BP 2012 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

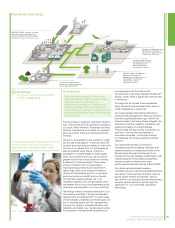

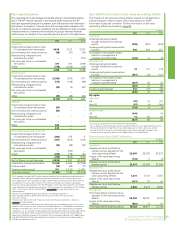

Investing in renewable energy

Since 2005 we have invested $7.6 billion in

lower-carbon businesses and are on track to

meet our commitment to invest $8 billion by

2015. In biofuels, our three sugar cane mills

in Brazil now have a total crush capacity of

7.2 million tonnes and produce fuels for use in

transport and power. At the end of 2012 we

started up the Vivergo JV bioethanol plant in

Hull, UK. We also have research, demonstration

and production facilities planned or operating

in the US, UK and Brazil. During the year we

cancelled plans to build a commercial-scale

cellulosic ethanol plant in Florida and

refocused our cellulosic strategy on research,

development and technology licensing. In

wind we have interests in 16 wind farms in

the US, which together provide BP with a net

generating capacity of 1,558MW.a

Alternative Energy

For more on our activities see Other

businesses and corporate page 82.

Downstream

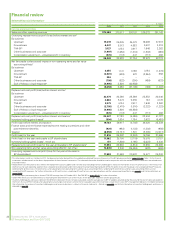

RC profit before interest and tax for 2012 was

$2.8 billion, compared with $5.5 billion in 2011.

After adjusting for non-operating items and fair

value accounting effects, underlying RC profit

before interest and taxb in 2012 was an all-time

record of $6.4 billion compared with $6.0 billion

in 2011. This reflected a favourable refining

environment, which we were able to capture by

virtue of our strong operations, partly offset by

weak petrochemicals margins and a significantly

lower supply and trading contribution than in

2011. 2012 was also our fourth consecutive year

of growth in underlying RC profit before interest

and tax. We also continued to make good

progress in repositioning Downstream to

improve our margin quality and the efficiency of

the portfolio.

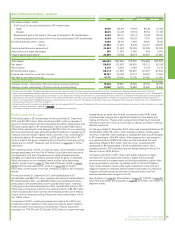

Since the start of 2008, our focus on safe and

reliable operations in Downstream has

translated into improvements in process safety.

We have seen a 55% reduction in loss of

primary containment and a 40% reduction in our

process safety incident index over the period.

Refinery operations were strong this year, with

Solomon refining availability of 94.8%. (See

refining availability on page 74.) Utilization rates

were at 88% despite a relatively high level of

turnaround activity in 2012.

Our lubricants business continued to deliver

robust performance in 2012, despite weak

demand.

In petrochemicals, a combination of increased

supply and lower demand growth in the market

narrowed margins for our business in 2012,

although we were able to maintain production

volumes at around the same levels as 2011.

During the year we continued to make good

progress in repositioning the Downstream

business. In August 2012 we announced an

agreement to sell our Carson refinery, in

California, and related logistics and marketing

assets in the region to Tesoro Corporation for an

estimated $2.5 billion. In October 2012 we

announced an agreement to sell our Texas City

refinery and all associated assets in the

south-east US to Marathon Petroleum

Corporation. This sale was completed on

1 February 2013 for proceeds of up to

$2.4 billion (see page 72).

Meanwhile, we made significant progress

with the upgrade of our Whiting refinery. On

completion, this modernization project is

expected to allow us to capture additional

margin through the processing of a greater

proportion of heavy crudes. During the year the

new crude oil unit, coker, upgraded sulphur

recovery complex and gasoil hydrotreater all

advanced towards their targeted start-up dates

in 2013 and the whole project remains on

schedule to start up in the second half of 2013.

We also made good progress towards our aim

of divesting the LPG bulk and bottled business,

completing the exit from three of the nine

countries we originally identified and

announcing the sale of our operations in a

further three countries in 2012.

In petrochemicals we sold our PTA interest in

Malaysia during the year and made progress on

major new projects in China and India. We also

signed two licensing agreements for our

proprietary petrochemicals technology (see

page 16 for further details).

TNK-BP

We began reporting TNK-BP as a separate

operating segment with effect from 1 January

2012, reflecting the way in which we were

managing our investment.

Following the announcement of our proposed

transaction with Rosneft on 22 October 2012,

BP’s investment in TNK-BP met the criteria to

be classified as an asset held for sale.

Consequently, BP ceased equity accounting for

its share of TNK-BP’s earnings from the date of

the announcement.

RC profit before interest and taxbc for 2012 was

$3.4 billion, compared with $4.1 billion in 2011.

After adjusting for non-operating items,

underlying RC profit before interest and taxbc for

2012 was $3.1 billion, compared with $4.1 billion

in 2011. The most significant factor affecting

performance in 2012 compared with 2011 was

the absence of more than two months’ income

following the cessation of equity accounting.

b See footnote b on page 34.

c

Under equity accounting, BP’s share of TNK-BP’s earnings

after interest and tax has been included in the BP group

income statement within profit before interest and tax.

Outlook

The company’s divestment programme is

fundamentally reshaping and repositioning our

upstream and downstream portfolios. In the

Upstream segment, we now have a portfolio

that we believe plays to our distinctive strengths

and capabilities in exploration, deep water, giant

fields and gas value chains. In the Downstream

segment, we expect that the measures we are

taking to improve efficiency and margin quality

will be largely complete by the end of 2013.

Looking ahead, we continue to expect that we

can deliver around 50% growth in operating

cash flow by 2014 compared with 2011.d We

intend to use the proceeds of improved cash

flow in a number of ways, including increased

investment in upstream development. This will

focus on four high-margin areas: Angola,

Azerbaijan, the Gulf of Mexico and the

North Sea.

More development, more exploration

The level of planned activity is reflected in the

number of rigs we have at work. Across our

portfolio, we had 53 rigs in operation at the end

of 2012 – 20 onshore and 33 offshore, including

11 in the deep water. We expect to have around

60 rigs in operation in 2014.

We intend to increase investment in exploration.

Our drilling programme is expected to test 15

new plays between 2012 and 2015.

d See footnote c on page 21.

a

Excludes 32MW of capacity in the Netherlands, which is

managed by our Downstream segment.

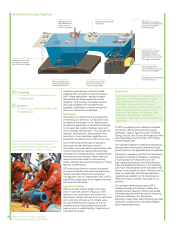

PSVM is one of the largest subsea developments

in the world and was one of BP’s key project

start-ups for 2012. It is the second BP-operated

development in Angola after Block 18’s Greater

Plutonio (below).

TNK-BP

For more on the segment’s financial

performance see pages 80-81.

Business review: Group overview

BP Annual Report and Form 20-F 2012 27

Business review: Group overview