Avon 2003 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

The functional currency for most of Avon’s foreign operations is the local cur-

rency. The cumulative effects of translating balance sheet accounts from the

functional currency into the U.S. dollar at current exchange rates are included in

Accumulated other comprehensive loss in Shareholders’ equity (deficit). The

U.S. dollar is used as the functional currency for operations in hyperinflationary

foreign economies where cumulative inflation rates exceed 100% over a three-

year period. Beginning in 2003, Turkey was designated as a country with a

highly inflationary economy. Venezuela converted to non-hyperinflationary sta-

tus effective January 1, 2002, due to reduced cumulative inflation rates. Prior to

January 1, 2002, Venezuela was designated as a country with a hyperinflation-

ary status. Russia converted to non-hyperinflationary status effective January 1,

2003, due to reduced cumulative inflation rates. Prior to January 1, 2003, Russia

was designated as a country with a hyperinflationary status.

Avon’s diversified global portfolio of businesses has demonstrated that the

effects of weak economies and currency fluctuations in certain countries may be

offset by strong results in others. Fluctuations in the value of foreign currencies

cause U.S. dollar-translated amounts to change in comparison with previous

periods. Accordingly, Avon cannot project the possible effect of such fluctuations

upon translated amounts or future earnings. This is due to the large number of

currencies, intercompany transactions, hedging-related activities entered into in

an attempt to minimize the impact of exchange rate changes on financial results,

and the fact that all foreign currencies do not react in the same manner against

the U.S. dollar. Nevertheless, during 2003, the U.S. dollar continued to weaken

against most major currencies. If this trend continues, it is expected to continue

to have a favorable impact on the translation of the Company’s overseas results.

Risk Management Strategies and Market Rate

Sensitive Instruments

Derivative Instruments

As discussed above, Avon operates globally, with manufacturing and distri-

bution facilities in various locations around the world. Avon may reduce its

exposure to fluctuations in earnings and cash flows associated with changes

in interest rates and foreign exchange rates by creating offsetting positions

through the use of derivative financial instruments. Since Avon uses foreign

currency rate-sensitive and interest rate-sensitive instruments to hedge a

certain portion of its existing and forecasted transactions, Avon expects that

any loss in value for the hedge instruments generally would be offset by

increases in the value of the underlying transactions.

Avon does not enter into derivative financial instruments for trading or speculative

purposes, nor is Avon a party to leveraged derivatives. The master agreements

governing Avon’s derivative contracts generally contain standard provisions that

could trigger early termination of the contracts in certain circumstances, including

if Avon were to merge with another entity and the creditworthiness of the surviving

entity were to be “materially weaker” than that of Avon prior to the merger.

Interest Rate Risk

Avon’s long-term borrowings, which are primarily on a fixed-rate basis, are

subject to interest rate risk. Avon uses interest rate swaps to hedge interest

rate risk on its fixed-rate debt. In addition, Avon may periodically employ

interest rate caps, treasury locks and forward interest rate agreements to

reduce exposure, if any, to increases in variable interest rates.

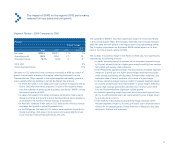

At December 31, 2003, Avon held interest rate swap agreements that effec-

tively convert the fixed interest rate on $975.0 or approximately 90% of Avon’s

outstanding debt to a variable interest rate based on LIBOR, as follows:

Notional

Amount Maturity Date Related Outstanding Debt

$100.0 November 2004 $200.0, 6.90% Notes, due 2004

$100.0 November 2004 200.0, 6.90% Notes, due 2004

$100.0 August 2007 100.0, 6.55% Notes, due 2007

$150.0 November 2009 300.0, 7.15% Notes, due 2009

$150.0 November 2009* 300.0, 7.15% Notes, due 2009

$125.0 May 2013** 125.0, 4.625% Notes, due 2013

$125.0 July 2018 250.0, 4.20% Notes, due 2018

$125.0 July 2018 250.0, 4.20% Notes, due 2018

* This interest rate swap agreement requires Avon to post collateral in certain circum-

stances if Avon’s credit rating drops below BBB.

** This interest rate swap agreement permits either party to terminate the swap at the

end of seven years (May 2010).

46