BP 2012 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2012 BP annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Business review: BP in more depth

Business review: BP in more depth

BP Annual Report and Form 20-F 2012

81

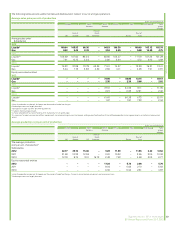

The 2012 result also included a net non-operating gain of $246 million,

primarily dividend income from TNK-BP of $709 million, partly offset by a

charge of $325 million to settle disputes with AAR. With the cessation of

equity accounting, under IFRS dividends from our investment in TNK-BP

are recognized as revenue in the period in which they become receivable.

In addition, within equity-accounted earnings, there was an impairment

loss associated with the temporary shutdown of the Lisichansk refinery in

the Ukraine (due to deteriorating economic conditions) and environmental

provisions, partly offset by gains on disposals. Prior to 2012, non-

operating items for the TNK-BP segment were not identified or disclosed.

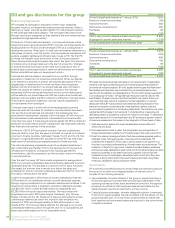

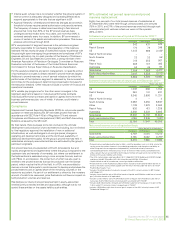

After adjusting for non-operating items, the underlying replacement cost

profit before interest and taxa b for the TNK-BP segment was $3,127

million, compared with $4,134 million in 2011. The primary factors

impacting the 2012 result, compared with 2011, were the absence of

more than two months of equity-accounted earnings, lower realizations

and the impact of the tax reference price lag on Russian export duties in

falling price environments, partly offset by positive foreign exchange

effects.

BP received $1,399 million in cash dividends from its investment in

TNK-BP in 2012, as compared with $3,747 million during 2011. This

included $709 million received after reaching agreement with Rosneft for

the sale of BP’s shareholding in TNK-BP.

a

Underlying replacement cost profit is not a recognized GAAP measure. See footnote b on

page 34 for information on underlying replacement cost profit.

b See footnote h on page 80.

Production and reserves

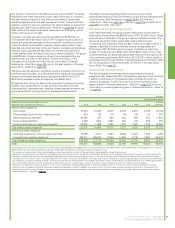

BP’s share of TNK-BP production for the full year of 2012 was

1,012mboe/d, 2% higher than in 2011. After adjusting for the effect of the

acquisition of BP’s upstream interests in Vietnam and Venezuela,

production increased only slightly compared with 2011, with the ramp-up

of new developments offsetting declines from mature fields and the

impact of divestments.

The TNK-BP segment’s total hydrocarbon reserves, on an oil equivalent

basis, was 5,315mmboe at 31 December 2012, an increase of 11%

(increase of 5% for crude oil and increase of 56% for natural gas),

compared with the 31 December 2011 reserves of 4,802mmboe.

The proved reserves replacement ratio is the extent to which production

is replaced by proved reserves additions. For 2012, the proved reserves

replacement ratio excluding acquisitions and disposals was 242% (2011

245%, 2010 165%). For more information on proved reserves

replacement for the group, see pages 85-86.

Key business events

On 11 March, TNK-BP announced the acquisition of two companies that

operate the jet fuel storage and re-fuelling services at the Koltsovo

International Airport in Ekaterinburg. The airport is the fifth largest in the

Russian Federation in terms of number of passengers.

On 21 May, TNK-BP announced the appointment of Evert Henkes to the

board of TNK-BP Ltd as a BP-nominated independent director. He became

the tenth member of the board of TNK-BP Ltd and the second of the

board’s three independent directors. This appointment followed the

resignations of Gerhard Schroeder and James Leng.

On 28 May, TNK-BP announced that Mikhail Fridman had resigned from

the position of chief executive officer of the TNK-BP group. He also

resigned from the position of chairman of the management board of

TNK-BP Management, a Russian subsidiary of TNK-BP, which manages

the company’s assets in Russia and Ukraine, including the publicly traded

company, TNK-BP Holding. Both resignations took effect at the end of

June 2012.

On 20 August, TNK-BP announced that it had sold OJSC

Novosibirskneftegaz and OJSC Severnoeneftegaz as part of the

company’s strategy to optimize the asset portfolio and improve per barrel

efficiency.

On 9 October, TNK-BP announced that the group’s subsidiary, TNK

Vietnam, had produced the first gas from the Lan Do field in Block 06.1,

offshore of Ba Ria Vung Tau province. Two sub-sea wells were tied back

to the Lan Tay platform, through 28 kilometres of flow line and umbilical,

enabling TNK Vietnam to produce gas from the existing infrastructure.

The Lan Do field is expected to bring 2 billion cubic metres (70 billion

cubic feet) of gas to market annually.

On 13 November, BP and AAR announced they had reached an

agreement to settle all outstanding disputes between them, including the

arbitrations brought by each against the other. The agreement included a

waiver of the new opportunities provision in the TNK-BP shareholder

agreement, allowing each party to explore new opportunities and

partnerships in Russia and Ukraine. BP paid AAR $325 million as part of

the settlement. See Legal proceedings on pages 169-171 for further

information.