Avon 2003 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

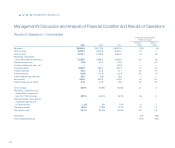

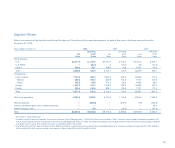

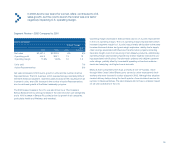

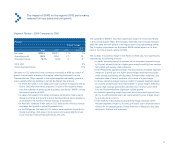

Segment Review – 2002 Compared to 2001

Latin America

%/Point Change

Local

2002 2001 US $ Currency

Net sales $1,654.9 $1,856.5 (11)% 12%

Operating profit 361.6 411.0 (12) 6

Operating margin 21.8% 22.1% (.3) (.3)

Units sold 9%

Active Representatives 9%

Net sales in U.S. dollars were significantly impacted by weaker foreign exchange

rates in most major markets. Excluding the impact of foreign currency exchange,

Net sales increased in 2002 with increases in all major markets in the region,

reflecting growth in units and active Representatives.

• In Argentina, Net sales in U.S. dollars decreased significantly due to the

negative impact of foreign exchange, but increased in local currency

despite the country’s economic and political issues, driven by growth in

active Representatives. Local management has taken numerous actions

to counter the challenges presented by this economic and political crisis.

• In Venezuela, Net sales in U.S. dollars decreased due to the negative

impact of foreign exchange, but increased significantly in local currency,

despite the country’s economic and political issues during 2002, bene-

fiting from inflationary price increases, new product launches and con-

sumer promotions.

• In Brazil, Net sales in U.S. dollars decreased due to the negative

impact of foreign exchange, but increased significantly in local cur-

rency, reflecting increases in units and active Representatives as well

as successful product launches.

• In Mexico, Net sales increased in U.S. dollars and local currency, bene-

fiting from new product launches with higher price points in non-CFT

product lines.

The decrease in operating margin in Latin America was most significantly

impacted by the following markets:

• In Argentina, operating margin decreased (which decreased segment

margin by .3 point) primarily due to an increase in the expense ratio. The

higher expense ratio was driven by an increase in the cost of imported

supplies resulting from the devaluation of the Argentine peso, as well as

increased sales incentives, sampling and higher banking taxes.

• In Central America, operating margin decreased (which decreased seg-

ment margin by .3 point) primarily due to an increase in the expense

ratio resulting from incremental marketing investments such as advertis-

ing, and additional bad debt expense.

Operating margin was favorably impacted by greater contributions from

countries with higher operating margins (which increased segment margin

by .4 point).

During 2002, the Brazilian real weakened as investor sentiment turned bear-

ish in the run up to the November presidential election. Investors were wor-

ried about the economic policies of the leading candidate from the Worker’s

Party. As predicted by the polls, the Worker’s Party candidate won the elec-

tion. Investors initially reacted negatively to the results. During 2003, investor

confidence, however, turned more favorable as the newly elected govern-

ment’s policies were more conservative than the market anticipated.

Argentina’s economic activity was severely depressed during 2002. This

resulted from the massive currency devaluation in early 2002 when the gov-

ernment allowed the peso to float freely after being pegged to the U.S. dollar

for over 10 years.

38