Avon 2003 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2003 Avon annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

corresponding taxes. Avon vigorously contested this assessment through

local administrative and judicial proceedings since 1998. In the third quarter

of 2001, the Argentine government issued a decree permitting taxpayers to

satisfy certain tax liabilities on favorable terms using Argentine government

bonds as payment. Avon decided to settle this contested tax assessment

by applying for relief under this new government program and purchased

bonds to tender in settlement of the aforementioned assessment. As a

result, a pretax charge of $6.4 ($3.4 after tax, or $.01 per diluted share) was

included in Other expense (income), net in the Consolidated Statements

of Income in the third quarter of 2001.

Various other lawsuits and claims, arising in the ordinary course of business

or related to businesses previously sold, are pending or threatened against

Avon. In the opinion of Avon’s management, based on its review of the infor-

mation available at this time, the total cost of resolving such other contingen-

cies at December 31, 2003, should not have a material adverse effect on the

Consolidated Financial Statements.

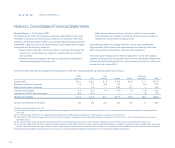

15. Contract Settlement

In July 2001, Avon announced that, due to a change in Sears’ business strategy,

which included de-emphasizing cosmetics, Avon would not proceed with the

launch of its retail brand, beComing, in Sears stores in the fall of 2001. In July

2001, Avon and Sears reached an agreement, under which Avon received a

Contract settlement gain, net of related expenses, of approximately $25.9 pretax

($15.7 after tax, or $.06 per diluted share) to compensate Avon for lost profits

and incremental expenses as a result of the cancellation of the retail agreement.

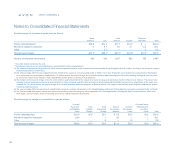

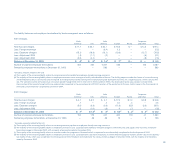

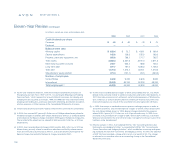

16. Supplemental Income Statement Information

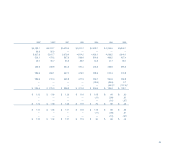

For the years ended December 31, 2003, 2002 and 2001, the components of

Other expense (income), net were as follows:

2003 2002 2001

Argentina excise tax settlement $ — $ — $ 6.4

Foreign exchange losses (gains), net 15.9 (16.0) 7.7

Amortization of debt issue costs

and other financing 14.1 6.7 5.0

Other (1.4) (.6) (3.3)

Other expense (income), net $ 28.6 $ (9.9) $15.8

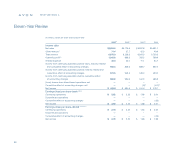

17. Other Information

In January 2003, Avon announced that it had agreed with J.C. Penney to end the

business relationship, which began in 2001, pursuant to which Avon’s beComing

line of products had been carried in approximately 90 J.C. Penney stores. The

beComing brand is now being sold through Avon’s direct selling channel in the

U.S., exclusively by Avon Beauty Advisors, who are independent Avon sales

Representatives with specialized beauty product training and consultative sell-

ing skills. For the year ended December 31, 2003, costs associated with ending

this business relationship were $18.3, including severance costs ($4.1), asset

and inventory write-downs ($12.1) and other related expenses ($2.1). These

costs, which were incurred in the first and second quarters, were included in

the Consolidated Statements of Income in Marketing, distribution and adminis-

trative expenses ($10.5) and in Cost of sales ($7.8).

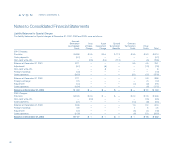

Notes to Consolidated Financial Statements

notes to statements

96