Avon 2003 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

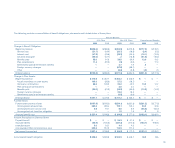

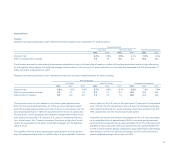

Assumptions

Pension

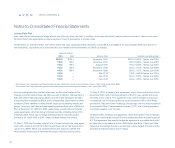

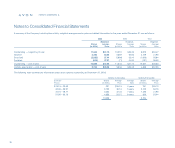

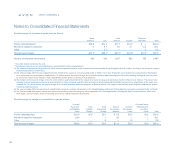

Weighted-average assumptions used to determine benefit obligations as of December 31 were as follows:

Pension Benefits

U.S. Plans Non-U.S. Plans Postretirement Benefits

2003 2002 2003 2002 2003 2002

Discount rate 6.3% 6.8% 5.8% 5.7% 6.3% 6.8%

Rate of compensation increase 4.5 4.5 3.0 3.0 N/A N/A

The discount rate used for determining future pension obligations for each individual plan is based on a review of long-term bonds that receive a high rating given

by a recognized rating agency. The weighted-average discount rate for U.S. and non-U.S. plans determined on this basis has decreased to 6.0% at December 31,

2003, from 6.3% at December 31, 2002.

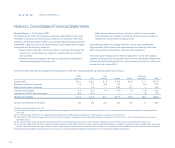

Weighted-average assumptions used to determine net cost for the years ended December 31 were as follows:

Pension Benefits

U.S. Plans Non-U.S. Plans Postretirement Benefits

2003 2002 2001 2003 2002 2001 2003 2002 2001

Discount rate 6.8% 7.3% 7.8% 5.7% 6.0% 6.1% 6.8% 7.3% 7.8%

Rate of compensation increase 4.5 4.5 4.5 3.0 3.1 3.3 N/A N/A N/A

Rate of return on assets 8.8 8.8 9.5 7.2 7.5 7.5 N/A N/A N/A

81

The expected return on plan assets for all pension plans approximated

$75.0 for the year ended December 31, 2003, and was calculated based

upon the average expected long-term rate of return on plan assets. For the

year ended December 31, 2003, the assumed rate of return on assets glob-

ally was 8.3%, which represents the weighted-average rate of return on all

plan assets including the U.S. and non-U.S. plans. In estimating the long-

term rate of return, the Company considers the nature of the plans’ invest-

ments, an expectation for the plans’ investment strategies and the historical

rates of return.

The majority of the Company’s pension plan assets relate to the U.S. pension

plan. The assumed rate of return for 2003 for the U.S. plan was 8.8%. Historical

rates of return for the U.S. plan for the most recent 10-year and 20-year periods

were 7.8% and 10.5%, respectively. In the U.S plan, the Company’s asset allo-

cation policy has favored U.S. equity securities, which have returned 10% and

12%, respectively, over the 10-year and 20-year period.

In addition, the current rate of return assumption for the U.S. plan was based

on an asset allocation of approximately 35% in corporate and government

bonds (which are expected to earn approximately 5% to 7% in the long term)

and 65% in equity securities (which are expected to earn approximately 9%

to 10% in the long term). Similar assessments were performed in determining

rates of return on non-U.S. pension plan assets, to arrive at the Company’s

current weighted-average rate of return of 8.3%.