Avon 2003 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

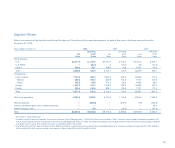

Segment Review – 2002 Compared to 2001

Pacific

%/Point Change

Local

2002 2001 US $ Currency

Net sales $829.7 $773.7 7% 8%

Operating profit 133.6 112.5 19 19

Operating margin 15.8% 14.3% 1.5 1.5

Units sold 19%

Active Representatives 6%

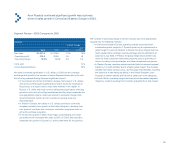

Net sales in U.S. dollars and local currency increased as a result of growth in

most major markets in the region, driven primarily by increases in units and

active Representatives.

• In China, Net sales in U.S. dollars and local currency increased primarily

due to a continued increase in the number of Avon beauty boutiques.

• In Japan, Net sales in U.S dollars were flat due to the negative impact of

foreign exchange and a weak economic environment, but increased in

local currency driven by an increase in active Representatives and

aggressive sales and merchandising programs.

• In the Philippines, Net sales in U.S. dollars were flat due to the negative

impact of foreign exchange, but increased in local currency due to an

increase in active Representatives, partially offset by the impact of the

depressed economic situation in the country.

The increase in operating margin in the Pacific was most significantly

impacted by the following markets:

• In China, operating margin improved (which increased segment margin

by 1.4 points) primarily due to a lower expense ratio resulting from oper-

ating expense leverage as this market achieves scale, partially offset by

incremental advertising expenses. Operating margin was negatively

impacted by a decline in gross margin resulting from aggressive pricing

and merchandising to increase market share.

• In Japan, operating margin improved (which increased segment margin

by .6 point) resulting primarily from gross margin expansion due to a

favorable mix of products sold and a lower expense ratio due to general

cost containment initiatives.

• In the Philippines, operating margin decreased (which decreased segment

margin by .5 point) due to a decrease in gross margin resulting from an

unfavorable mix of products sold, and a higher expense ratio due to

increased sales incentives, higher bad debt expense and incremental

spending on sampling.

Global Expenses

Global expenses increased $14.2 in 2003 primarily due to expenses of $6.5

related to Avon’s supply chain initiatives; incremental investments of $5.8 for

global marketing and research and development; higher pension expense of

$5.4; higher legal expenses of $4.7; higher professional service fees of $3.6;

and higher expenses of $2.8 resulting from higher charitable contributions to

the Avon Foundation; partially offset by lower bonus accruals of $12.6 and

higher net gains of $3.4 in 2003 on Company-owned life insurance policies.

Global expenses increased $3.2 in 2002 primarily due to incremental invest-

ments of $12.2 for research and development and global marketing, as well as

a new Teen product line called Mark. (which launched in late 2003), higher bonus

accruals of $9.2, merit salary increases of approximately $4.0, and severance

accruals of $3.1 for employees not included in the 2002 Special charges. These

increases were partially offset by net savings of approximately $23.0 from work-

force reductions associated with Avon’s Business Transformation initiatives.

42