Avon 2003 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

The company contributed a cumulative $205 million to its

U.S. qualified pension plan over the past three years.

In addition, at December 31, 2003, the Company recognized a liability on its bal-

ance sheet for each pension plan if the fair value of the assets of that pension

plan is less than the accumulated benefit obligation, or “ABO.” This liability

is called a “minimum pension liability” and is recorded in Accumulated other

comprehensive loss in Shareholders’ equity (deficit) on the Consolidated

Balance Sheets. As of December 2003, Avon reported a balance in Accumulated

other comprehensive loss of $285.8 (the balance was $288.5 in 2002) in the

Consolidated Balance Sheets (see Note 5, Accumulated Other Comprehensive

Loss). This balance primarily represents the after-tax impact of recording the

minimum pension liability for the U.S. pension plan, and to a lesser extent, for

the pension plan in the United Kingdom. This balance has no impact on the

Company’s net income, liquidity or cash flows.

Deferred Tax Assets

Avon records a valuation allowance to reduce its deferred tax assets to the

amount that is more likely than not to be realized. While Avon has considered

projected future taxable income and ongoing tax planning strategies in assessing

the need for the valuation allowance, in the event Avon were to determine that it

would be able to realize a net deferred tax asset in the future, in excess of the net

recorded amount, an adjustment to the deferred tax asset would increase earn-

ings in the period such determination was made. Likewise, should Avon deter-

mine that it would not be able to realize all or part of its net deferred tax asset in

the future, an adjustment to the deferred tax asset would decrease earnings in

the period such determination was made.

Stock-based Compensation

Avon applies the recognition and measurement principles of Accounting

Principles Board (“APB”) Opinion 25, “Accounting for Stock Issued to

Employees,” in accounting for its long-term stock-based incentive plans. No

compensation cost related to grants of stock options was reflected in Net

income, as all options granted under the plans had an exercise price equal to

the market price. Net income in 2003, 2002 and 2001 would have been lower

by $28.7, $30.1 and $27.6, respectively, if Avon had applied the fair value

recognition provisions of Statement of Financial Accounting Standards

(“FAS”) No. 123, “Accounting for Stock-Based Compensation,” to stock

options (see Note 8, Long-Term Incentive Plans).

Contingencies

In accordance with FAS No. 5, “Accounting for Contingencies,” Avon deter-

mines whether to disclose and accrue for loss contingencies based on an

assessment of whether the risk of loss is remote, reasonably possible or prob-

able. Management’s assessment is developed in consultation with the Company’s

outside counsel and other advisors and is based on an analysis of possible

outcomes under various strategies. Loss contingency assumptions involve

judgments that are inherently subjective and can involve matters that are in

litigation, which by its nature is unpredictable. Management believes that its

assessment of the probability of loss contingencies is reasonable, but because

of the subjectivity involved and the unpredictable nature of the subject matter at

issue, management’s assessment may prove ultimately to be incorrect, which

could materially impact the Consolidated Financial Statements in current or

future periods.

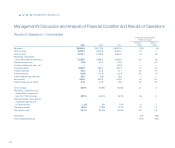

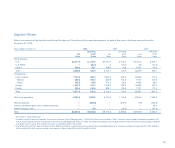

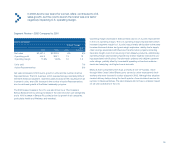

Business

Avon is a global manufacturer and marketer of beauty and related products.

Avon’s business is primarily comprised of one industry segment, direct selling,

which is conducted worldwide. The Company’s reportable segments are based

on geographic operations in four regions: North America, Latin America,

Europe and the Pacific. Sales are made to the ultimate consumer principally by

independent Avon Representatives. The product categories include Beauty,

which consists of cosmetics, fragrance and toiletries (“CFT”); Beauty Plus, which

consists of fashion jewelry, watches, apparel and accessories; and Beyond

Beauty, which consists of home products, gift and decorative products and

candles. Sales from Health and Wellness products and the Mark. brand are

included among these three categories based on product type.

27