Avon 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

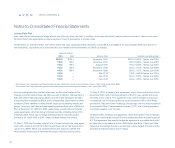

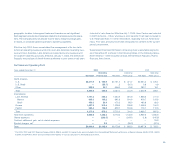

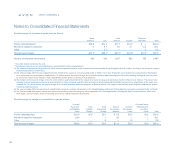

The U.S. pension plans include funded qualified plans and unfunded non-qualified plans. As of December 31, 2003 and 2002, the U.S. qualified pension plans

had benefit obligations of $611.5 and $575.6, and plan assets of $547.7 and $475.8, respectively. Avon believes it has adequate investments and cash flows to

fund the liabilities associated with the unfunded non-qualified plans.

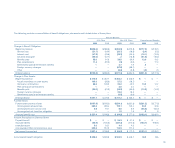

The projected benefit obligation, accumulated benefit obligation and fair value of plan assets for pension benefit plans with accumulated benefit obligations in

excess of plan assets as of December 31, 2003 and 2002, were as follows:

Pension Benefits

U.S. Plans Non-U.S. Plans

2003 2002 2003 2002

Projected benefit obligation $705.5 $659.0 $485.1 $412.5

Accumulated benefit obligation 629.0 605.8 452.8 385.6

Fair value plan assets 547.7 475.8 220.2 173.5

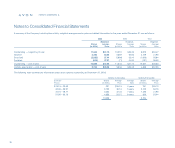

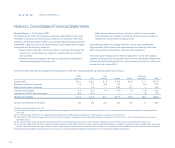

Net Periodic Benefit Cost

Net periodic benefit cost for the years ended December 31 was determined as follows:

Pension Benefits

U.S. Plans Non-U.S. Plans Postretirement Benefits

2003 2002 2001 2003 2002 2001 2003 2002 2001

Service cost $ 21.7 $ 19.0 $ 18.7 $ 20.7 $ 18.8 $ 15.6 $ 2.4 $ 2.2 $ 1.2

Interest cost 47.2 43.6 41.9 30.3 25.4 23.3 12.1 12.5 10.7

Expected return on plan assets (52.3) (53.2) (49.3) (22.9) (20.9) (18.8) —— —

Amortization of transition liability —— — .8 .5 .2 — — —

Amortization of prior service cost 1.9 1.5 (.1) 3.5 1.4 1.1 (5.0) (4.1) (3.9)

Amortization of actuarial losses (gains) 18.9 1.4 2.3 6.0 2.8 1.7 1.8 .7 (.3)

Settlements or curtailments — — 2.5 (.1) 2.6 — (.1) — (2.1)

Special termination benefits — — 9.4 .7 — — — — .7

Other —— — (1.4) (1.0) (1.1) —— —

Net periodic benefit cost $ 37.4 $ 12.3 $ 25.4 $ 37.6 $ 29.6 $ 22.0 $11.2 $11.3 $ 6.3

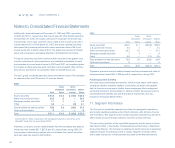

Notes to Consolidated Financial Statements

notes to statements

80

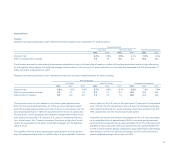

In 2002 and 2001, the plan assets experienced weaker investment returns,

which was mostly due to unfavorable returns on equity securities. These unfa-

vorable investment returns increased pension costs in 2003 and will increase

pension costs in 2004. In addition, net periodic pension cost may significantly

increase in the future if settlement losses are required to be recorded due to an

increase in the aggregate benefits paid as lump sum distributions. Settlement

losses may result in the future if the number of eligible participants deciding to

receive lump sum distributions and the amount of their benefits increases.

Special termination benefits and settlements or curtailments primarily repre-

sent the impact of employee terminations on the Company’s benefits plans in

the U.S. and certain international locations (see Note 13, Special Charges).