Avon 2003 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

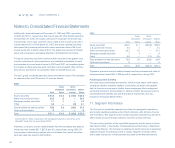

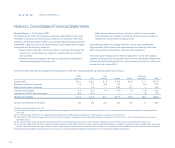

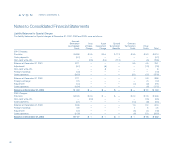

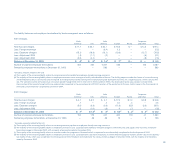

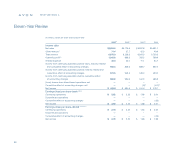

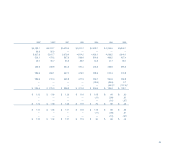

Liability Balances for Special Charges

The liability balances for Special charges at December 31, 2001, 2002 and 2003, were as follows:

Accrued

Severance Cost Asset Special Contract

and Related of Sales Impairment Termination Termination Other

Costs Charge Charge Benefits Costs Costs Total

2001 Charges:

Provision $ 69.8 $ 2.5 $ 5.4 $ 11.2 $ 3.5 $ 5.0 $ 97.4

Cash payments (2.7) — — — — — (2.7)

Non-cash write-offs — (2.5) (5.4) (11.2) — (.5) (19.6)

Balance at December 31, 2001 67.1 — — — 3.5 4.5 75.1

Adjustment (5.7) — (.6) — — (1.0) (7.3)

Non-cash write-offs — — .6 — — — .6

Foreign exchange (1.0) — — — — — (1.0)

Cash payments (33.3) — — — (3.1) (1.2) (37.6)

Balance at December 31, 2002 27.1 — — — .4 2.3 29.8

Foreign exchange (1.1) — — — — (.1) (1.2)

Adjustment (1.4) — — — (.4) (.3) (2.1)

Cash payments (16.4) — — — — (.8) (17.2)

Balance at December 31, 2003 $ 8.2 $ — $ — $ — $ — $ 1.1 $ 9.3

2002 Charges:

Provision $ 34.9 $ 2.0 $ — $ — $ 2.4 $ 4.3 $ 43.6

Non-cash write-offs — (2.0) — — — (1.3) (3.3)

Cash payments (4.1) — — — (1.4) (.8) (6.3)

Balance at December 31, 2002 30.8 — — — 1.0 2.2 34.0

Foreign exchange 3.9 — — — .1 .5 4.5

Adjustment (1.2) — — — (.5) (.1) (1.8)

Cash payments (21.8) — — — (.6) (1.1) (23.5)

Balance at December 31, 2003 $ 11.7 $ — $ — $ — $ — $ 1.5 $ 13.2

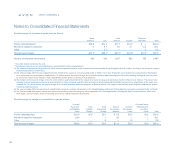

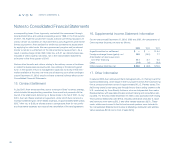

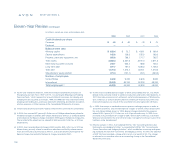

Notes to Consolidated Financial Statements

notes to statements

92