Avon 2003 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

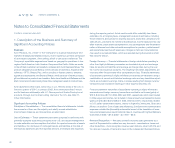

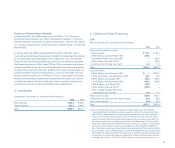

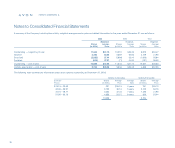

Interest Rate Risk

Avon uses interest rate swaps to hedge interest rate risk on its fixed-rate debt. In addition, Avon may periodically employ interest rate caps, treasury locks and

forward interest rate agreements to reduce exposure, if any, to fluctuations in interest rates.

At December 31, 2003 and 2002, Avon held interest rate swap agreements that effectively convert $975.0 and $600.0 (or approximately 90% and 45% of its

fixed-rate debt), respectively, of its fixed-rate debt to a variable interest rate based on LIBOR, as follows:

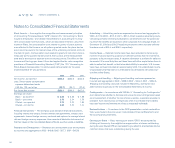

Notional Amount

2003 2002 Maturity Date Related Outstanding Debt

$100.0 $100.0 November 2004 $200.0, 6.90% Notes, due 2004

100.0 100.0 November 2004 200.0, 6.90% Notes, due 2004

100.0 100.0 August 2007 100.0, 6.55% Notes, due 2007

150.0 150.0 November 2009 300.0, 7.15% Notes, due 2009

150.0 150.0 November 2009* 300.0, 7.15% Notes, due 2009

125.0 — May 2013** 125.0, 4.625% Notes, due 2013

125.0 — July 2018 250.0, 4.20% Notes, due 2018

125.0 — July 2018 250.0, 4.20% Notes, due 2018

** This interest rate swap agreement requires Avon to post collateral in certain circumstances if Avon’s credit rating drops below BBB.

** This interest rate swap agreement permits either party to terminate the swap at the end of seven years (May 2010).

Notes to Consolidated Financial Statements

notes to statements

72

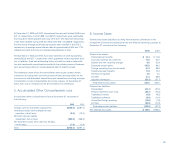

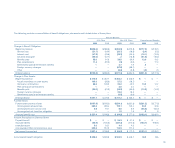

Avon has designated the interest rate swaps as fair value hedges of the

changes in the fair value of fixed-rate debt pursuant to FAS No. 133 (see Note 4,

Debt and Other Financing). During 2003, Long-term debt decreased by $53.1

and during 2002 increased by $46.8, with corresponding adjustments to Other

assets and Other liabilities to reflect the fair values of outstanding interest rate

swaps. Long-term debt also includes remaining unamortized gains of $9.3 and

$5.4 at December 31, 2003 and 2002, respectively, resulting from terminated

swap agreements, which are being amortized over the remaining terms of the

underlying debt. There was no hedge ineffectiveness for the years ended

December 31, 2003, 2002 or 2001, related to these interest rate swaps.

On May 1, 2003, the Company entered into a 10-year interest rate swap agree-

ment with a notional amount of $125.0 to effectively convert the fixed interest

rate on the 4.625% Notes to a variable interest rate, based on LIBOR. The

swap permits either party to terminate the swap at the end of seven years.

On May 9, 2003, a treasury lock agreement, which Avon had entered into in

December 2002, with a notional amount of $100.0, was settled and Avon

recorded a loss of $2.8. This agreement was used to hedge the exposure

to a possible rise in interest rates prior to the issuance of the 4.20% Notes

(see Note 4, Debt and Other Financing). Accordingly, the loss was recorded in

Accumulated Other Comprehensive Income (“OCI”) and is being amortized

to interest expense over 10 years.

On May 9, 2003, a treasury lock agreement, which Avon entered into in February

2003, with a notional amount of $75.0 was settled and Avon recorded a gain of

$.1. This agreement was used to hedge the exposure to a possible rise in inter-

est rates prior to the issuance of the 4.20% Notes, (see Note 4, Debt and Other

Financing). Accordingly, the gain was recorded in Accumulated OCI and is being

amortized to interest expense over 10 years.