Avon 2003 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

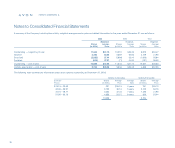

At December 31, 2003 and 2002, international lines of credit totaled $446.5 and

$411.4, respectively, of which $39.7 and $63.9, respectively, were outstanding

and included in Notes payable and Long-term debt. The maximum borrowings

under these facilities during 2003 and 2002 were $73.1 and $89.8, respectively,

and the annual average borrowings during each year were $60.1 and $75.4,

respectively, at average annual interest rates of approximately 6.0% and 7.7%,

respectively. Such lines have no compensating balances or fees.

At December 31, 2003 and 2002, Avon also had letters of credit outstanding

totaling $25.3 and $27.7, respectively, which guarantee various insurance activi-

ties. In addition, Avon had outstanding letters of credit for various trade activi-

ties and commercial commitments executed in the ordinary course of business,

such as purchase orders for normal replenishment of inventory levels.

The indentures under which the above Notes were issued contain certain

covenants, including limits on the incurrence of liens and restrictions on the

incurrence of sale/leaseback transactions and transactions involving a merger,

consolidation or sale of substantially all of Avon’s assets. At December 31,

2003, Avon was in compliance with all covenants in its indentures.

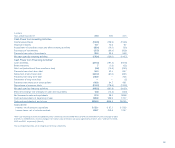

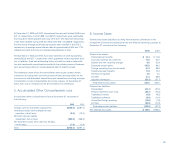

5. Accumulated Other Comprehensive Loss

Accumulated other comprehensive loss at December 31 consisted of

the following:

2003 2002

Foreign currency translation adjustments $(433.5) $(487.2)

Unrealized losses from available-for-sale

securities, net of taxes (8.5) (13.0)

Minimum pension liability

adjustment, net of taxes (285.8) (288.6)

Net derivative losses from cash flow hedges,

net of taxes (1.6) (2.6)

Total $(729.4) $(791.4)

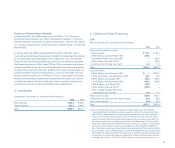

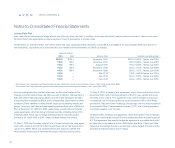

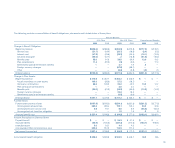

6. Income Taxes

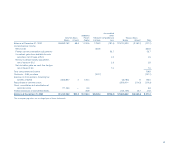

Deferred tax assets (liabilities) resulting from temporary differences in the

recognition of income and expense for tax and financial reporting purposes at

December 31 consisted of the following:

2003 2002

Deferred tax assets:

Postretirement benefits $ 74.4 $ 74.8

Accrued expenses and reserves 74.0 54.2

Special and non-recurring charges 6.0 22.9

Employee benefit plans 105.0 88.2

Foreign operating loss carryforwards 51.3 38.9

Postemployment benefits 11.8 10.3

Revenue recognition 2.8 3.0

All other 31.3 38.9

Valuation allowance (52.1) (37.7)

Total deferred tax assets 304.5 293.5

Deferred tax liabilities:

Depreciation (44.1) (37.2)

Prepaid retirement plan costs (38.7) (13.2)

Capitalized interest (5.5) (6.5)

Capitalized software (6.5) (11.0)

Unremitted foreign earnings (16.9) (7.8)

All other (24.8) (21.5)

Total deferred tax liabilities (136.5) (97.2)

Net deferred tax assets $ 168.0 $196.3

69