Avon 2003 Annual Report Download - page 26

Download and view the complete annual report

Please find page 26 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Off Balance Sheet Arrangements

At December 31, 2003, Avon had no material off balance sheet arrangements.

Capital Resources

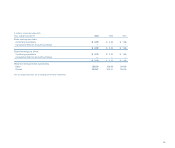

Total debt of $1,121.8 at December 31, 2003, decreased $250.4 from

$1,372.2 at December 31, 2002, principally due to the redemption of Avon’s

Convertible Notes in July 2003 and adjustments of $53.0 to reflect the fair

value of interest rate swaps, partially offset by the issuance in June 2003 of

$250.0 of 4.20% registered notes (see Note 4, Debt and Other Financing).

Total debt of $1,372.2 at December 31, 2002, increased $47.1 from $1,325.1

at December 31, 2001, principally due to adjustments to reflect the fair value

of outstanding interest rate swaps, (see Note 4, Debt and Other Financing),

amortization of the discount on Avon’s outstanding convertible notes and

translation of Avon’s Japanese yen denominated notes payable.

Avon has a five-year $600.0 revolving credit and competitive advance facility

(the “credit facility”), which expires in 2006. The credit facility may be used for

general corporate purposes, including financing working capital and capital

expenditures and the stock repurchase program. The interest rate on borrow-

ings under the credit facility is based on LIBOR or on the higher of prime or

1/2% plus the federal funds rate. The credit facility has an annual facility fee,

payable quarterly, of $.5, based on Avon’s current credit ratings. The credit

facility contains various covenants, including one financial covenant which

requires Avon’s interest coverage ratio (determined in relation to Avon’s con-

solidated pretax income and interest expense) to equal or exceed 4:1. At

December 31, 2003, Avon was in compliance with all covenants in the credit

facility. At December 31, 2003 and 2002, there were no borrowings under the

credit facility. Avon maintains a $600.0 commercial paper program, which is

supported by the credit facility. Outstanding commercial paper effectively

reduces the amount available for borrowing under the credit facility. At

December 31, 2003 and 2002, Avon had no commercial paper outstanding.

The cost of borrowings under the credit facility, as well as the amount of the

facility fee and utilization fee (applicable only if more than 50% of the facility is

borrowed), depend on Avon’s credit ratings. A downgrade in Avon’s credit rat-

ings would increase the cost to Avon of maintaining and borrowing under the

credit facility or increase the cost to Avon of issuing commercial paper in the

future. The credit facility does not contain a rating downgrade trigger that

would prevent Avon from borrowing under the credit facility. The credit facility

would become unavailable for borrowing only if Avon were to fail to satisfy one

of the conditions to borrowing in the facility. These conditions to borrowing are

generally based on the accuracy of certain representations and warranties,

compliance by Avon with the covenants in the credit facility (discussed above)

and the absence of defaults, including but not limited to bankruptcy and insol-

vency, change of control, failure to pay other material debts and failure to stay

or pay material judgments, as those events are described more fully in the

credit facility agreement.

At December 31, 2003, Avon was in compliance with all covenants in its

indentures (see Note 4, Debt and Other Financing). Such indentures do not

contain any rating downgrade triggers that would accelerate the maturity

of its debt. Neither the credit facility nor any of the indentures contains any

covenant or other requirement relating to maintenance of a positive

shareholders’ equity balance.

Avon had uncommitted domestic lines of credit available of $20.8 and $18.9 at

December 31, 2003 and 2002, respectively, with various banks. In addition, as

of December 31, 2003 and 2002, there were international lines of credit totaling

$446.5 and $411.4, respectively, of which $39.7 and $63.9, respectively, were

outstanding and included in Notes payable and Long-term debt. At December 31,

2003 and 2002, Avon had letters of credit outstanding totaling $25.3 and $27.7,

respectively, which guarantee various insurance activities. In addition, Avon

had outstanding letters of credit for various trade activities and commercial

commitments executed in the ordinary course of business, such as purchase

orders for normal replenishment of inventory levels.

Foreign Operations

For the three years ended 2003, 2002 and 2001, the Company derived approxi-

mately 60% to 70% of its consolidated Net sales and Operating profit from

operations of subsidiaries outside of the U.S. In addition, as of December 31,

2003 and 2002, these subsidiaries comprised approximately 60% and 50%,

respectively, of the Company’s consolidated total assets. Avon has significant

net assets in Brazil, Mexico, Poland, Japan, Russia and the United Kingdom.

45

Total debt decreased by $250.4 million in 2003.