Avon 2003 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

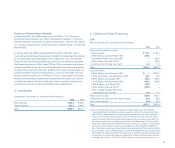

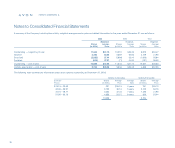

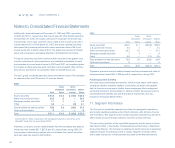

The Company adopted the disclosure provisions of FAS No. 123, “Accounting

for Stock-Based Compensation,” in lieu of recording the value of the compen-

sation costs of the 2000 Plan, as permitted by FAS No. 123. Had compensation

cost for the plans been based on the fair value at the grant dates for awards

under those plans consistent with the method prescribed by FAS No. 123, net

income and earnings per share (after the cumulative effect of the accounting

change) would have been the pro forma amounts indicated below:

2003 2002 2001

Pro forma Net income $636.1 $504.5 $417.0

Pro forma Earnings per share:

Basic $ 2.70 $ 2.14 $ 1.76

Diluted $ 2.66 $ 2.10 $ 1.74

The fair value for these options was estimated at the date of grant using

a Black-Scholes option pricing model with the following weighted-

average assumptions:

2003 2002 2001

Risk-free interest rate 2.4% 4.6% 4.7%

Expected life 4 years 4 years 4 years

Expected volatility 45% 45% 40%

Expected dividend yield 1.6% 1.5% 1.8%

The weighted-average grant date fair values of options granted during 2003,

2002 and 2001 were $17.66, $19.09 and $12.05, respectively.

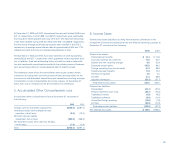

Restricted Stock

During 2003, 2002 and 2001, restricted stock with aggregate value and vest-

ing and related amortization periods was granted to employees as follows:

2003 – 110,250 shares valued at $5.7 vesting over three years; 2002 – 79,300

shares valued at $4.2 vesting over three years; and 2001 – 143,500 shares

valued at $6.2 vesting over three years.

Compensation expense under all stock-based compensation plans in 2003 was

$6.4 (2002 – $6.6; 2001 – $7.5). The unamortized cost of restricted stock as of

December 31, 2003, was $4.7 (2002 – $5.6) and was included in Additional

paid-in capital on the Consolidated Balance Sheets.

Transformation Long-Term Incentive Plan

In 2002, Avon established a three-year Transformation Long-Term Incentive

Plan providing for performance cash awards based on the achievement of

cumulative Business Transformation goals over the period 2002 to 2004. While

it is possible that total cash payments of approximately $50.0 will be made in

the first quarter of 2005 in connection with this program, no expense has been

recognized under this plan due to the aggressive nature of the goals. The

Company does not anticipate that this incremental expense will affect its ability

to meet its financial targets due to the self-funding nature of the plan.

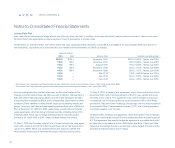

Board of Directors Remuneration

Each non-management director is annually granted options to purchase 4,000

shares of common stock, at an exercise price based on the fair market price of

the stock on the date of grant. The aggregate annual grant made to all non-

management directors in 2003 and 2002 consisted of 36,000 options in each

year with an exercise price of $52.80 and $53.11, respectively.

Effective January 1, 2004, the annual retainer paid to non-management direc-

tors consists of thirty-five thousand dollars cash (thirty thousand dollars prior

to January 1, 2004) plus an annual grant of restricted stock having a value of

thirty-five thousand dollars (thirty thousand dollars prior to January 1, 2004)

based on the average closing market price of the stock for the 10 days pre-

ceding the date of grant. These shares are restricted as to transfer until the

director retires from the Board. The aggregate annual grant of restricted stock

made to all non-management directors in 2003 and 2002 consisted of 4,680

and 4,869 shares, respectively.

In addition, effective January 1, 2004, non-management directors are paid a

$10,000 retainer for membership on the Audit Committee and $5,000 for mem-

bership on each other committee of the Board of Directors on which he or she

serves. Non-management directors appointed to chair a committee are also

paid $10,000 for the Audit Committee and $5,000 for all other committees.

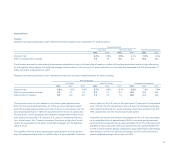

Had the Company recorded compensation cost for stock-based com-

pensation under FAS No. 123, diluted EPS would have been $2.66 in

2003, versus $2.10 and $1.74 in 2002 and 2001, respectively.

77