Avon 2003 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

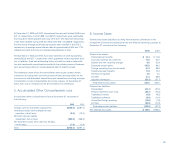

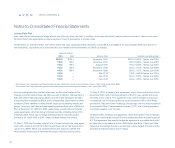

As a result of worldwide tax audit settlements, payments, net of associated

benefits and refund, of $45.1 were made during 2003. In addition, a payment

of $68.7 was made during January 2004 with respect to another tax audit set-

tlement recorded in 2003. The cash flow impact of this January 2004 payment

will be partially offset by the tax benefit on the interest portion of the payment.

These settlements resulted in a favorable impact on the effective tax rate

of 2.5%.

In January 2001, Avon received a federal income tax refund consisting of

$32.5 of tax and $62.7 of interest related to the carryback of foreign tax cred-

its and general business credits to the years ended December 31, 1982, 1983,

1985 and 1986. The Company recognized $40.1 as an income tax benefit

in 2000 resulting from the impact of the tax refund offset by taxes due on

interest received and other related tax obligations.

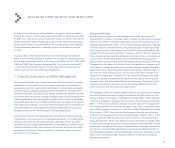

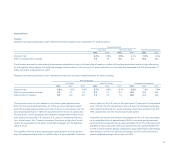

7. Financial Instruments and Risk Management

Avon operates globally, with manufacturing and distribution facilities in various

locations around the world. Avon may reduce its exposure to fluctuations in

earnings and cash flows associated with changes in interest rates and foreign

exchange rates by creating offsetting positions through the use of derivative

financial instruments. Since Avon uses foreign currency-rate sensitive and inter-

est-rate sensitive instruments to hedge a certain portion of its existing and fore-

casted transactions, Avon expects that any gain or loss in value for the hedge

instruments generally would be offset by decreases or increases in the value of

the underlying transactions. Avon also enters into foreign currency forward con-

tracts and options to protect against the adverse effects that exchange rate

fluctuations may have on the earnings of its foreign subsidiaries.

Avon does not enter into derivative financial instruments for trading or specula-

tive purposes, nor is Avon a party to leveraged derivatives. The master agree-

ments governing Avon’s derivative contracts generally contain standard

provisions that could trigger early termination of the contracts in certain circum-

stances, including if Avon were to merge with another entity and the credit

worthiness of the surviving entity were to be “materially weaker” than that

of Avon prior to the merger.

Accounting Policies

Derivatives are recognized on the balance sheet at their fair values. The

accounting for changes in fair value (gains or losses) of a derivative instrument

depends on whether it has been designated by Avon and qualifies as part of a

hedging relationship and further, on the type of hedging relationship. Changes

in the fair value of a derivative that is designated as a fair value hedge, along

with the loss or gain on the hedged asset or liability that is attributable to the

hedged risk, are recorded in earnings. Changes in the fair value of a derivative

that is designated as a cash flow hedge are recorded in other comprehensive

income (“OCI”) to the extent effective and reclassified into earnings in the

same period or periods during which the hedged transaction affects earnings.

Changes in the fair value of a derivative that is designated as a hedge of a net

investment in a foreign operation are recorded in foreign currency translation

adjustments within OCI to the extent effective as a hedge. “Effectiveness” is

the extent to which changes in fair value of a derivative offset changes in fair

value of the hedged item. Changes in the fair value of a derivative not desig-

nated as a hedging instrument are recognized in earnings in Other expense

(income), net on the Consolidated Statements of Income. Changes in the fair

value of a derivative are reported on the Consolidated Statements of Cash

Flows consistent with the underlying hedged item.

Avon assesses, both at the hedge’s inception and on an ongoing basis, whether

the derivatives that are used in hedging transactions are highly effective in off-

setting changes in fair values or cash flows of hedged items. Highly effective

means that cumulative changes in the fair value of the derivative are between

80% — 125% of the cumulative changes in the fair value of the hedged item.

The ineffective portion of the derivative’s gain or loss, if any, is recorded in earn-

ings in Other expense (income), net on the Consolidated Statements of Income.

Prior to June 1, 2001, Avon excluded the change in the time value of option

contracts from its assessment of hedge effectiveness. Effective June 1, 2001,

Avon includes the change in the time value of options in its assessment of

hedge effectiveness. When Avon determines that a derivative is not highly effec-

tive as a hedge, hedge accounting is discontinued prospectively. When hedge

accounting is discontinued because it is probable that a forecasted transaction

will not occur, Avon discontinues hedge accounting for the affected portion of

the forecasted transaction, and reclassifies gains and losses that were accumu-

lated in OCI to earnings in Other expense (income), net on the Consolidated

Statements of Income.

Avon’s tax rate in 2003 was 32.1%, versus 35.0% in 2002.

71