Avon 2003 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

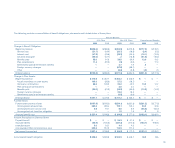

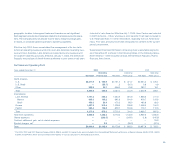

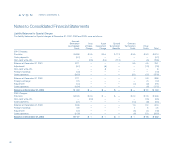

The following table presents consolidated net sales by classes of principal

products, for the years ended December 31:

2003 2002 2001

Beauty* $4,487.7 $3,903.4 $3,724.3

Beauty Plus** 1,259.6 1,238.8 1,233.3

Beyond Beauty*** 1,057.3 1,028.4 1,000.2

Total Net sales $6,804.6 $6,170.6 $5,957.8

*** Beauty includes cosmetics, fragrances and toiletries.

*** Beauty Plus includes fashion jewelry, watches, apparel and accessories.

*** Beyond Beauty includes home products, gift and decorative products and candles.

Sales from Health and Wellness products and the Mark. brand are included in

the above categories based on product type.

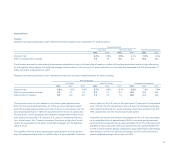

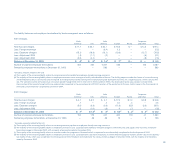

12. Leases and Commitments

Minimum rental commitments under noncancellable operating leases, prima-

rily for equipment and office facilities at December 31, 2003, consisted of

the following:

Year

2004 $ 77.5

2005 57.9

2006 42.4

2007 34.0

2008 32.1

Later years 143.4

Sublease rental income (13.8)

Total $373.5

Rent expense in 2003 was $94.1 (2002 - $90.8; 2001 - $92.1). Various con-

struction and information systems projects were in progress at December 31,

2003, with an estimated cost to complete of approximately $180.0.

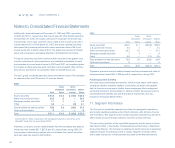

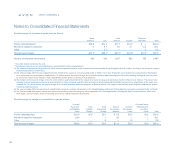

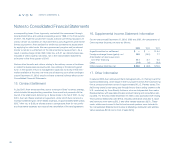

13. Special Charges

In May 2001, Avon announced its new Business Transformation plans, which

are designed to significantly reduce costs and expand profit margins, while

continuing to focus on consumer growth strategies. Business Transformation

initiatives include an end-to-end evaluation of business processes in key

operating areas, with target completion dates through 2004. Specifically, the

initiatives focus on simplifying Avon’s marketing processes, taking advantage

of supply chain opportunities, strengthening Avon’s sales model through the

Sales Leadership program and the Internet, streamlining the Company’s orga-

nizational structure and integrating certain similar activities across markets to

achieve efficiencies. Avon anticipates significant benefits from these Business

Transformation initiatives, but the scope and complexity of these initiatives

necessarily involve planning and execution risk.

Special Charges — Fourth Quarter 2001

In the fourth quarter of 2001, Avon recorded Special charges of $97.4 pretax

($68.3 after tax, or $.28 per share on a diluted basis) primarily associated with

facility rationalizations and workforce reduction programs related to implemen-

tation of certain Business Transformation initiatives. The charges of $97.4 were

included in the Consolidated Statement of Income for 2001 as Special charges

($94.9) and as inventory write-downs, which were included in Cost of sales

($2.5). Approximately 80% of the charges related to future cash expenditures.

Approximately 85% of these cash expenditures were made by December

2003. All payments are funded by cash flow from operations.

In May 2001, Avon announced its new Business Transformation

plans, which are designed to significantly reduce costs and

expand profit margins, while continuing to focus on consumer

growth strategies.

87