Avon 2003 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

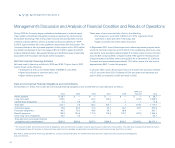

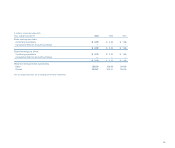

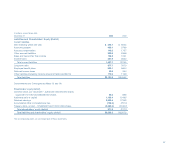

Management’s Discussion and Analysis of Financial Condition and Results of Operations

management’s discussion

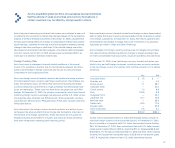

Avon’s foreign-currency financial instruments were analyzed at year-end to

determine their sensitivity to foreign exchange rate changes. Based on the

Company’s foreign exchange contracts at December 31, 2003, the impact

of a 10% appreciation or 10% depreciation of the U.S. dollar against the

Company’s foreign exchange contracts would not represent a material poten-

tial change in fair value, earnings or cash flows. This potential change does

not consider the underlying foreign currency exposures of the Company. The

hypothetical impact was calculated on the combined option and forward posi-

tions using forward rates at December 31, 2003, adjusted for an assumed 10%

appreciation or 10% depreciation of the U.S. dollar against the foreign con-

tracts. The impact of payments to settle option contracts are not significant

to this calculation. In 2003, net foreign exchange losses associated with the

Company’s foreign exchange contracts totaled $1.3 and were recorded in Other

expense (income), net. Additionally, net foreign exchange losses of $2.4 related

to derivative instruments designated as cash flow hedges are recorded in

Accumulated other comprehensive loss at December 31, 2003.

Equity Price Risk

Avon is exposed to equity price fluctuations for investments included in the

grantor trust (see Note 10, Employee Benefit Plans). A 10% change (either an

increase or decrease) in equity prices would not be material based on the fair

value of equity investments as of December 31, 2003.

Credit Risk

Avon attempts to minimize its credit exposure to counterparties by entering into

derivative transactions and similar agreements only with major international

financial institutions with “A” or higher credit ratings as issued by Standard &

Poor’s Corporation. Avon’s foreign currency and interest rate derivatives are

comprised of over-the-counter forward contracts, swaps or options with major

international financial institutions. Although Avon’s theoretical credit risk is the

replacement cost at the then estimated fair value of these instruments, manage-

ment believes that the risk of incurring credit risk losses is remote and that

such losses, if any, would not be material.

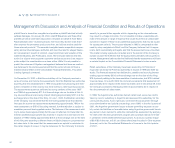

Non-performance of the counterparties on the balance of all the foreign

exchange and interest rate swap and forward rate agreements would not

result in a material write-off at December 31, 2003. In addition, in the event of

non-performance by such counterparties, Avon would be exposed to market

risk on the underlying items being hedged as a result of changes in foreign

exchange and interest rates.

Accounting Changes

See Note 2, Accounting Changes, for a discussion regarding recent accounting

standards, including the following:

• Emerging Issues Task Force (“EITF”) 00-14, “Accounting for Certain

Sales Incentives,”

• EITF 00-25, “Accounting for Consideration from a Vendor to a Retailer in

Connection with the Purchase or Promotion of the Vendor’s Products,”

• EITF 01-09, “Accounting for Consideration Given by a Vendor to a

Customer (Including a Reseller of the Vendor’s Products),”

• FAS No. 142, “Goodwill and Other Intangible Assets,”

• FAS No. 144, “Accounting for the Impairment or Disposal of Long-Lived

Assets,”

• FAS No. 143, “Accounting for Asset Retirement Obligations,”

• FAS No. 146, “Accounting for Costs Associated with Exit or Disposal

Activities,”

• FASB Interpretation No. 45, “Guarantor’s Accounting and Disclosure

Requirements for Guarantees, Including Indirect Guarantees of

Indebtedness of Others,”

• FAS No. 148, “Accounting for Stock-Based Compensation – Transition

and Disclosure,”

• FASB Interpretation No. 46, “Consolidation of Variable Interest Entities,”

• FAS No.132 “Employers’ Disclosures about Pensions and Other

Postretirement Benefits,” and

• FASB Staff Position No. FAS 106-a, “Accounting and Disclosure

Requirements Related to the Medicare Prescription Drug, Improvement

and Modernization Act of 2003.”

48