scale, feedstock-advantaged, highly

upgraded, dual-fuel-capable, well-located refineries integrated into

advantaged logistics and marketing. Consequently, in the US, we are in

the process of completing refinery sales that will roughly halve our US

refining capacity through the sale of our Texas City refinery (which

completed on 1 February 2013) and our Carson refinery and related

marketing and logistics assets (see refinery table below). The Texas City

refinerya was not strongly integrated into BP’s marketing assets and has

limited access to logistics and tankage flexibility. The Carson refinery is

gasoline biased and would need investment in logistics and/or

configuration to upgrade capability. This portfolio re-shaping will shift the

balance of our US refining portfolio to northern tier refineries able to

access advantaged, US mid-continent and Canadian crudes and utilize a

significantly greater proportion of heavy crudes.

In our remaining FVCs, we believe we have a portfolio of well-located

refineries, integrated with strong marketing positions offering the potential

for improvement and growth.

a We will retain the petrochemicals manufacturing plants at Texas City.

Refining

At 31 December 2012, we owned or had a share in 16 refineries

producing refined petroleum products that we supply to retail and

commercial customers. On 1 February 2013 we completed the sale of the

Texas City refinery and a portion of our retail and logistics network in the

south-east US to Marathon Petroleum Corporation for up to $2.4 billion. In

addition, we have announced the sale of our South West FVC including

the Carson refinery in California, ARCO network and related logistics

assets in the region to Tesoro Corporation for $2.5 billion and we expect

to close this sale by the middle of 2013 subject to regulatory and other

approvals.

Strategic investments in our refineries are focused on securing the safety

and reliability of our assets while improving the relative unit margins to

capture capability versus the competition. The most important of these

strategic investments under way is the Whiting refinery modernization

project (WRMP), which we expect will allow the capture of additional

margin through the processing of a greater proportion of heavy crudes.

This project made significant progress in 2012 as we entered the

heaviest field construction phase. The new crude oil unit, coker,

upgraded sulphur recovery complex and gasoil hydrotreater all

advanced towards their targeted start-up dates in 2013. The largest of

the refinery’s crude units, which processed sweet crude, was taken

out of service in early November. This outage will allow construction of

a replacement crude distillation unit, and will facilitate demolition of the

existing unit, thereby enabling the expected start-up of the WRMP

project in the second half of 2013. BP is temporarily redeploying

refining and technical resources from around the world to assist with

the start-up of the new units.

We continue to invest in developing capability to produce cleaner fuels

to meet the requirements of our customers and their communities. For

example, we are currently investing in a new hydrotreater unit and

hydrogen plant at our Cherry Point refinery. This project is designed to

allow the refinery to produce fuels that meet ultra-low sulphur diesel

(ULSD) standards for rail and marine diesel customers. In addition, the

new hydrogen plant is designed to improve operation of naphtha

reforming units at the refinery. The project has progressed steadily

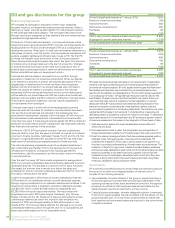

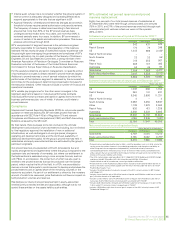

The following tables summarize the BP group’s interests in refineries and average daily crude distillation capacities as at 31 December 2012.

thousand barrels per day

Crude distillation capacitiesa

Group interestbBP

Refinery Fuels value chain %Total share

US

California CarsoncUS South West 100.0 266 266

Washington Cherry Point US North West 100.0 234 234

Indiana Whiting US East of Rockies 100.0 413 413

Ohio Toledo US East of Rockies 50.0 160 80

Texas Texas Cityc– 100.0 475 475

Total US 1,548 1,468

Europe

Germany BayernoildRhine 22.5 217 49

Gelsenkirchen Rhine 50.0 265 132

Karlsruhed Rhine 12.0 322 39

Lingen Rhine 100.0 95 95

Schwedtd Rhine 18.8 239 45

Netherlands Rotterdam Rhine 100.0 377 377

Spain Castellón Iberia 100.0 110 110

Total Europe 1,625 847

Rest of World

Australia Bulwer Australia New Zealand 100.0 102 102

Kwinana Australia New Zealand 100.0 146 146

New Zealand Whangareid Australia New Zealand 23.7 118 28

South Africa Durband Southern Africa 50.0 180 90

Total Rest of World 546 366

Total 3,719 2,681

Capacity relating to assets held for sale (741)

Total capacity post-divestment 1,940

a Crude distillation capacity is gross rated capacity, which is defined as the highest average sustained unit rate for a consecutive 30-day period.

b BP share of equity, which is not necessarily the same as BP share of processing entitlements.

c Refinery classified as assets held for sale at 31 December 2012.

d Indicates refineries not operated by BP.